Soybean prices are giving back a portion of yesterday's gains. Bulls are happy to see U.S. subsidies being brought to the table. The optimist argue that it will send another warning shot to the Chinese and hopefully bring an end to trade negotiations sooner rather than later.

Bears argue it shows that Washington is willing to dig their heels in deeper for what many believe is going to be a much longer-term battle.

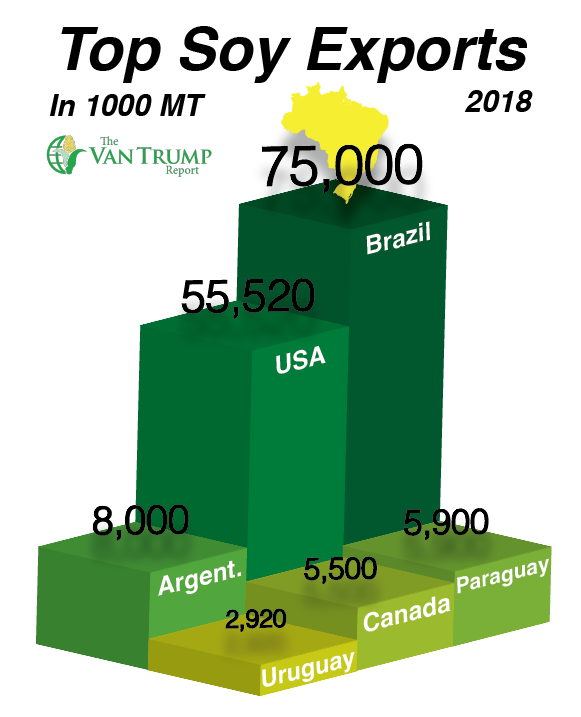

Regardless, there's still a ton of unknowns and uncertainty, not only regarding the recently announced subsidies, but also the ongoing trade negotiations with the world's top buyer of soybeans. From a demand perspective, I continue to see record demand for U.S. soy from global buyers other than China. I suspect the large discount to South American soy is a big incentive.

From what I have been hearing as of late, U.S. soybeans with the +25% tariff are arguably a bit cheaper than Brazilian soybeans. In other words, Chinese importers have to be painfully monitoring prices and just shaking their heads. Perhaps they have some deals in place that allow or help them import our U.S. soybeans through other nations?

Bottom-line, we need to continue to see demand stay strong, just around the next corner is when we traditionally start to see the Chinese buying of U.S. soybean kick into a higher gear.

Technically, the market appears somewhat comfortable in this $8.50 to $9.00 range.

Record U.S. production is still very much a possibility, especially with the cooler and wetter forecast. The trade is also digesting fresh talk of another round of record setting soybean acres in South America coming in the weeks ahead.

As both a spec and a producer, I am staying extremely patient and giving the market time to more fully adjust.

CHECK OUT ALL THE DAILY INFORMATION IN THE VAN TRUMP REPORT

About the Author(s)

You May Also Like