December 30, 2019

By Jay Parsons

According to the 2017 USDA Census of Agriculture, almost 48% of Nebraska farms own livestock — with almost 41% of them owning cattle. Annual livestock sales approach $12.7 billion, with more than $10.6 billion generated from cattle sales.

Before the turn of the century, there was little these livestock producers could do to protect against risk using USDA-administered crop insurance programs. In the past two decades, the following have been introduced: Livestock Risk Protection (LRP) insurance for cattle, swine and lamb; Livestock Gross Margin (LGM) insurance for cattle, swine and dairy; Pasture, Rangeland, Forage (PRF) insurance; the Annual Forage Insurance Program (AFIP); and, most recently, Dairy Revenue Protection (DRP) insurance.

While no one should buy insurance hoping to make money on it, these subsidized insurance products provide access to new tools for livestock producers to protect their bottom line.

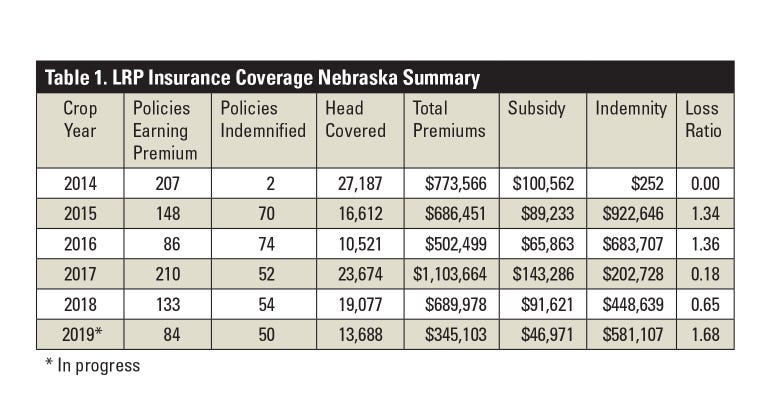

LRP is an insurance policy that protects against downward movement in national livestock prices. The crop year for LRP begins July 1 and runs through June 30 of the following year. Table 1 (below) summarizes the use of LRP in Nebraska since July 1, 2013.

Most of the LRP policies sold in Nebraska are for feeder cattle weighing less than 900 pounds. Of the 868 policies on which premiums were paid from 2014-19, 790 of them were for feeder cattle. The loss ratio (indemnity/total premiums) has varied greatly over this period, depending upon whether cattle prices are moving up or down during the year.

Overall, 35 percent of the policies earning a premium have paid out an indemnity during this period, with an overall loss ratio of 0.69 on policies sold in Nebraska. The premium subsidy on LRP is 13%. When that is taken into account, the effective producer loss ratio is 0.80.

Beginning with the 2020 LRP crop insurance year that started July 1, 2019, the premium subsidies have been increased to anywhere from 20% to 38%, depending upon the coverage selected.

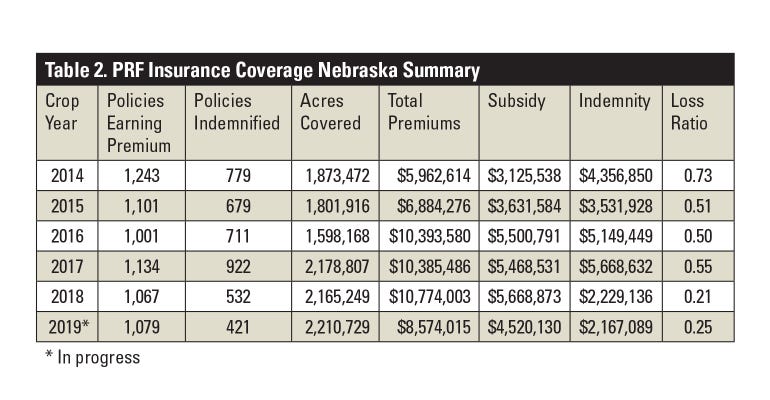

PRF insurance is designed to protect against deficits in precipitation on perennial forage intended for use under livestock grazing or haying. It is available for purchase on a calendar year basis with a sign-up deadline of Nov. 15 of the preceding year.

