November 18, 2019

Despite plentiful pork supplies, retail supermarket pork features have been underwhelming in 2019. Many of the current questions surrounding U.S. pork production pertain to growing foreign demand for U.S. pork products.

However, domestic retail demand remains the largest share of U.S. pork consumption. Higher U.S. pork prices appear to be rationing domestic pork demand somewhat, but overall demand remains steady. Competition is also fierce in the meat case, as U.S. red meat and poultry production is at record levels. Retailers have a bevy of proteins to pick from and feature into the holidays, which means consumers have many choices.

USDA’s Agricultural Marketing Service publishes a weekly retail feature activity report for pork. This report provides a summary of weighted average prices for pork cuts being promoted or featured in supermarkets. AMS gathers information from publicly available sources that primarily include retailer websites.

The activity index is a measure of the absolute frequency of feature activity equal to the total number of stores for each advertised pork item. For example, a retailer with 100 outlets featuring three pork items has an activity index of 300.

3 big holidays feature ham

The retail pork feature activity index tends to spike during major holiday times of year: Easter, Thanksgiving and Christmas. Hams are a big part of holiday features. This year has seen a similar pattern of holiday features, but pork feature levels have fallen short of both year-ago and five-year average levels. Through October, volume of pork retail features averaged 11% lower than a year ago and 14% lower than the five-year average.

Seasonal meat offerings are expected to fill weekly feature advertisements in preparation for the upcoming holidays. According to the AMS Livestock & Poultry Program’s Agricultural Analytics Division, most ham marketing occurs during the Christmas season, with Thanksgiving and Easter following in order.

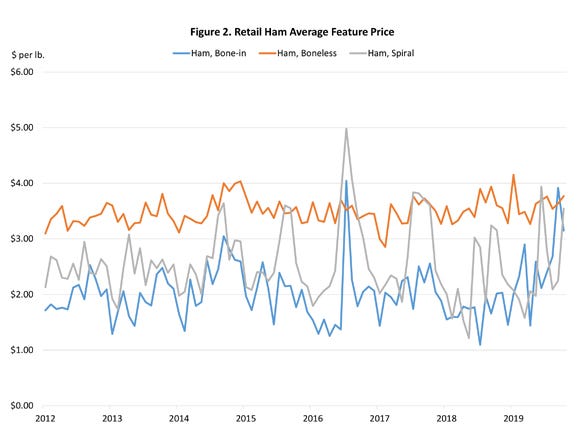

Spiral-cut bone-in hams are most associated with the holiday seasons, with 85% of annual marketings in 2018 occurring during the Big 3. A third of the remaining 15% were marketed in January and February, likely from stocks unsold during the prior Christmas season. Non-sliced bone-in hams, known as traditional hams, also depend heavily on holiday business. The same can be said for boneless hams, especially popular for Easter.

According to USDA’s National Ag Statistics Service Cold Storage report, September saw a significant drawdown in ham inventories, likely in large part due to strong demand in export markets, especially Mexico. Mexico is by far the largest buyer of U.S. export hams. Fresh and frozen ham products are the majority of hams sent to Mexico.

Total ham inventories at end of September were 6% lower than a year ago and 12% lower than the five-year average. Ham prices have been supported by a tight supply of hams in the freezer. The expectation is for prices to strengthen going into Thanksgiving and Christmas, as end-users draw from whittled-down inventories and exports remain strong.

Year-to-year comparisons

The national negotiated sales ham cutout for the week ending Nov. 8 was $79.03 per cwt, up over $20 per cwt or 35% higher from the beginning of September. Most retailers are making ham purchases for the holidays during this time. Wholesale ham values are currently up a whopping $29 per cwt or 57% from last year.

During the second half of last year, ham prices were especially soft because of tariffs imposed by Mexico. Keep this in mind when comparing ham values to a year ago. If the tariff was still in place as it was last year, we could possibly see much lower ham values. While we will have to wait for the export data, it’s likely that Mexican orders were maintained between early September and late October.

Holiday ham demand causes ham prices to vary counter-seasonally to hog prices, with the year’s lowest ham prices typically in the spring and summer, and the highest prices usually in September and October. But consumers who choose to wait or look for good deals will likely find some good prices. This is because of retail features that could be price discounts or non-price promotions such as “buy one, get one free.”

Which data used matters

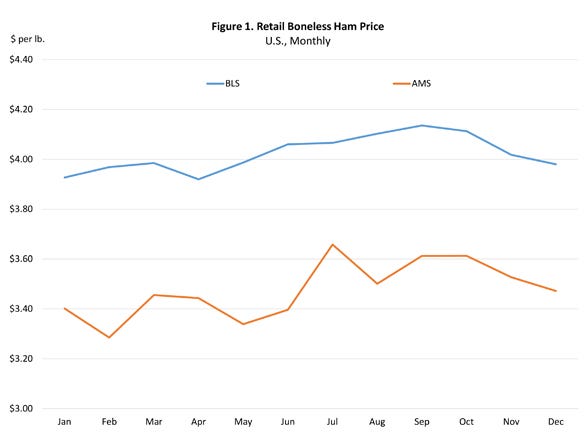

The Bureau of Labor Statistics collects a limited number of meat and poultry prices at retail establishments to calculate the Consumer Price Index. For ham, this is a price for boneless (excluding canned) hams. The main knock regarding BLS reported meat prices is that BLS data do not fully capture the effect of retail promotions.

Apparently, retailers are often very reluctant to change stickers but, during certain times they run special promotions, either offering discounts or buy one, get one free deals. The promotional impact shows up in AMS weekly retail feature data. From 2012 through 2018 the average difference between the BLS and AMS data for boneless hams was 55 cents per pound. Another way to interpret the data is the average promotional price discount is about 50 cents per pound.

Consumers can find ham in the retail meat case throughout the year in a variety of forms including bone-in or boneless, spiral-cut or uncut. However, marketing of ham is concentrated each year around the three big holiday seasons. In addition, featuring and prices appear to be most volatile for bone-in and spiral cut ham.

October bone-in ham prices ran $1.13 per pound higher than October 2018, while boneless ham prices were only 17 cents per pound higher than last year. Spiral ham prices were 39 cents per pound higher.

It is not unusual for ham prices to soften in late November and December as seasonal demand wanes once holiday purchases are completed, and end-users work down inventories while at the same time weekly hog slaughter hits some of the highest levels for the year. On the positive side for ham prices, export demand remains strong.

Eden was an Iowa State University George Washington Carver summer research program intern and is currently a Kansas State University agricultural economics graduate student. Schulz is the Iowa State University Extension livestock economist.

You May Also Like