Hot money ran cold again this week through the commodity markets. Big speculators added to bearish bets and liquidated some of their sparse bullish positions.

Here’s what funds were up to through Tuesday, August 27, when the CFTC collected data for its latest Commitment of Traders released Friday.

![]()

Rare commodity

Bullish fund traders were hard to find this week as big speculators extended bearish bets in crop and livestock by another 61,250 contracts. Investors hoping to gain exposure to commodities through index funds were also selling a little of their net long positions.

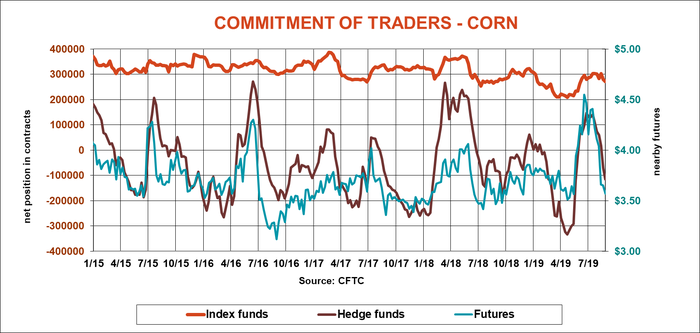

USDA wake

After turning bearish on corn last for the first time since Memorial Day, big speculators kept pressing this week, adding 44,409 contracts to their net short position, taking it out to 114,984 contracts.

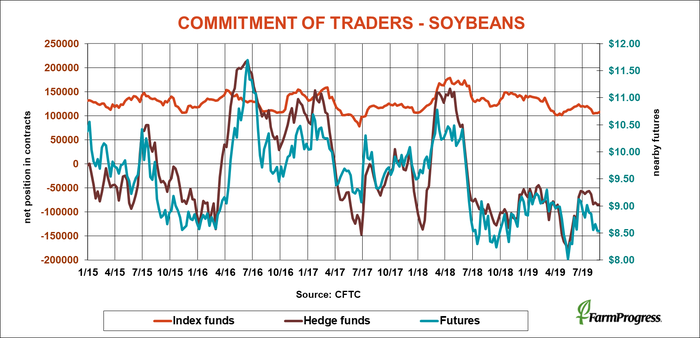

Tippy-toe

Big speculators didn’t do much in soybeans over the last week, at least collectively through Tuesday, when the CFTC data is collected. The hedge funds added only 190 contracts to their modest net short position.

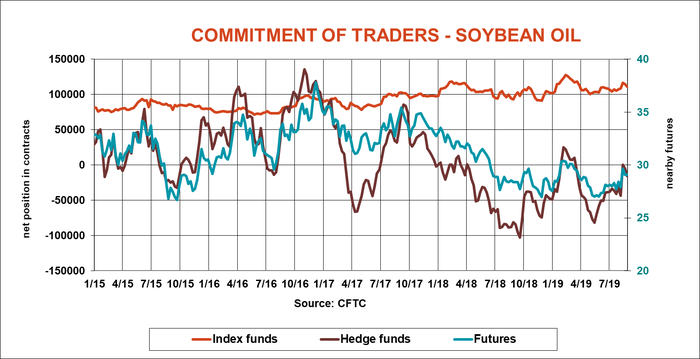

Triple play

After shifting short again last week, big speculators tripled their new bearish bet in soybean oil last week, selling a net 10,618 contracts.

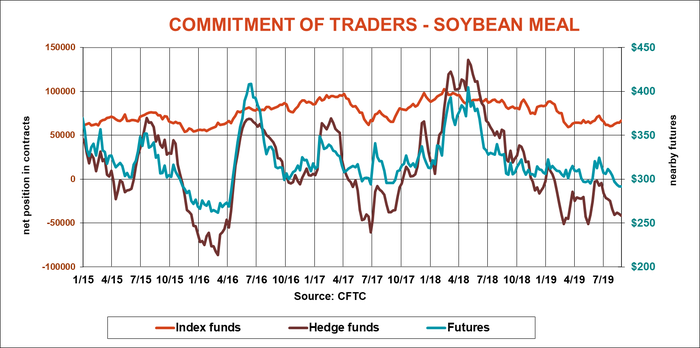

Out of favor

Soybean meal normally leads the bean complex but continues to see hard times. Funds added another 1,547 contracts to their net short position in the product.