PRF is based on precipitation data from the National Oceanic and Atmospheric Administration Climate Prediction Center (NOAA-CPC). It is a group insurance policy based on grids that are about 17-by-17 miles.

The insurance provides producers with the opportunity to insure 70% to 90% of the Expected Grid Index precipitation across a series of two-month intervals within the rainfall coverage period for each year. Premium subsidies range from 51% to 59%, depending upon the coverage level selected.

Table 2 (below) summarizes the use of PRF in Nebraska from 2014-19. The number of perennial forage acres covered with PRF has topped 2 million in each of the past three years. The number of policies earning premiums has remained relatively stable over this period of time.

About 61% of the policies have been indemnified with an overall loss ratio of 0.44. (Note: The 2019 insurance year is still in progress.) The average subsidy for policies sold in Nebraska from 2014-19 was 53%. Taking that into account, the effective producer loss ratio is 0.92.

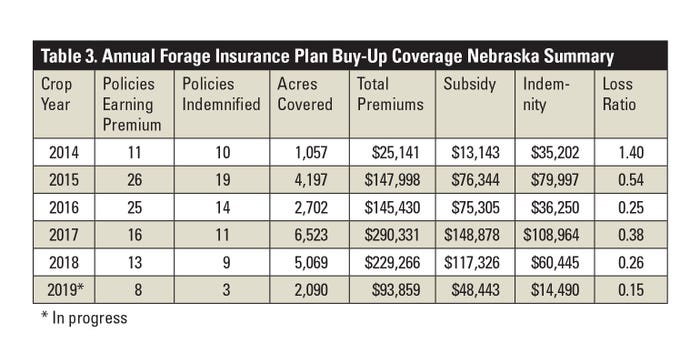

AFIP is a pilot insurance program that was first offered in 2014. AFIP is designed to meet the needs of producers planting annual forage crops for use as livestock feed or fodder. Like PRF, AFIP is based on precipitation index data provided by the NOAA-CPC.

Plans are available for four separate growing seasons tied to three-month planting periods that cover the entire year, starting July 16 and running through July 15 the following year. Table 3 (below) summarizes the use of AFIP in Nebraska from 2014-19. Use of this product has been limited.

However, the acres covered and liability protection have increased considerably the past two years despite fewer policies earning a premium. This means the people who are using it are doing so more extensively.

AFIP policies need to be signed up for by July 15, so producers need to plan ahead in order to cover crops that may be planted in any one of four planting periods stretching out over 12 months.

Over the period from 2014-19, 67% of the AFIP policies earning a premium paid out an indemnity. The overall loss ratio over this period to date is 0.36. The average premium subsidy on policies sold is 51%, indicating virtually all of the coverage was at the maximum of 90% of expected precipitation. With the subsidy taken into account, the effective producer loss ratio is 0.74.

LGM is a lightly used product in Nebraska. It insures the difference between an output price and feed cost. From 2014-19, there were only four LGM policies in Nebraska with premiums paid. Three of these were in dairy and one in cattle. Only one of the policies was indemnified.

There does seem to be some interest in the new DRP insurance with 10 policies earning a premium in 2019, its first year of availability. However, indemnities have yet to be paid out on it.

Livestock insurance is another tool for Nebraska producers. The two most commonly used livestock insurance tools in Nebraska are PRF and LRP for feeder cattle. The average 53% premium subsidy received by Nebraska producers since 2014 has made it an affordable protection tool despite relatively good precipitation across the state over that period.

It is not purchased hoping for drought, but it could be an effective strategy to help control the effect of one if it does occur. The recent changes to LRP will increase the subsidy received to 20% or higher, making it more affordable.

Data for this article was downloaded from the USDA-Risk Management Agency Summary of Business on Dec. 19.

Parsons is a farm and ranch management specialist in the Department of Agricultural Economics at the University of Nebraska-Lincoln.

You May Also Like