Soybean bulls are happy to see the USDA finally reducing their crop-condition estimate. Prices were up double-digits in the overnight, but continue to trade around the $9.00 level.

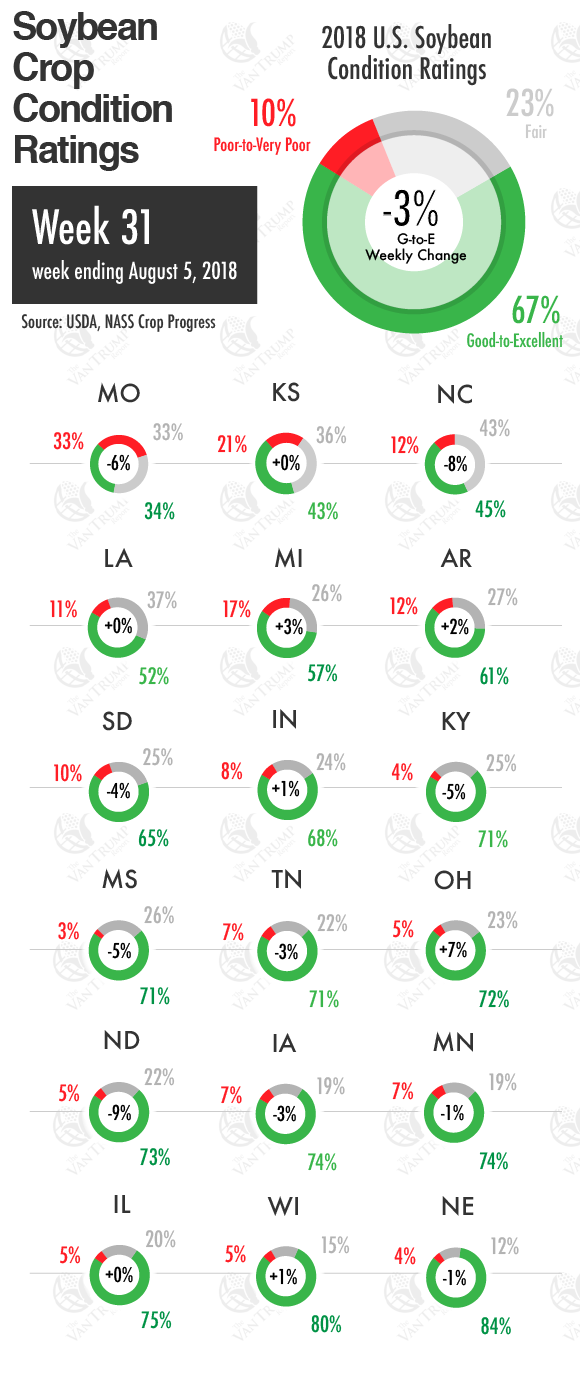

Weekly ratings fell from 70% rated "Good-to-Excellent" last week down to 67% this week. States deteriorating the most are: North Dakota -9%; North Carolina -8%; Missouri -6%; Kentucky and Mississippi -5%; South Dakota -4%; Iowa and Tennessee -3%; Minnesota and Nebraska -1%; Illinois, Kansas and Louisiana "unchanged"; Indiana and Wisconsin +1%; Arkansas +2%; Michigan +3%; Ohio +7%.

Soybeans "blooming" are reported at 92% vs. the 5-year average of 86%. Soybeans "setting pods" were reported at 75% vs. the 5-year average of 58%.

From a historical perspective, I don't like reading that NOV soybeans tend to deteriorate in price from now through early-October. I'm hoping this year bucks the trend. I suspect a lot will depend on remaining August weather and how Chinese trade talks progress in Washington. I still see more extreme volatility on the horizon.

Many professional traders still see an easy -$1.00 move to the downside on further deterioration in Chinese trade talks and a cooperative U.S. weather. On the flip side, many professional bulls are talking about +$1.00 immediately added to the upside should trade talks produce an agreement and or U.S. weather deteriorates more rapidly in the weeks ahead. Bottom-line, nobody really knows the direction of the next $1.00 move in this market, but traders continue to believe the wild swings are still in play.

CHECK OUT ALL THE DAILY INFORMATION IN THE VAN TRUMP REPORT

About the Author(s)

You May Also Like