Despite anxiety over trade disputes, grain markets rallied in the second half of July. A round of furious short covering by these hedge funds helped fuel the gains.

Here’s what funds were up to through Tuesday, July 31, when the CFTC collected data for its latest Commitment of Traders.

![]()

Short squeeze

Big speculators sold ag contracts relentlessly this spring and summer, turning a bullish bet bearish in crop and livestock futures. But hedge funds bought across the board in the crop market last week, covering a net 143,644 contracts of their net short position to fuel the rally.

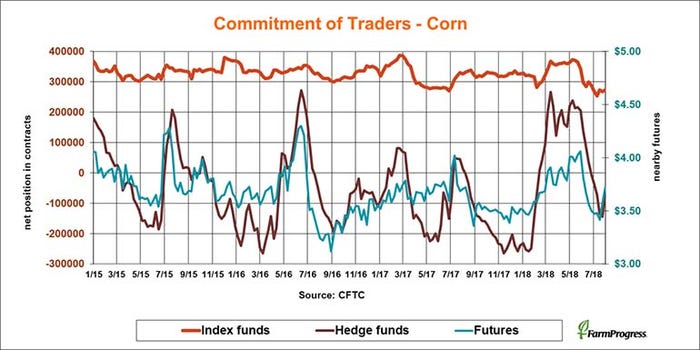

Corn comfort

After nine consecutive weeks of selling, big speculators started jumping off the bearish bandwagon this week. Hedge funds slashed 80,948 contracts off their net short position. They’re still short, but only by 63,633 lots.

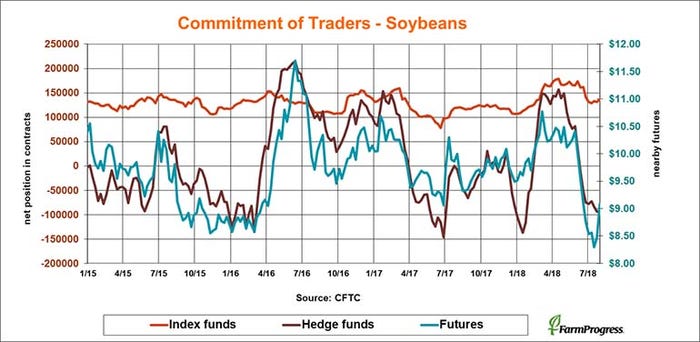

Soft step

Soybean futures rallied nearly $1 a bushel on their July rally. But funds didn’t appear to drive the gains. Big speculators covered just 1,810 contracts of their net short position this week. Index funds used by investors wanting to gain exposure to commodities were a little more interested but only added 5,645 contracts to their net long position.

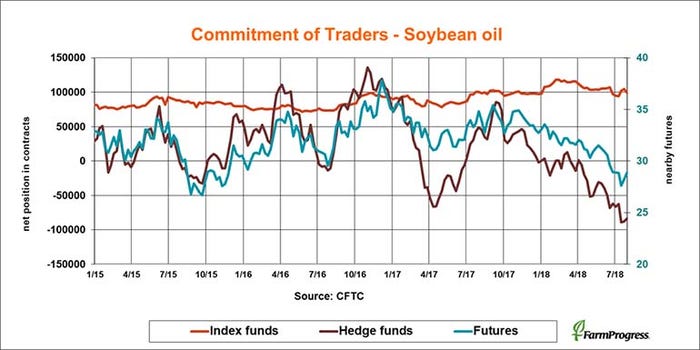

Different directions

Big speculators bought back 4,442 contracts of their large bearish bet in soybean oil this week. Index fund investors were selling, trimming 5,442 contracts from their net long position.

