March 26, 2020

The global impact of the coronavirus devastated most commodity markets during late winter. And crude oil prices crashed as the dispute between Saudi Arabia and Russia escalated. All of this led to the lowest crude oil prices in 18 years and negative profit margins for many ethanol plants. As ethanol production slows, the supply of dried distillers grain has declined, which could increase demand for soybean meal. Also, the spread of COVID-19 in South America is limiting its export shipments, which could benefit soybean prices.

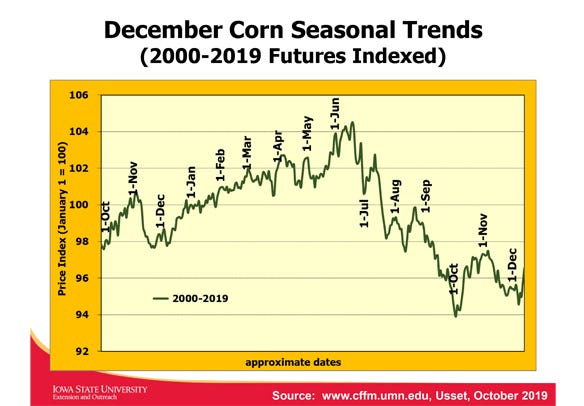

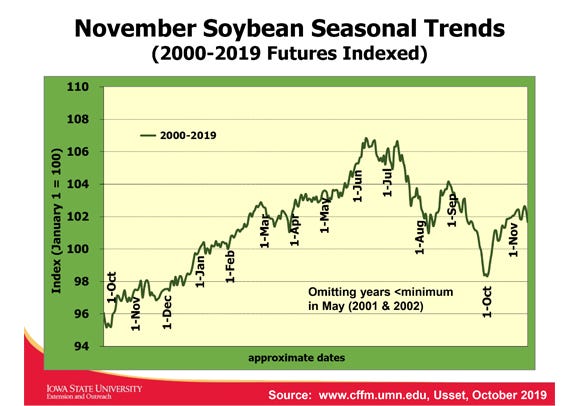

The good news: Spring is typically when both corn and soybean futures prices rally. That’s because of the uncertainty for worldwide production in the Northern Hemisphere. This is where nearly 85% of the world’s feed grains and nearly 50% of the oilseed crops are produced.

However, prospects already existed for large 2020 U.S. planted corn and soybean acres. This was in response to 2019’s smaller crop production and a record 19.61 million prevented planting acres. At the USDA Ag Outlook Conference in February, it was forecast that U.S. corn planted acreage would grow to 94 million and soybeans to 85 million.

Weather this spring and summer will be key to determining both planted and harvested acres, as well as the potential crop size. With existing saturated soils throughout much of the Corn Belt, expect the likelihood of both delayed and prevented planting acres to remain of concern. By mid-March commodity funds have built extensive “short futures” positions and may need to “short-cover” or “buy back” their futures contracts if 2020 crop production becomes of concern.

Spring corn futures price rally trends

As a result, expect short-covering rallies as speculators buy back these short futures contracts and new speculative money flows to “long futures.” Evidence of these short-covering rallies for December corn futures over the past five years include:

2019 — December corn posted a low on May 13, then rallied 90 cents until June 17

2018 — December corn posted a low on April 20, then rallied 27 cents until May24

2017 — December corn posted a low on April 21, then increased 38 cents until July 11

2016 — December corn posted a low on April 25, then rallied 70 cents until June17

2015 �— December corn went 20 cents lower from April 20 to June15, then increased 70 cents by July 11

Corn futures price objectives

Producers have benefited in recent years by selling into the spring weather-scare rallies. This strategy is easier said than done as market analysts become bullish with a sudden increase in futures prices. The weather-scare rallies during the spring typically provide very good opportunities to sell both old- and new-crop corn bushels. However, producers should consider now what would be reasonable futures price objectives for marketing their corn bushels.

The July 2020 corn futures contract traded at a life-of-contract low of $3.38¼ per bushel on March 18. Expect a potential Fibonacci retracement of at least 38% or 50% of the difference between the winter high of $4.04½ and this price low. That futures price objective would be between $3.63 and $3.71 per bushel. Consider making scale-in incremental sales when these prices are reached. Expect stiff technical resistance if July futures prices were to reach levels of $3.79 and $3.90 per bushel, which are 62% and 78% retracements, respectively, of that winter price range.

The December ’20 corn futures contract traded at a life-of-contract low near $3.55¼ per bushel on March 18. The crop insurance projected price determined in the month of February was $3.88 per bushel. This price helps in the calculation for the minimum revenue guarantee of your Revenue Protection crop insurance coverage. Thus, a futures price rally of 33 cents per bushel or greater above this price low would exceed the crop insurance price guarantee.

