The farm specific Chapter 12 bankruptcy code goes back to the farm debt crisis in the 1980s, which agricultural tax law specialist Roger McEowen helped develop with bankruptcy attorneys and judges as well as academics in an effort to come up with a favorable provision in the bankruptcy code for agricultural producers.

McEowen, current Kansas Farm Bureau professor of Agricultural Law and Taxation at Washburn University School of Law, explained the code offered a way to allow farmers to write down debt inline with the value. In the 1980s, land values collapsed substantially, so the idea was to write the debt down to the value of what that reduced land value was and then reorganize that debt and put together a reorganization plan over three to five years with a specified interest rate, which was lower than the prevailing rates at that time, and try to keep the farmer on the farm.

Chapter 12 bankruptcy provides farmers with more repayment flexibility than would be the case under Chapter 7 or Chapter 11 bankruptcy. The ability to make seasonal payments accommodates the reality of a farmer’s fluctuating income and is not offered under any other chapter of bankruptcy. In addition, the fact that farmers can sell farmland and farm equipment free and clear of liens gives them more options to pay down their debts.

Lenders may seek to work with their farmer customers to find cost efficiencies, improve marketing and enhance the use of risk management tools. If Chapter 12 is used, farmers must meet the following criteria: be engaged in farming; more than 50% of the gross income for the preceding tax year must have come from the farming operation; total debts may not exceed $4.2 million for a farming operation and at least 50% of the total debates that are fixed in amount must be related to the farming operation.

Prior to 2005, the Chapter 12 liability cap was $1.5 million; it was raised to $3.2 million in 2005 and, after adjusting for inflation, now stands at $4.2 million.

McEowen says he’s been one of the proponents over the past few years to put the bug in prominent people in Congress that the threshold should be increased. And it appears, they’re listening.

In the House, Rep. Antonio Delgado, D-N,Y., led House Judiciary Committee Ranking Member Jim Sensenbrenner, R-Wis., House Agriculture Committee Chairman Collin Peterson, D-Minn., and Reps. TJ Cox, D-Cal., Kelly Armstrong, R-N.D., and Dusty Johnson, R-S.D., in introducing the bipartisan Family Farmer Relief Act of 2019. It is the House companion bill to legislation introduced by Sens. Chuck Grassley, R-Iowa, Amy Klobuchar, D-Minn., Ron Johnson, R-Wis., Patrick Leahy, D-Vt., Thom Tillis, R-N.C., Doug Jones, D-Ala., Joni Ernst, R-Iowa, and Tina Smith, D- Minn.

The changes reflect the increase in land values as well as the growth in the average size of U.S. farming operations over time and are meant to provide farmers with additional options to manage the downturn in the farm economy. The legislation is endorsed by the American Farm Bureau Federation and the National Farmers Union.

Look at the numbers

McEowen said nationwide, Chapter 12 bankruptcies peaked in 2010 at 707 filings, and tailored off since then. It bottomed out in 2014 in terms of the number of filings nationwide and has gone up from 2014 through 2017.

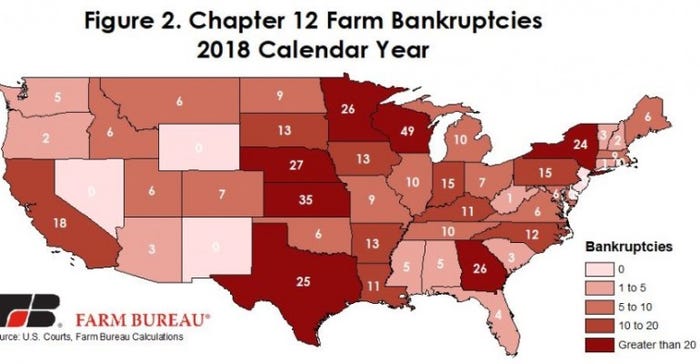

Chapter 12 filings in 2018 totaled 498. Although down 1% from 501 in 2017, it’s possible that the number of farm bankruptcies as a share of total farm operations was higher, according to a recent "Market Intel" report from the American Farm Bureau Federation. Chapter 12 bankruptcy filings in 19 states were higher than prior-year levels. In these states, there were 303 bankruptcy filings, up from 204 filings the year before. In the Midwest, for example, bankruptcies totaled 223 filings, up 19% from prior-year levels. Bankruptcies in the Midwest were also double what they were in 2008 and at the highest level in more than a decade.

McEowen also said the drop in 2018 from the year prior isn’t an indication that things are necessarily better economically.

He said one reason is that the aggregate debt test, the thresholds to be eligible for Chapter 12, is causing some farmers to be ineligible. Before things started to get a little bumpy in 2010 until 2013 prior to the rough times, farmers were acquiring more land or buying more expensive equipment which in turn led them to incur more debt. However, at the time, they were able to satisfactorily service that debt because crop prices were high. Yet now their assets have forced them above that $4.2 million threshold, a key reason the $10 million level would offer additional assistance to today’s struggling farmers.

Another reason filings may be down from prior years is that recent poor years have “cleaned out some of the farming operations that were in particular trouble,” McEowen added.

When is it time?

Farmers probably know about Chapter 12 bankruptcy is available to them, it’s a whole other thing for them to actually go ahead and file bankruptcy because it's still has a stigma associated with it in the minds of some farmers, McEowen says.

“They're reluctant in many instances to contact an attorney that specializes in Chapter 12 or get some advice until it's too late. And I, I think that's the unfortunate part of it. Many of these things the farmers encounter that cause financial issues are actually largely beyond their control. Now that's not always the case obviously, but sometimes they are. And Chapter 12 is there to help them.”

McEowen is a proponent of a farmer always being in touch with their farm management specialist. Many land grant universities will provide farm management services. They can offer unbiased advice on how your numbers stack up in terms of your solvency and your debt-service and liquidity ratios.

If you have a good our management team that is watching those economic indicators for years, and even every six months, then every year you can keep control of it and maybe you wouldn't have to file a chapter 12. “But if you're not watching that and it gets out of hand, that's when you get in trouble,” McEowen said.

Hear more of our interview with McEowen on Chapter 12 bankruptcy by clicking on the link below. You may also visit his website: www.washburnlaw.edu/waltr.

About the Author(s)

You May Also Like