Corn prices continue to dance to the sound of lower-lows. Despite contraction in both domestic and global ending supplies when compared to last year, the market feels like it could remain under nearby pressure. One could certainly argue that we are technically "oversold", and a bounce is inevitable, as prices have tumbled -40 cents since early-August. Bulls continue to argue that the current USDA yield estimate for the U.S. is overstated at 181.3 bushels per acre and at best should be 180.

Bulls also argue that the USDA will need to further raise their export estimate. When you add it all together many bulls are forecasting a sub-1.5 billion bushel ending stock estimate vs. the USDA's current estimate of 1.77 billion bushel estimate. I know it doesn't sound like that big of a difference, but I believe it matters a great deal to the overall perception and mindset of the trade. I suspect, a sub-1.5 billion bushel number would go a long way to deterring some of the current bears.

In other words, despite the fact we are going to harvest a record yield, the devil is clearly going to be in the details. A simple -1 or -2 bushel negative adjustment to yield could be somewhat of a game-changer. I'm not holding my breath but certainly see it as a possibility. On the demand side of the equation, there's a bit of uncertainty surrounding a Reuters recent announcement that major U.S. ethanol producer Green Plains Inc is shutting down two ethanol plants in Iowa (Superior and Lakota) and reducing their production at another plant in Minnesota (Fairmont). I'm not sure what it means for overall corn demand being used for ethanol. I suspect, eventually other plants will pick up the majority of the lost capacity, so probably no-harm no-foul, just perhaps a small black-eye. I have been reporting for several months that some of the less efficient plants were going to start being taken offline, well here we are.

