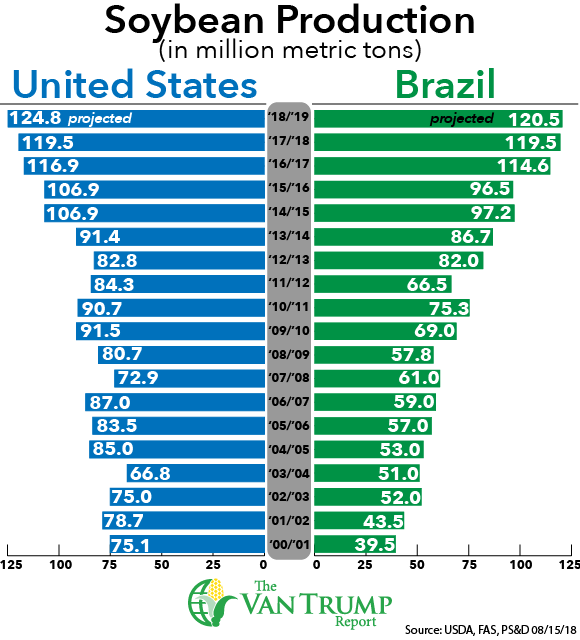

Soybean prices are slightly higher this morning. There's some talk of higher prices in China as a couple of their larger production areas are forecasting a possible weather hiccup. Bears here at home are talking about a drier U.S. forecast and continued talk that an already record USDA production estimate is growing even larger, pushing towards a 53 bushel yield average and +900 million in ending stocks. This is creating what seems to be more talk of the so called perfect bearish storm gaining even more momentum.

An all-time record Brazilian crop, being followed by an all-time record U.S. crop, happening at the same time the U.S. is trying to renegotiate trade with the worlds top buyer of soybeans has created the dark clouds. But perhaps intensifying the bearish storm is talk of extended trade complications with the Chinese, as well as an increase in total upcoming South American soybean acres. This has bears talking about the very real possibility of a +1.0 billion bushels U.S. ending stock number out on the horizon. If the early weather in South America looks to be cooperative and we do not see any real progress with the Chinese, the bears will probably try to apply more longer-term pressure to price.

There's some talk that with the funds short about 50,000 contracts, we could see some buying nearby in order to square positions ahead of Wednesday's USDA report. There's also some talk that we could see some buying if we get another bearish USDA report. Remember last month, following the massively bearish report in August, many inside the trade were surprised to see the market rally just a few days later. The USDA's updated estimates were released on August 10th, the market fell by -40 cents that afternoon. We fell by another -10 cents the following morning. Then over the next five or six trading sessions the market proceeded to gain it all back. The bulls however quickly ran out of momentum and prices once again took a deep tumble.

I just think without the weather creating more widespread complications, and without a resolution between Washington and Beijing, it's going to be tough to hold the nearby rallies. As producers, I suspect most of us are looking for ways to store unpriced new-crop bushels. The problem is, everyone making the same move always tends to worry me and rarely works out as all are anticipating.

The current board price is about -$1.20 less than last year, and most all areas are seeing a significantly weaker basis. I continue to hear more growers to the north trying to figure out how they are going to make $6.50 cash soybeans work? Bottom-line, I'm worried that prices could remain underwater longer than many of us are planning on holding our breath. If we happen to post some type of nearby rally of any significance, I think I will look to reduce a bit more new-crop risk. I just have a hard time believing all of us doing nothing and simply waiting is going to be the right answer. Let ' s hope I'm wrong...

The opinions of the author are not necessarily those of Corn+Soybean Digest or Farm Progress.

CHECK OUT ALL THE DAILY INFORMATION IN THE VAN TRUMP REPORT

About the Author(s)

You May Also Like