February 5, 2019

The challenge for U.S. beef exporters to continue to grow market share in Japan recently stiffened.

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership entered into force Dec. 30. This trade agreement is comprised of 11 nations, including Japan and major beef exporters such as Australia, Canada and New Zealand.

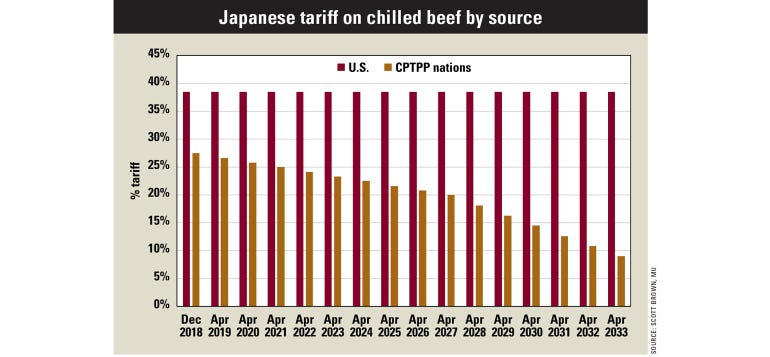

Under the agreement, Japan’s beef tariffs were lowered from the 38.5% most-favored nation rate (this is the tariff on U.S. beef shipments) to 27.5%, with further decreases occurring for the next 15 years until the tariff drops to 9% in 2033.

Nations that are a part of the CPTPP also will receive preferential treatment regarding the triggering of Japan’s beef safeguard tariff, which raises tariffs when beef import volumes sharply increase relative to recent history. This policy caused the tariff on U.S. exports of frozen beef to Japan to increase to 50% as recently as from Aug. 1, 2017, to March 31, 2018.

Critical access

The importance of the Japan beef market to U.S. beef and cattle prices was detailed in this column a few months ago. Japan imports more than a billion pounds of beef each year, with the total growing to eclipse 1.2 billion pounds in both 2017 and 2018.

The U.S. market share of Japan’s beef imports recently has risen to about 40%, fighting the long uphill battle after the discovery of bovine spongiform encephalopathy, or BSE, in December 2003, which lowered market share from more than 45% at the time to less than 10% for more than four years.

Australia supplies just more than half of Japan’s imported beef, with Canada and New Zealand combining for about 6%. Beef imports from other nations only account for about 2% of the total.

Time for talk

Although the CPTPP is a recent development, the U.S. has been at a tariff disadvantage relative to Australia for some time now, after the Japan-Australia Economic Partnership Agreement, which began in 2015. This initially dropped tariffs on Australian beef from the 38.5% level to 32.5% on fresh beef and 30.5% for frozen product, with additional decreases over time, which now will be superseded by the lower CPTPP rates beginning April 1.

So far, the lower tariffs on Australian product have not resulted in a sharp downturn in U.S. market share, as beef production in Australia has been constrained because of dry weather and herd rebuilding.

While trade issues affecting U.S. pork have dominated the headlines in recent months, the lack of headlines regarding improved access into Japan’s beef market may continue to be a hindrance to the beef industry.

With negotiations for a potential U.S.–Japan trade agreement continuing since last September, there is hope that the tariff disadvantages to this most important beef market may be a short-term issue to navigate, rather than a long-term drag on exports. Only time will tell.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like