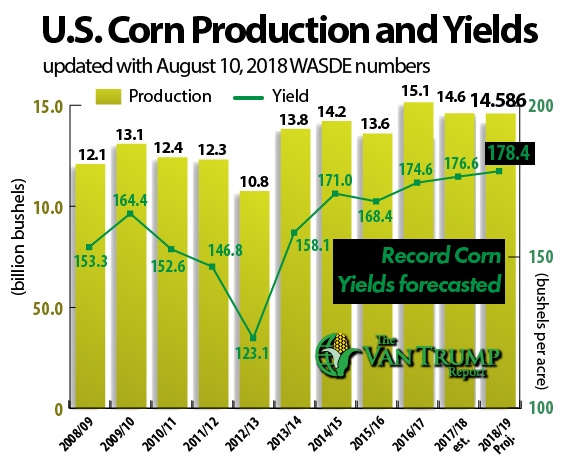

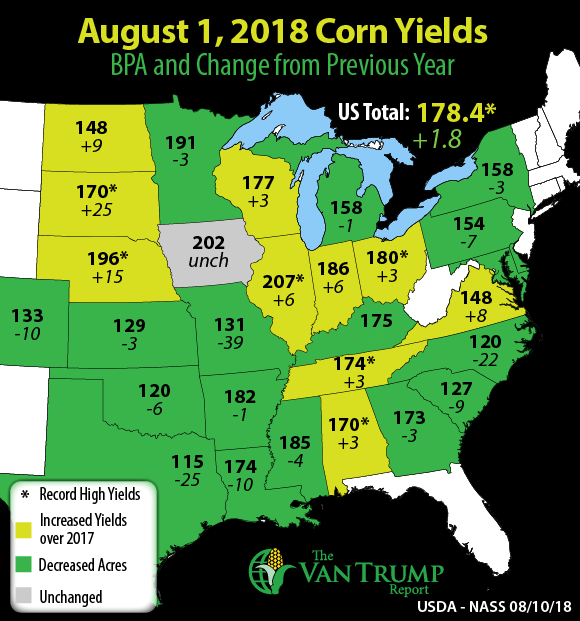

Corn traders are adjusting to the USDA's most recent numbers. The bulls didn't seem that surprised by the USDA going with such a high population count, but did seem a bit caught off guard by such a high ear weight, third highest in more than a decade. This allowed the USDA to come in with a higher yield than most were anticipating, +4.4 bushels per acre higher than last month and at a fresh new record 178.4 bushels per acre.

The report showed that Illinois, Indiana, Nebraska, Ohio, North Dakota, and South Dakota are going to harvest better yields than last year. The yield for Iowa is forecast to be the same as last year. Missouri, Minnesota, and Kansas are forecast below a year ago. In summary, total U.S. corn production is forecast at 14.6 billion bushels, up +356 million from the July report.

The good news continues to be demand. Exports were raised +125 million. Feed demand was raised +100 million bushels. Ethanol was left "unchanged" for the time being, something I think might move higher in the weeks ahead. Despite overall demand being extremely strong, the new record yield forecast at 178.4 bushels per acre has caused supply to rise faster, in turn ending stocks are increased by +132 million bushels. World ending stocks were also are raised slightly higher.

Even though EU corn production was lowered by -1.7 MMTs, and Brazil's production was lowered -1.5 MMTs, the USDA elected to raise Ukraine corn production higher by +1.0 MMTs. Also keep in mind, U.S. production was raised higher by +9.05 MMTs. Net-net, traders start this week with more bushels than last week. The question now is will demand continue to increase and will the U.S. crop continue to get larger in upcoming reports?

If the trade starts to believe the yield is going to continue to grow and ultimately push north of 180 bushels per acre, it's going top be extremely difficult to mount any sustained rally. As I've been saying for weeks, a "demand story" simply won't be enough to carry the market on its own merit. In today's new trading world it needs more help...

As a producer, I'm most concerned about "basis" and how quickly it could erode moving forward. Make certain you are paying extremely close attention. If you can get a good new-crop basis, I wouldn't play around and drag your feet for too long. As a spec, I'm still looking to be a buyer on a deeper break in price.

CHECK OUT ALL THE DAILY INFORMATION IN THE VAN TRUMP REPORT

About the Author(s)

You May Also Like