June 5, 2020

Before COVID-19, U.S. agriculture was gaining some momentum coming off a difficult year. Trade deals were coming into place and commodity prices had a hint of getting better.

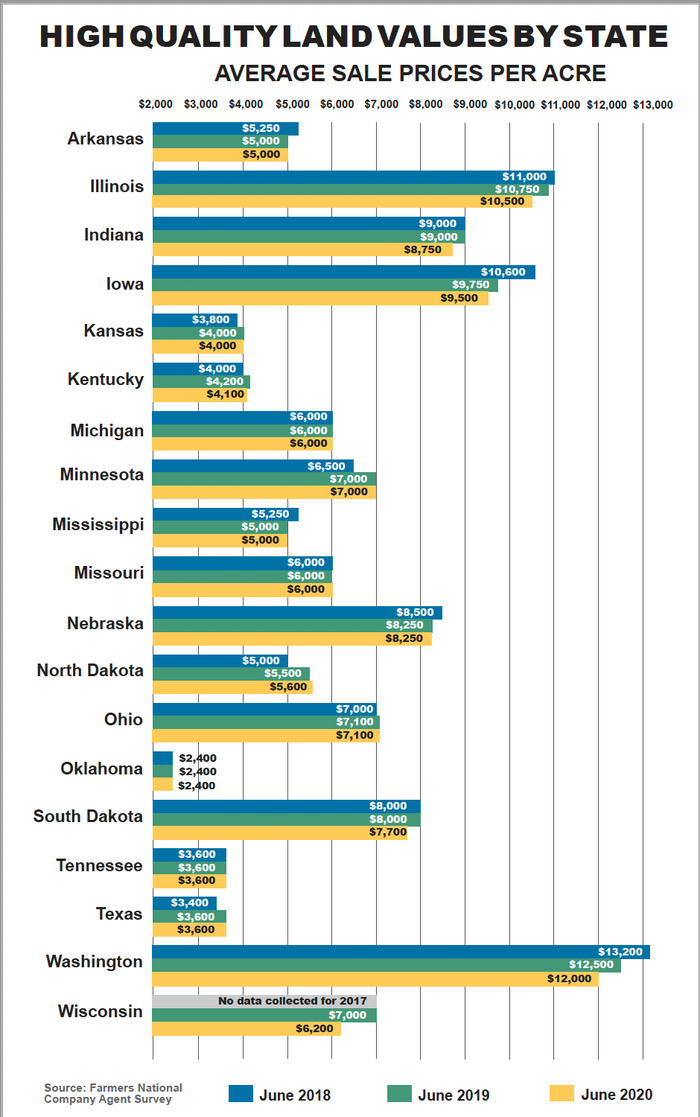

“The market for good cropland was stable to slightly stronger in many areas as interest rates remained low and demand was fairly strong for the low supply of land for sale. Recreational land had good demand as the general economy and the overall wealth of individuals was strong,” said Randy Dickhut, senior vice president of real estate operations for Farmers National Company.

After COVID-19 struck, disruptions impacted most aspects of agriculture. Dairy producers saw an immediate drop in fluid milk consumption when schools closed. Livestock producers who sold directly to restaurants or farmer’s markets saw their prime marketing channel dry up overnight. The shutdown of meat processing facilities impacted consumers and that impact stretched all the way back to the farm. Corn producers saw the bottom drop out of ethanol usage at the institution of stay-at-home rules.

Farmers National Company land auctions continued during March and April albeit with social distancing procedures in place. What were to be public auctions became stay-in-your-pickup in the parking lot live auctions, bid sales or online auctions. Sale outcomes varied by region and property. The land market became more cautious in the areas with dairy, livestock and ethanol as these industries endured mounting bad news. In other areas, land sale prices were stable as demand for good quality land was more than adequate for the amount that did come up for sale.

“Real estate sales activity at Farmers National Company was strong during the first seven months of its fiscal year despite an industry wide slowdown. Sales volume was up 6% to 8% compared to each of the past three years,” said Dickhut.

What is coming next for the land market?

Various factors that can impact land values are pulling in opposite directions. Positive influences include the continued low supply of good land for sale and historically low interest rates. For many, investing in ag land will be a safe haven for the current times, a long-term hedge or the means to invest in the sustainability of the food supply. The average land buyer who has resources may invest in recreational land for a place in the country. Farmers will remain buyers of land if they have the financial standing to do so.

