May 3, 2017

By Scott Brown

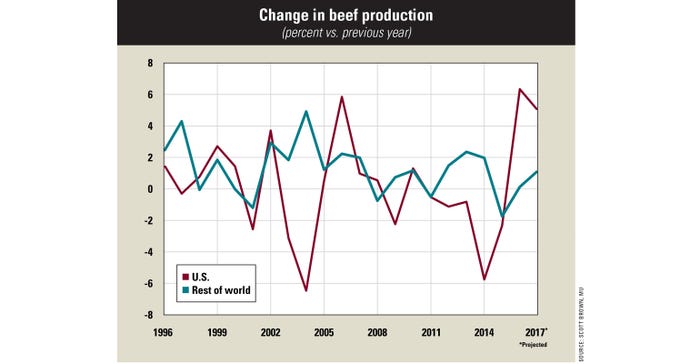

Much has been made of the challenges facing U.S. beef and other meat exports in recent months, and rightly so. The strength of the U.S. dollar and uncertainty surrounding future trade policy are reasons to be cautious about the meat export outlook. However, the timing of the increases in U.S. beef and meat production has fit in very nicely with developments in other areas of the world.

According to the USDA Foreign Agricultural Service, the U.S. produces about 20% of the world's beef. Recent FAS projections for 2017 indicate that U.S. beef production will finish the year 9.1% above the 2014 level, while beef production in the rest of the world remains 0.5% below 2014 output.

Who's losing ground?

Major beef producers posting the largest declines during that span include Australia (−20.4%), Russia (−4.7) and Brazil (−2.3). Also New Zealand, an important supplier of grinding beef to the U.S. market, is down 7.3% on beef production.

The reasons for the declines in other markets vary, as do the anticipated timelines for recovery.

Australia's recent beef production declines are largely tied to severe drought conditions, which began in 2011 and persisted into the beginning of last year. Improved moisture and pasture conditions are now expected to spur beef herd recovery.

Brazil similarly dealt with a multiyear drought that now appears to have ended. However, the complete effects of the meatpacking scandal there earlier this spring are still unknown. Though it appears that Brazil's meat exports have recovered fairly quickly with the government's response, consumer perception of the quality of meat sourced from Brazil may be tarnished.

The decline in Russia is longer-term in nature, primarily a factor of economic and lending conditions that could persist for some time.

Will markets shift?

As beneficial as the timing of these international developments have been as the U.S. ramps up beef and other meat production levels, it is important to realize that the international situation may be changing soon, while beef production increases are expected to continue here at home.

Cattle prices are expected to remain under pressure, even if domestic and international beef demand strength continues to maintain the recent positive levels. If either demand source were to falter to an appreciable degree, the market situation could quickly turn from difficult to disastrous.

So be aware that recent international developments, which have favored U.S. cattle markets, may be about ready to turn. Major beef-producing countries appear to be gearing up for expansion after a few years of decline.

Consider your role in "right-sizing" cattle and beef supplies to match anticipated future consumer demand. And above all, continue producing the high-quality product that both domestic and international consumers have come to recognize.

As the global beef and meat marketplace becomes increasingly crowded, a positive reputation for quality and safety will continue to pay dividends to U.S. cattle producers.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

You May Also Like