When President Donald Trump announced tariffs of about $60 billion on Chinese imports to the US in March, a howl rose from the ag community.

China retaliated with a list of 128 US products, then added a list of 106 more things subject to a 25% tariff. Beef was on that list.

However, analysts with Rabobank's RaboResearch food and agribusiness group say because beef trade between the two countries is limited, such a tariff will have "minimal impact" on the US beef industry, and even less on broader global beef trade.

However, China's beef market is growing. Rabobank analysts said it grew 32%, year over year, in the first quarter. It now stands at 211,000 tons and is carrying a significant price advantage over pork and of course, chicken. Overall, the analysts say Chinese domestic beef production is rising, as are beef prices and beef imports. The major suppliers, however, are typically lower-quality meat providers than US production. These include Brazil and No. 1, Uruguay at No. 2, Argentina at No. 3. Australia is also a major supplier to China.

More important to US beef producers, and to global beef trade, is the continuing drought in the US. Rabobank analysts say they still expect a 5% growth in US production for 2018, but the drought could have significant, mostly negative effects. For one thing, they say, rising costs of forage and feed will drive up cost of gain and limit carcass weights. If the dryness continues, cow slaughter could rise further: It was already 10% higher in mid April of this year than at the same time last April.

Drought over the winter already drove many lightweight calves into grow yards and feed yards earlier than normal because of the lack of wheat pasture and other winter grazing, they note. This will substantially reduce fed cattle supplies through the fourth quarter of the year. At the time of the analysis in mid to late May, Rabobank analysts noted 20 states with measureable drought stress, with 70% of US beef cows in those states. They added that eight states had extreme or exceptional drought, and those contain 34% of the US cow herd. They recalled the increased cow slaughter already in play and added, "… the likelihood of some degree of forced liquidation during the coming grazing season is very high."

Analysts also noted rising hay prices and USDA's estimate for a 2-million-acre reduction in corn planting, plus the late spring and delayed planting. This seems to be driving feed-grain prices higher -- another negative for livestock production, including beef producers.

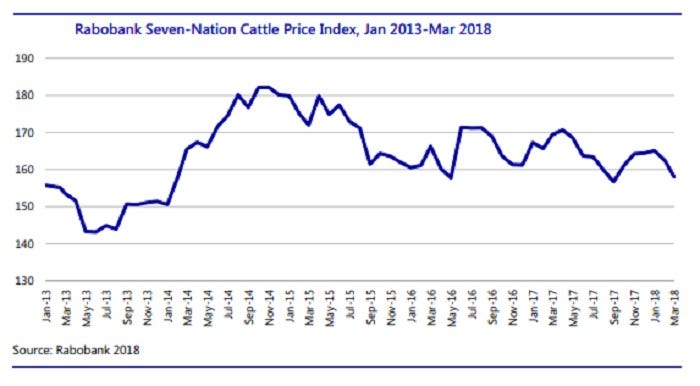

In fact, Rabobank analysts say worldwide beef production in the major producing countries is on the rise, along with global beef production and generally strong prices. This was the good news in their second-quarter report.

RaboResearch food and agribusiness analysts say their cattle price index has dropped recently, but is holding up well from good global demand, despite growth in the global supply of cattle.

About the Author(s)

You May Also Like