Soybean prices rallied +30 cents last week, but the trade still remains deeply concerned about the Chinese trade headwinds. Bulls argue that current prices are still extremely undervalued as demand remains strong. Bulls are also thinking the USDA will show another slight deterioration in their weekly crop-condition report due out this afternoon.

Last week, conditions fell from 71% rated "Good-to-Excellent" down to 69%, but is still well above last years rating of 61% at this juncture. Personally, I fell like it's extremely hard to get any type of accurate yield estimates on U.S. soybeans in July, so much can change in the final innings.

From my perspective, the USDA's current estimate of 48.5 bushels per acre could be argued plus or minus 2 either direction. Unfortunately, I don't feel like the trade is heavily debating U.S. production. The bigger debate continues to circulate around U.S. and Chinese trade relations.

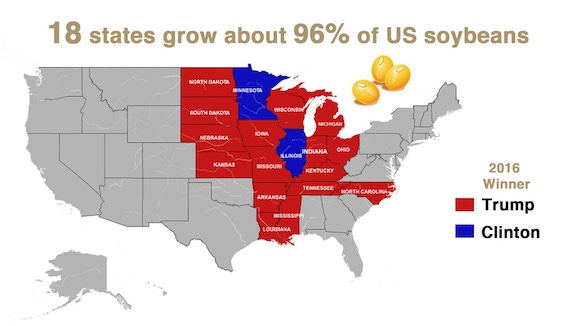

We continue to hear talk from fund managers that the Chinese might be digging in their heels. Thoughts are they are staying silent and not wanting to respond or evoke President Trump, but perhaps wanting to drag things out to influence the upcoming U.S. November mid-term elections. I've seen all kinds of political propaganda floating around as of late, but it all seems to boil down to the swing-states in the heart of America. The theory is if enough voters in the rural areas get frustrated with the trade conflict perhaps they will abstain from the election or vote differently.

There was a graphic floating around inside the trade this weekend that was being ran on Chinese state ran new sites. It seems to insinuate that the targeted tariffs on U.S. soybeans could help shift or change U.S. leadership. Obviously, even if it's just talk of the Chinese wanting to play their hand in this manner, it might be tough to attract large bullish interest in the soybean market.

From a technical perspective, psychological resistance at $9.00 still seems to be the next major hurdle. Perhaps if the market can claw itself back and close above this level it will start to attract more longer-term bullish interest. I'm just still not 100% sold that the low is in place. I think we could see another leg lower, especially if President Trump decides to turn up the heat one more time.

As I mentioned with corn, I think "timing" is going to be the biggest and most difficult obstacle for producers to navigate in the coming weeks and months. As U.S. leaders try to negotiate better trade deals the waters could continue to get extremely rough at times. Make certain you are paying close attention and keeping your pricing window in clear perspective. I've always felt like the clock start to tick a lot faster once we move beyond July...

About the Author(s)

You May Also Like