University of Missouri Extension ag business specialist Darla Campbell finds that farmers looking to put a floor price under livestock sales may consider Livestock Risk Protection insurance.

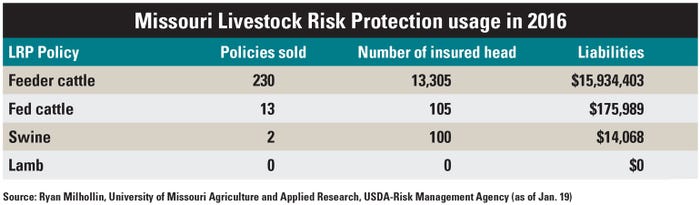

LRP provides protection against price declines for sheep, swine or cattle. However, the majority of policies taken out are for cattle.

The cost usually ranges from 1% to 5% of the value of the animal, and the premium must be paid at the time the policy is purchased.

Policies are subsidized by the federal government at 13%, which is much lower than the typical 50% crop insurance subsidy, Campbell explains in the monthly Ag Connection newsletter.

"To obtain this insurance, producers should find a reputable and experienced agent," she notes. A one-time application, which establishes producer eligibility, is required.

Then the producer purchases a Specific Coverage Endorsement (SCE), which includes making the following decisions:

1. Number, type and weight of livestock

2. Coverage level (percent)

3. Endorsement length (number of weeks until expected to sell)

4. Ownership share (must be >10%)

According to the USDA-Risk Management Agency, the number of livestock covered in a policy can range from one to 1,000 per contract, or up to 2,000 in one year (July1 to June 30).

With the main buyers of the policy in Missouri being cattle producers, it is important to understand how the policy works.

• Cattle are split into steers, heifers, dairy and Brahman.

• Cattle are insured by weight and classification — feeder cattle (under 600 pounds) and fed cattle (600 to 900 pounds).

Campbell says that the coverage level ranges from 70% to 100%, but not all coverage levels are available on any given day. "As would be expected, when the percentage goes up," she says, "so does the cost."

She explains that the endorsement length is the time from which the policy is purchased until the expected sale date of the insured animals. According to the RMA, this period for feeder cattle can be 13, 17, 21, 26, 30, 34, 39, 43, 47 or 52 weeks. "Match the weeks closest to when the cattle will be ready for market," Campbell adds. "Do not sell any earlier than 30 days before the specified time."

This insurance and the volatility of livestock markets are widespread topics of interest for agriculture, she says, and farmers should pay close attention as the next farm bill approaches.

About the Author(s)

You May Also Like