Challenges that could put pressure on land values include the overriding potential for depressed farm incomes and the further decline of working capital for producers. Will lower farm incomes overcome the low interest environment to put pressure on farmland values? Will farm finances be helped enough by the additional infusion of federal cash payments to producers to maintain financial stability? Will there be more land come onto the market due to financial pressures that could tip the supply and demand equation?

“It is too soon to accurately answer what’s next for the land market except that agricultural land will continue to be bought and sold. Land passing to the next generation is a constant that remains in play no matter what. Decisions made by inheritors of land, producers, lenders, legislators and investors will come together over the coming months to provide the answer to what’s next for land values,” said Dickhut.

Here's a look at what's happening in regions across the United States.

Iowa and Wisconsin

“Despite a slower land market in general, sales activity for Farmers National Company in Iowa increased 7% over last year for the first four months of the year, while acres sold were up 4%,” reported Sam Kain, area sales manager for the company. “There definitely has been a slowdown as we moved through spring as buyers and sellers became more cautious waiting out the uncertain economic times.”

With less high-quality land selling in the market, it is more difficult to gauge value trends. Ever since COVID-19 responses have been in place, land values in Iowa and Wisconsin have softened, Kain said. In Wisconsin, where dairy producers are once again struggling with low prices and decreased markets, land values overall may be down 10%. Iowa producers have seen lost demand for ethanol hurting grain prices while livestock prices plummeted from processing plant shutdowns.

“Buyer interest in farmland has slowed even though interest rates are extremely low,” Kain said.

Nebraska, Kansas, Oklahoma and Texas

“Our late spring land auctions were successful at or slightly above market values as there was good competitive bidding," said Paul Schadegg, area sales manager for Farmers National Company. "Grazing land sales are softer due to the drop in cattle markets."

Schadegg is optimistic for future land sale activity, however.

“I am pleased with the continued interest from both sellers wanting to market their land in the next six months along with buyers inquiring about what is currently for sale and what is expected to come on the market in the near future,” he said.

For the time being, private treaty listings may become the preferred sale method for land.

North Dakota, South Dakota and Minnesota

Brian Mohr, area sales manager for Farmers National Company, believes that COVID-19 issues will impact both listing volume and buying activity in the coming months as the land market weighs the influencing factors.

“Sales activity this time of year is always slow, but it is slower than normal, which is understandable with all that is happening in the world and in agriculture. Good tillable land continues to sell well at a price comparable to or slightly below last year. Grass and pastureland are softer than cropland due to the stress in cattle markets,” Mohr said.

“Buyer interest in farmland has slowed even though interest rates are extremely low. I look for activity to pick up come late summer as more information is available, crops are nearing harvest and hopefully there are no more interruptions in meat and food supplies,” Mohr said.

Washington

“The real estate market in eastern Washington has remained active during the COVID response,” said Flo Sayre, managing broker for Farmers National Company in Pasco, Wash. “We are getting regular calls to list properties and are still actively showing properties, although most have been virtual showings.”

Tier 1 farmland with project water has remained strong at the upper price levels, especially if the use will be for higher value crops. Potato and onion producers are facing challenges with decreased demand from restaurants and institutional food services. Alfalfa demand is questionable as dairy producers experience losses and exports are variable.

“The market will remain active as some people will be moving money into real estate from other investments. During times of uncertainty, many people look for a safe investment, especially for the long-term,” she said.

Georgia

The land real estate market in Georgia has continued to be on the slower side even before COVID-19 effects came into the picture.

“There seems to be no discernible difference in sales activity between the period prior to the appearance of COVID-19 and post appearance when looking at the number of sales for each time frame,” said Wayne Groover, managing broker for Farmers National Company. “In our analysis of land sales across the state, selling prices have ranged from a low of $950 per acre for recreational type properties with poor soils or cut over timber to a high for the period of $11,000 per acre for transitional or development tracts.”

The analysis covers the period of Jan. 1 through May 15, 2020, for tracts larger than 50 acres. The majority of the sales analyzed came from central and northern Georgia.

“The makeup of the type of land being sold was not surprising for the sample in this time period. There was no row crop land that was sold for this area, while 24% was pasture or hay ground used for agricultural purposes with the majority or 62% being wooded recreational land,” Groover noted.

Source: Farmers National Company, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like