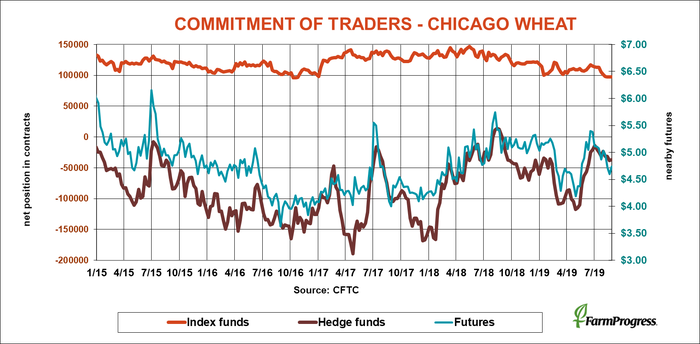

False hope

Soft red winter wheat tried to prove a turnaround this week, helped by big speculators who trimmed 1,008 contracts off their net short position. But deliveries swamped the market later in the week.

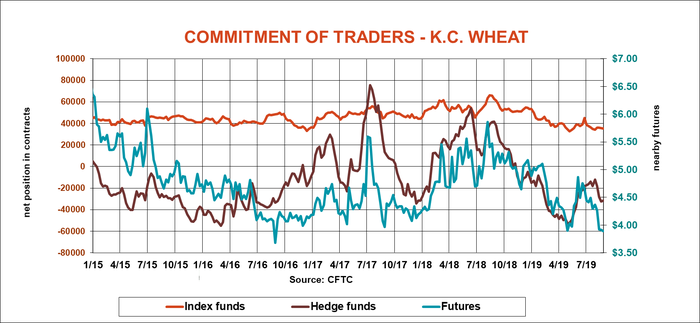

Short pause

Funds covered a few bearish bets in hard red winter wheat this week, buying back 653 lots of their net short position. That wasn’t enough to keep the market from staying trapped below $4 however.

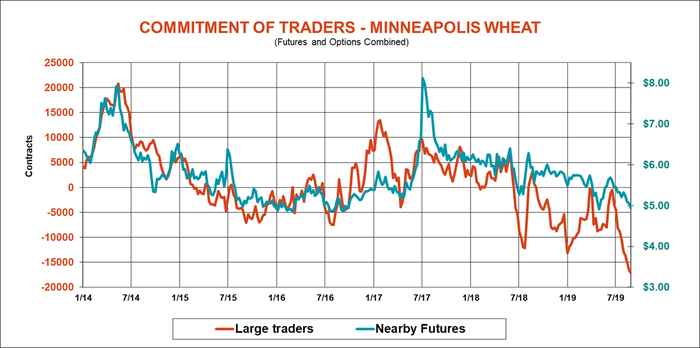

Still no end

Large traders in Minneapolis sold again this week, adding another 599 contracts to their record net short position ahead of active deliveries on first notice day Friday.

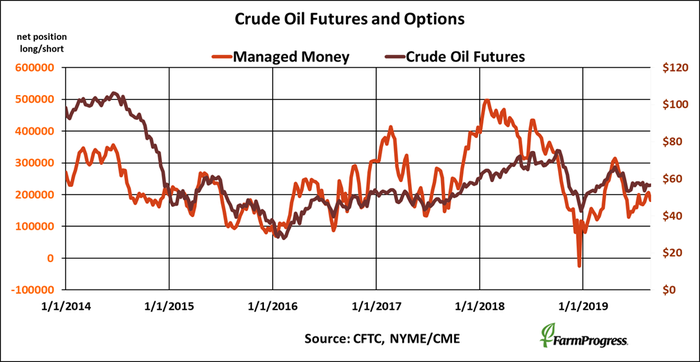

Gassed

Money managers ran hot or cold on crude oil over the summer. This week they gave petroleum the cold shoulder, selling $1.4 billion in crude oil futures and options as prices continue to churn.

About the Author(s)

You May Also Like