Based on the past five years of performance and the December Corn Seasonal Trends chart, such a rally is possible and could provide a comfort level to make new-crop sales. If this occurs, expect the December ’20 corn futures price highs of $4.11½ per bushel in October and $4.04¾ in January to provide stiff overhead technical resistance for such a price rally. Making incremental sales between $3.90 and $4.15 per bushel seems reasonable for preharvest futures price targets. If the December ’20 corn futures price exceeds $4.15 per bushel, consider using futures hedges or buying put options.

Soybean futures price objectives

Fortunately, last fall and early winter offered opportunities to price both old- and new-crop soybeans above $9.50 per bushel. The winter high price for July ’20 soybean futures was $9.84¼. That life-of-contract low of $8.29 per bushel was reached on March 18. Expect a potential Fibonacci retracement of at least 38% or 50% of this difference, which results in futures price objectives between $8.88 and $9.07 per bushel. Consider scale-in incremental sales when these prices are reached. There is likely stiff technical resistance if prices were to reach levels of $9.25 and $9.50 per bushel, which are 62% and 78% retracements, respectively, of that winter price range.

Expect November ’20 soybean futures to be slow to rally with late corn planting, as even more than the 85 million soybean planted acres could result. However, late planting of soybeans could result in less-than trend yields. Don’t forget that the likelihood of an increase in U.S. soybean export demand is likely. It will be difficult for new-crop prices to rally above the Jan. 2 life-of-contract high of $9.82½.

Consider establishing both time and futures price objectives now, making incremental sales every three weeks from late May through mid-July. Reasonable price objectives could be incremental sales every 10 cents higher beginning at $9.50 through $9.80 per bushel. If the market should rally above $9.80, consider using futures hedges or buying put options.

Need for marketing plan

Write down your price and time objectives. A written marketing plan can help provide more discipline to implement sales when either a time or price objective is reached. This written plan can then be shared with your commodity broker, grain merchandisers and ag lender to help provide accountability. These preharvest sales can help generate fall and winter cash flow needs and avoid excessive bushels being stored commercially, where higher storage costs and wider basis may result.

Producers should consider making preharvest sales when futures prices are above the crop insurance projected prices. These spring projected prices have exceeded the harvest prices for corn the past six straight years and five out of six years for soybeans.

Large 2020 U.S. planted acres and more normal weather will likely mean a return to a more normal basis as compared to the 2019 crop. Expect basis to weaken as harvest approaches and be widest the first half of the harvest. Basis should then strengthen the last half of harvest and remain strong through December. Export demand could be critical in determining the fall and winter basis.

If large 2020 crop production does occur and use declines below current expectations, then a much larger futures carry will build into 2021. Carry is the difference between the December corn and November soybean futures prices as compared to the deferred, say the July futures, contracts. Producers who already “locked in” higher futures prices in the spring could then work with their broker or merchandiser as harvest approaches to “sell the carry” and use their own on-farm storage to deliver those bushels in late winter or spring.

Plan now for futures price volatility by identifying reasonable time, futures and cash price objectives as a part of your marketing plan. Market discipline will be critical to make necessary sales, and a written plan is recommended. Expect basis to remain extremely strong into early summer, except where ethanol plants have slowed or shuttered production already. Once confirmation of potentially large new crops is confirmed, this basis will weaken quickly and likely return to more normal basis by harvest. Price uncertainty will be driven by the status of the coronavirus pandemic, continuation of low crude oil futures prices and the potential for China to make large purchases of ag products to fulfill its Phase 1 trade agreement.

Think about preparing those written marketing plans now before the likelihood of futures price volatility occurs. Old- and new-crop marketing plan templates can be found on the Iowa Commodity Challenge website.

Crop insurance spring projected prices

During February, December 2020 corn futures prices averaged $3.88 per bushel, and November ’20 soybean futures prices averaged $9.17 per bushel. These simple averages are used to determine the 2020 spring projected prices used for crop insurance purposes. Thus, a farm’s revenue guarantee will reflect these prices.

Combined with relatively low volatility factors of 15% for corn and 12% for soybeans, market prices during the last five days of February meant that crop insurance premiums are less for the 2020 crop.

A producer who purchased Revenue Protection crop insurance with relatively low corn and soybean breakeven prices in 2020 should consider making new-crop sales when futures prices are above these levels of $3.88 per bushel for corn and $9.17 per bushel for soybeans.

Johnson is an ISU Extension farm management specialist. Contact [email protected].

About the Author(s)

You May Also Like