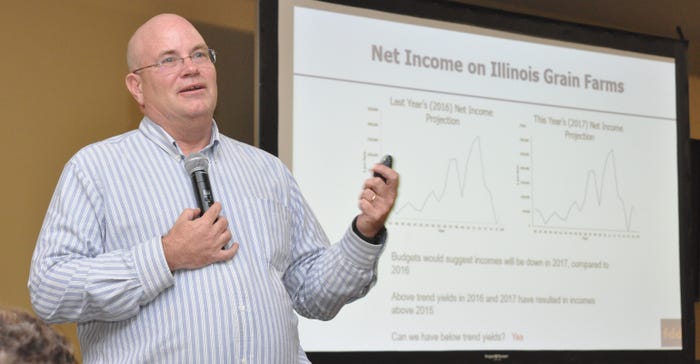

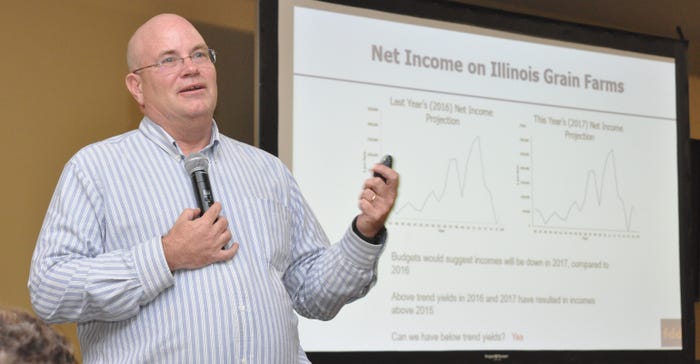

It’s hard to feel financially optimistic as farmers face so many unknown factors, like final 2017 ending stocks, the 2018 Farm Bill and trade uncertainty.

The good news? Most Illinois farms will see moderate incomes this year, says Gary Schnitkey, University of Illinois agricultural economist.

“It would be a lot worse if we had average yields or below-trend yields, and the same crop prices,” says Dale Lattz, U of I Farmdoc research associate. “But we’ve had really good production yields.”

What else should Illinois farmers look for in 2018? Here are the top five takeaways from ag economists.

1. It will take a major event, like a drought, to move the market. Another year of solid yields is a blessing and a curse. “We can’t demand our way out of this stock,” says Todd Hubbs, U of I College of Ag, Consumer and Environmental Sciences clinical assistant professor. “If we have another year like 2012, we could eat through those stocks rapidly.”

With a slight increase in ethanol use and feed use, Hubbs projects corn prices at $3.40 for the 2018-19 marketing year and $3.30 for the current year. For soybeans, he projects $9.20 for the current marketing year based on lower-than-projected 2016-17 ending stocks and strong exports to China. If the 2018 soybean crop averages 48.5 bushels per acre and projected soybean acres become a reality, Hubbs says 2017-18 ending stocks will outpace use and forecasts $8.80 soybeans for the 2018-19 marketing year.

2. Jump on corn rallies. Hubbs doesn’t see a market rally in the near future, but he advises against ruling one out. If you do see a rally, “wait and see” may not be the best choice. “Anytime you see $4 corn, think about marketing your crop,” he says. “If you get a chance to sell during a rally, take it.”

3. Be prepared for NAFTA withdrawal. “I wouldn’t bet a penny it’s not going to happen,” Hubbs says. “I think it’s going to happen, and we’ll have to deal with it.”

If the Trump administration does pull out of the North American Free Trade Agreement, Hubbs expects a price drop and eventually a recovery period. How well prices rebound will partially depend on new tariffs. “There is a lot of uncertainty surrounding the NAFTA negotiations,” he says. “The timing and final negotiated outcome of NAFTA will provide clarification on the size and impact of any tariffs U.S. farmers will face in trade with Mexico and Canada.”

4. High cash rent acres need serious consideration. “Cash rent returns have been near zero,” Schnitkey says, adding that farmers should budget for a loss in 2018 on high-rent acres, and it’s time to ask some tough questions. For farmers with a high percentage of high rent farms, what will happen if you don’t rent the land again? Or, what if you reach your credit limit?

For farmers with just a few high cash rent farms, it’s a good time to think about why you rent the land. If you’re holding out for the better prices, Schnitkey says to ask yourself, “Will the cash rent stay the same when we get to the ‘good times’?”

High cash rent decisions come down to having a good handle on your financial situation. “Determine how long it takes before you keep doing it [renting] and you run out of credit,” he says, adding that high cash rent acres need $4 corn, $11 soybeans or high yields to be profitable.

CASH RENT CRUNCH: “Cash rent returns have been near zero,” says Gary Schnitkey, adding that farmers should budget for a loss in 2018 on high-rent acres.

CASH RENT CRUNCH: “Cash rent returns have been near zero,” says Gary Schnitkey, adding that farmers should budget for a loss in 2018 on high-rent acres.

5. Find ways to cut costs. You saw this one coming, right? When you’re crunching 2018 numbers, Schnitkey recommends taking last year’s budget numbers and reducing fertilizer costs, which have come down in recent months. In addition to high cash rent situations, look at higher-cost items — like fertilizer, capital purchases and seed — to reduce costs.

What about crop rotation? Schnitney projects that soybeans will be more profitable than corn, including soybeans following soybeans, if soybean cyst nematodes are not a challenge. Take a look at Schnitkey’s 2018 crop budgets.

About the Author(s)

You May Also Like