September 11, 2018

By Austin Duerfeldt

The end of the year is fast approaching, which means it is time for bookwork and tax planning. When working on agricultural tax returns, some of the more utilized sections of the tax code deal with depreciation.

While the usual ways of depreciation are still very much active and available, the limits and qualifying property have changed under the new Tax Cuts and Jobs Act (TCJA). The changes provide interesting options for those looking to both acquire new and used assets for the business, and reduce taxable income.

Expensing with Section 179

Section 179 tends to be a favorite in tax planning for sole proprietors, partnerships and corporations. Section 179 allows the taxpayer to deduct costs of qualifying property, purchased for use in the active conduct of a trade or business, in the year the property is placed in service, rather than spreading those costs out over a number of years, as with regular depreciation.

For example: You bought a $40,000 round baler in May of the current tax year. Prior law would have you spreading that cost out over seven years. TCJA changes that to five years. Still, the $40,000 would be gradually deducted over a period of years. When preparing the tax return, we might find that with an additional $20,000 of deductions, the return could drop down a tax bracket. That is when Section 179 comes in handy. We may be able to use Section 179 on the round baler to get the additional deductions needed to achieve the lower tax bracket.

So, what is new with Section 179 in the TCJA? For starters, the phaseout threshold increased to $2.5 million. That means the amount of Section 179 you are eligible to take will be reduced if the total cost of qualifying property placed in service during the taxable year exceeds $2.5 million. Assuming your qualifying property purchased is below that threshold, in 2018 you are eligible to take up to $1 million in Section 179 expense.

Be careful on your anticipated use of Section 179 for business use vehicles like trucks, cars or SUVs. There are special weight categories a vehicle must meet to qualify for Section 179. For example, the sport utility vehicle limitation remains at $25,000, indexed for inflation after 2018.

There are newcomers to the eligible property definition that might yield some interest for farmers and ranchers. Specifically, roofs, heating, ventilation, air-conditioning property, fire protection, and alarm and security systems now qualify for Section 179. Before TCJA, these were still depreciable, but were not eligible for Section 179. Some possibilities of this addition would be heating your repair shop.

Other depreciation TCJA facts

Bonus depreciation is another tax tool that received a major overhaul. Previously, bonus depreciation allowed the taxpayer to deduct 50% of the cost of qualifying property purchased. One of the old criteria was that the original use of the property must commence with the taxpayer. That meant most used property didn’t qualify. That stipulation is gone, and used qualifying property is now eligible for bonus depreciation.

With TCJA, the additional bonus deduction has also increased from 50% to 100% until 2022. After that, it drops 20% per year until bonus depreciation is zero after 2026.

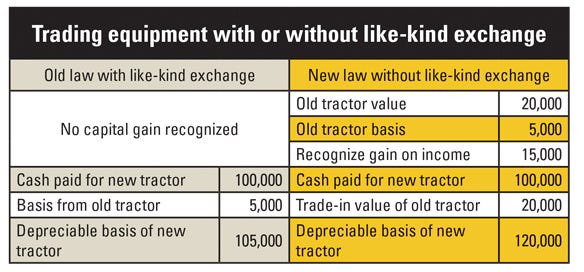

Another point of interest deals with the like-kind exchange rules. Like-kind exchange is no longer available for assets, such as tractors and breeding livestock. Now you have a situation where you will need to recognize capital gain on the equipment traded in, but will have a depreciable basis on the purchased equipment at full-value cash, plus fair-market-value trade-in.

Also, when talking about basis, it is simply what you paid for an asset, less the amount of depreciation (including regular depreciation, Section 179 and bonus depreciation) you’ve previously expensed on your tax return for this asset.

Take a look at the chart. A farmer is trading in a tractor with a trade-in value of $20,000 and remaining basis of $5,000. The farmer will pay $100,000 cash, so the fair-market value of the new tractor is $120,000. In short, a capital gain tax will be collected on the traded equipment, but the depreciable basis of the new equipment will be higher.

With all the power given to depreciate assets, recognize your operational limitations. Using financing to buy equipment for the additional depreciation just to avoid paying taxes can lead to more problems than paying the tax. Arranging a meeting with a tax professional to discuss these changes, as well as others, before year-end could be extremely beneficial.

Duerfeldt is a Nebraska Extension agricultural economist educator. Contact him at 402-873-3166.

You May Also Like