The House and Senate always take a different approach to the farm bill and settle those differences in conference. This year there could be even more of a divide in how to accomplish the farm safety net if the House moves ahead with its current version which failed on the House floor last month.

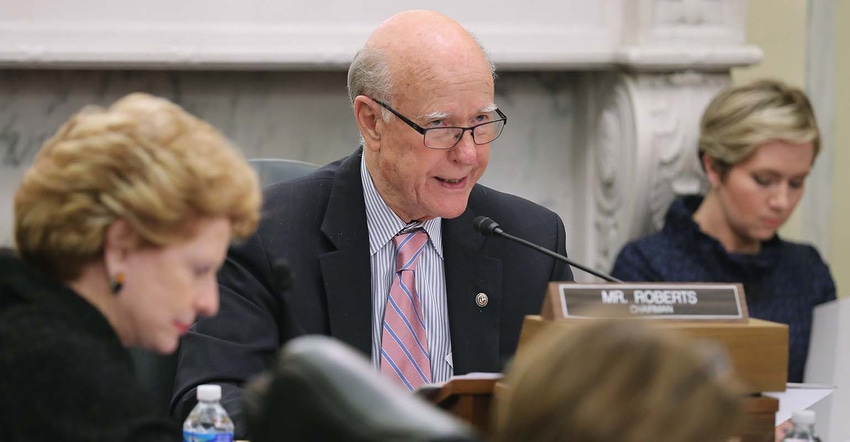

For months we’ve been hearing the Senate version would look to strike a much more balanced approach and Senate Agriculture Committee Chairman Pat Roberts, R-Kan., and Ranking Member Debbie Stabenow, D-Mich., did not disappoint. They’ve done what they do best: shepherd a bipartisan bill without all the partisan politics to its committee with the plan to get at least 60 votes on the full Senate floor.

The House and Senate have their differences. Here are some highlights of some of the major policy differences.

Commodity title

Both versions offer a one-time election for the Average Crop Revenue (ARC) program or the Price Loss Coverage (PLC) program. Both also updates the county payment to be based off of Risk Management Agency (RMA) data, as the hope is to address some of the differential payments seen across county lines.

The House version allows for reference price updates under PLC participation, whereas the Senate version keeps those reference prices the same.

Conservation funding

The Senate’s version cuts any overall drop in conservation funding, it did end up cutting funds from the two primary working lands conservation programs – the Conservation Stewardship Program (CSP) and Environmental Quality Incentives Program (EQIP). The House version rolled CSP into EQIP. Furthermore, funding for working lands conservation would be cut by $5 billion over the next 10 years in the House version.

Both versions increased total Conservation Reserve Program (CRP) by different mechanisms. The Senate version did increase CRP acres 1 million acres to a 25 million total cap and did so by reducing land rates for CRP to 85.5% of the average county rental rates. The House version increased the cap to 29 million acres with an 80% rental rate to achieve the savings needed to fund additional acres.

Research funding

The House version did not include an increase in the authorizations for major grant-making programs of the USDA like the Agriculture and Food Research Initiative (AFRI). These programs, which once set the standard for scientific innovation, have not seen major changes since 2008. The Senate version, however, offers an additional $200 million for the Foundation for Food and Agriculture Research (FFAR) to leverage public-private funds.

Trade assistance

Both bills place several trade programs under a new umbrella to allow for baseline funding. In the House it will be called International Market Development Programs, which includes the Market Access Program (MAP), the Foreign Market Development (FMD) Program, the Technical Assistance for Specialty Crops (TASC) Program and the Emerging Markets Program (EMP). The Senate version takes a similar approach and creates a new Priority Trade Promotion, Development, and Assistance program.

Payment limits

The House bill relaxes limits on payments made to farms when commodity prices or a farm’s revenues from the sale of those commodities go below a certain level. Up to three people involved in managing a farm can each receive a maximum of $125,000 a year on covered commodities. The exception is for those who grow peanuts, who can receive up to $125,000 per year for that crop alone. Among the various proposed changes regarding payment limits, the bill makes several more people eligible to receiving the maximum $125,000 a year including first cousins, nieces and nephews involved with a farm. The Conaway bill would exempt LLCs and Subchapter S corporations, meaning 10% or more of the nation’s commodity farms would eligible for unlimited subsidy payments overnight, and that number would surely grow as more farms reorganize to take advantage of the change. His bill also entirely removes payment limitations from marketing loan gains and loan deficiency payments. Under current law, all forms of commodity program benefits are subject to the payment limitation. Under the Conaway provision, there would be no limit at all on marketing loan gains or loan deficiency payments.

The Senate version does make a lower adjusted gross income level down to $700,000 per recipient from the 2014 farm bill’s version of $900,000. The Senate version also does not change any of the actively engaged in farming restrictions currently in place.

Nutrition funding

The nutrition title does not have the “welfare reform” focused measures seen in the House and instead focuses on improving program integrity provisions and establishes pilot programs to test drive different approaches including trying to build a strong connection to the health care community on diet-related challenges.

Here is a section-by-section breakdown for the Senate version. And the House breakdown as well.

About the Author(s)

You May Also Like