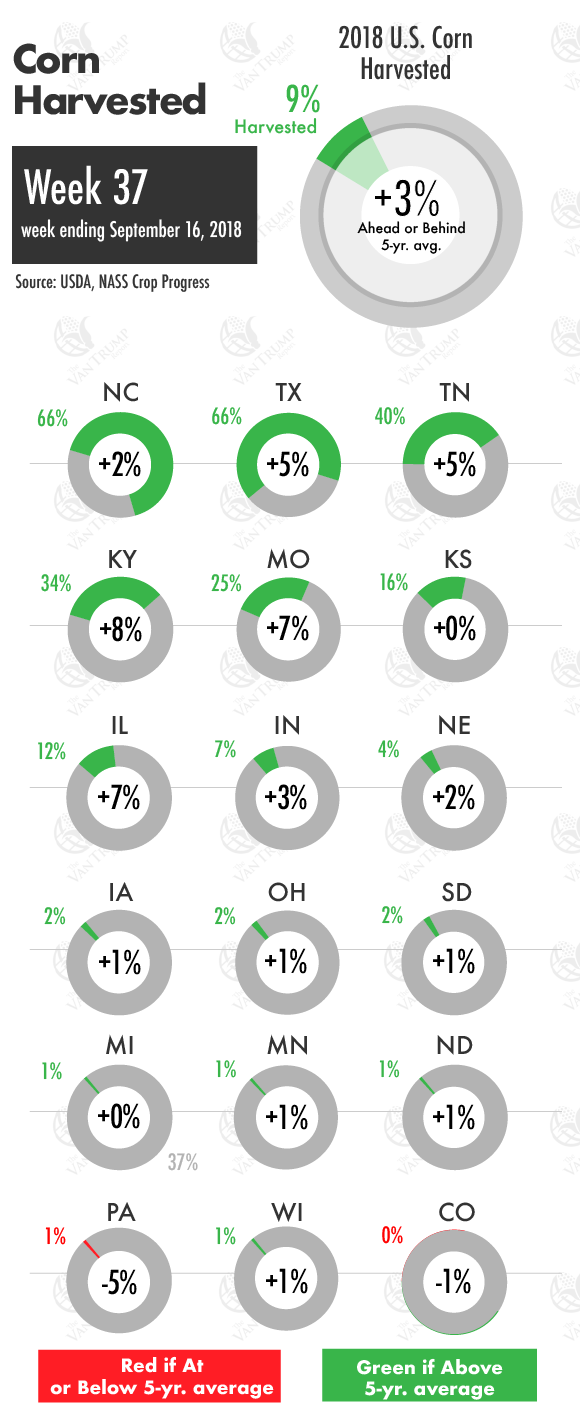

On the supply side, the USDA left overall crop conditions "unchanged" at 68% rated GD/EX. Corn reported as "dented" was estimated at 93% vs. the 5-year historical average of 86%. Corn reported as "mature" was estimated at 54% vs. the 5-year average of 36%. Corn actually "harvested was reported at 9% vs. the 5-year historical average of 6% by this date. The only states running behind schedule at this point seem to be Colorado and Pennsylvania.

All of the big production states are running ahead of their traditional harvest pace. I should also note, big production states are also showing much better "Excellent" ratings than last year: Illinois 31% of their crop rated EX this year vs. just 8% last year; Minnesota 24% of their crop rated EX this year vs. 16% last year; Nebraska 32% rated EX this year vs. 18% last year; Iowa 20% rated EX this year vs. 10% last year; Indiana 20% rated EX this year vs. 11% last year; Ohio 21% rated EX this year vs. 15% last year; South Dakota 19% rated EX this year vs. just 4% last year; Wisconsin 32% rated EX this year vs. 21% last year. From a technical perspective, bulls are hoping to find heavy support and a contract low posted somewhere between $3.35 and $3.45 per bushel. It makes sense to me, but I don't think it happens overnight, rather a slow grind sideways to lower. Globally, I can argue both sides, on improved rainfall in the forecast for both Argentina and Brazil. On the flip side, many insiders are reducing their European corn production estimate slightly.

Corn prices in the DEC18 contract battle to keep their head above $3.50 per bushel. New lows were posted last Thursday at $3.48^6. The bulls are hoping our historical tendency to bottom out sometime between mid-August to early-October will come sooner rather than later.

The USDA's most recent record yield forecast at 181.3 bushels per acre, adding another +241 million bushels to production, is certainly not helping things and hard for the bulls to digest. Especially when you throw on talk of U.S. producers increasing acreage next year and ending stocks currently at a comfortable +1.7 billion bushels. Demand remains extremely strong, but lack of a wide-spread weather story and no real global growth headlines or feeling that the funds want to be long, works to limit bullish momentum.

There's only so much heavy lifting we can place on "demand", eventually we have to have help from weather to create some talk of supply hiccups, and some strength from the larger macro bullish funds. We just don't have those headlines right now. In fact, the corn market feels somewhat lost to me and searching for direction. Unfortunately, as it drifts, I continue to see it glancing over at the soybean market. The lower soybeans prices travel, I suspect the lower corn prices drift.

Bulls argue that world corn stocks are down more than -20% compared to last year, but prices aren't reflecting the lower supply. Again, in today's trading world we need more than just demand. We need a global growth story and reason for more funds to be interested in seeing macro headlines from a bullish perspective.

We are still waiting to hear official headlines form Washington regarding the approval of E15 year round. While it is certainly a positive domestic headline for corn used for ethanol. I don't see it as something that is going to draw decidedly more bullish interest from the funds or shift their current outright bearish position. I just think the underlying landscape of trade uncertainty has created a bearish mindset or tone to the market.

Ink a trade deal with Canada, China and the European Union and I suspect the bearish clouds will start to dissipate, the low in the market will be established and corn prices will start ratcheting themselves higher. As producers, we have to stay patient, plan for a continued drift sideways to lower and perhaps a widening basis through harvest. Washington and South American weather are the wild-cards moving forward.

The opinions of the author are not necessarily those of Corn+Soybean Digest or Farm Progress.

CHECK OUT ALL THE DAILY INFORMATION IN THE VAN TRUMP REPORT

About the Author(s)

You May Also Like