Patience, we are told, is a virtue. With marketing opportunities slim and getting slimmer, you may need to be a very virtuous person in the year ahead.

Pricing some of your expected grain production before harvest is important and valuable. Early sales often beat the harvest price: for three out of four years in corn, and two out of three years in soybeans since 1990 (while two recent years, 2010 and 2012, prove that early sales are no guarantee of beating the harvest price). Despite the favorable odds, I don’t like pricing new-crop grain at prices below production costs. Guess what? With the late December/early January collapse in Nov’14 soybean prices, we now have all three major grains displaying new-crop prices less than production costs.

“Have patience” is currently item No. 1 on our marketing to-do list. Should there be any other items on that to-do list?

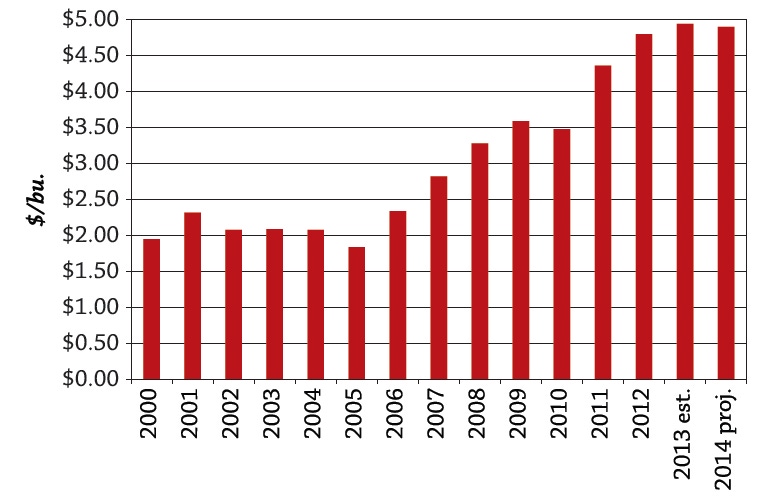

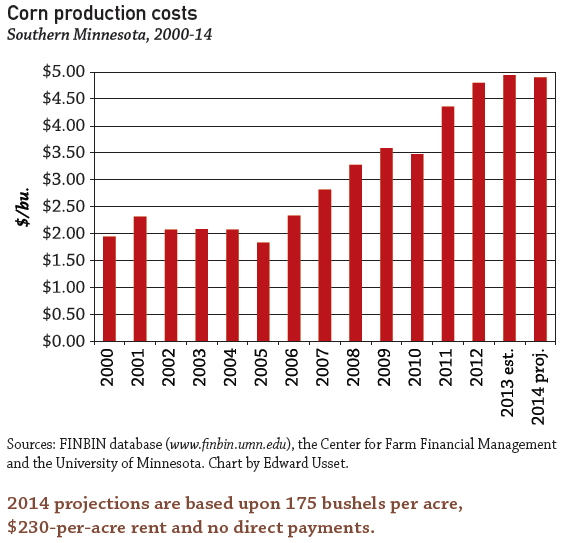

Yes. Now is a good time to revisit your production-cost calculations with a keen eye and sharp pencil. Production costs have risen sharply in recent years (see chart). My estimate of 2014 Minnesota production costs are about $4.90/bu. for corn, $11.00/bu. for soybeans and $6.90/bu. for HRS wheat. New-crop bids are $0.50-$1.00/bu. below these figures. It’s possible, however, that your costs are lower than these estimates, and you can still make profitable sales at these lower numbers. Take some time and do the math. It happens – prices can sink below costs. Sometimes it happens for a long period of time. From 1999 through 2002, cash corn bids of $1.50 per bushel or less were far too common, while cash soybean prices languished under $4.50 per bushel. Production costs were lower 15 years ago, but not that low. Our best hope is that the current situation is more like 2010. In the spring of that year, new-crop bids for corn and wheat were also below costs. Just a few months later, prices recovered and grain production was back in the black. With prices below production costs, is new-crop pricing simply off the table? Not if prices are heading even lower. Big crops happen, and we’ve all read the predictions of Dec’14 corn futures below $4.00 per bushel and Nov’14 soybean futures at $10.00 per bushel or less. I don’t like it, but sometimes marketing demands decisions intended to minimize losses. Patience is a virtue. Stubborn is not. Making a few early sales at a small loss is a difficult decision, but it could be the defensive measure needed to prevent larger losses at harvest.

About the Author(s)

You May Also Like