April 10, 2024

by Max Steffes

We are in such an interesting land market. At the start of March, a sales record was set in Cass County, N.D., of $11,160 per acre. At the end of March, another record was set near Ada, Minn., in the central Red River Valley for $11,200 per acre. And our team in Iowa continues to see acres selling between $15,000 and $25,000 each. Yet, net farm income is forecasted to be down significantly this year.

I still believe overall land values are correcting and have been since about September. Several bidders contend that the $11,160 price per acre would have been $12,000 to $13,000 a few months prior. Marginal land I’ve seen trade hands recently is down 10% to 40%. The price spread between high-quality and low-quality land continues to widen, and that has always been the case during market corrections. Poor land is the last up and the first down.

A few other factors to point out — beyond the obvious leading indicators of commodity prices, interest rates and yields — include:

Supercharged economy. Since 2020, $6 trillion has been added to our money supply, most of which was through fiscal and monetary spending. Our dollar is obviously worth less. Is the land bringing more, or is our dollar worth less?

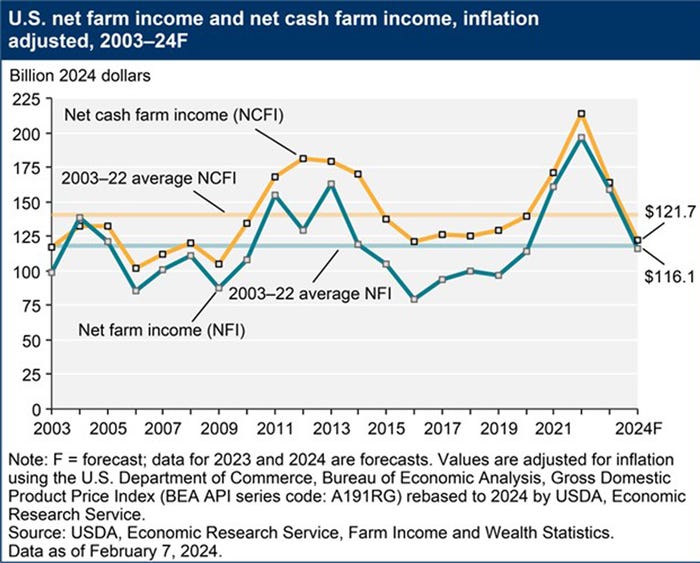

COVID cash. Many well-heeled farmers still value good land above most worldly possessions. Net farm income ballooned after the pandemic, and some of that cash wasn’t spent. In the Red River Valley, sugarbeet and potato farmers are coming off record profits. Some netted in excess of $1,500 or more per acre last year. In an environment with excess cash and a weaker dollar, many of them will gladly trade whatever cash they saved for good land despite major headwinds on the horizon.

High rents. You’ve heard the stories of rent per acre at over $300 in the Red River Vally and more than $400 in some areas of South Dakota and southern Minnesota. It doesn’t make much sense from a dollars-and-cents perspective, but it’s kept land as a viable investment for those with capital. The investors are still active, and land rents continue to lag the present-day economies of production ag.

Election year. Things tend to get silly and make no sense during an election year. Remember January 2020? First came COVID-19 and then a booming economy. Who would have thought? On the land front, out of the 10 past presidential election cycles, land values have only gone down twice. Most of the time it makes double-digit gains.

What’s in store? I certainly don’t see double-digit gains, but I don’t think we’ll see productive land correcting downward much. If commodity prices stay where they are, good land will be flat this year and poor land will continue its downward correction.

There is just too much cash in the economy for good land to correct much, even in today’s $4 corn environment. On the other hand, watch the leading indicators. If there is a major run in corn or soybean prices, expect land to follow.

Steffes is the director of real estate for Steffes Group LLC and writes from Fargo, N.D.

You May Also Like