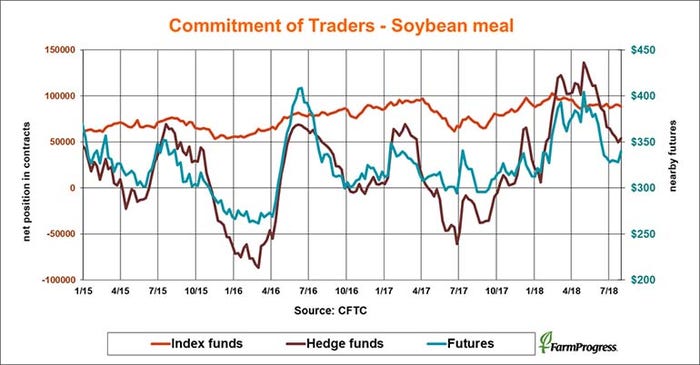

Still long

Big speculators are still long soybean meal despite three months of selling. This week they changed direction and got a little longer, adding 4.636 contracts to their modest bullish bet.

End of an era

Big speculators have been bearish on soft red winter wheat for more than four years. But this week hedge funds covered the rest of their net short position, buying 28,857 to flip long. Their bullish bet isn’t much, just 37 contracts.

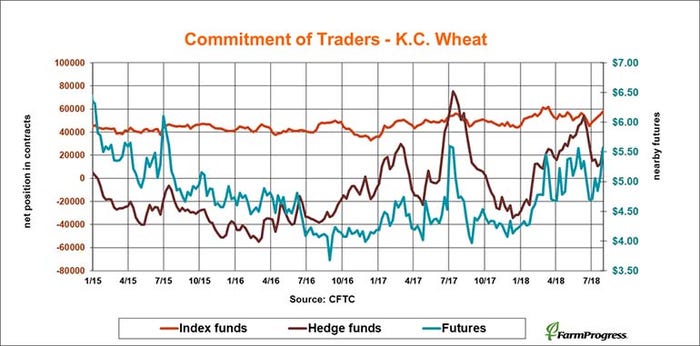

Double play

Big speculators more than doubled their small bullish bet in hard red winter wheat this week, adding 13,667 contracts to their net long position.

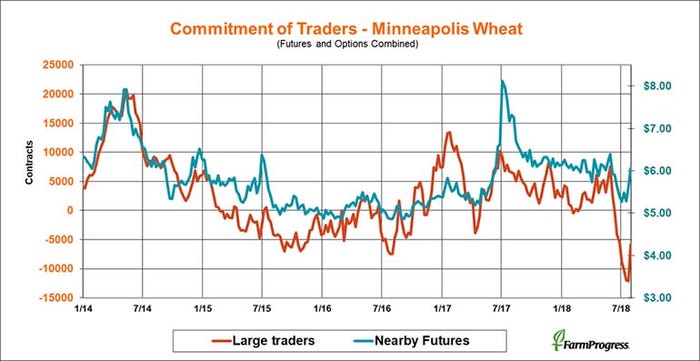

No record

After pushing their bearish bet in spring wheat to a record level, large traders ran for the exits this week, buying back 6,230 contracts.

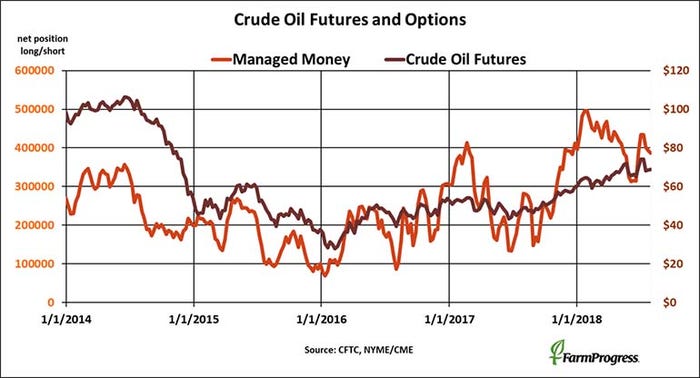

Greasing the skids

Money managers sold crude oil for the fourth straight week, trimming their net long position by $370 million worth of crude.

About the Author(s)

You May Also Like