Corn and soybean bulls are taking the latest market moves as a positive sign that there could be more length added to prices as rains are delayed. The weekend temperatures could reach 100 degrees in the northern Plains, coupled with high winds that could increase the amount of moisture taken out of the soils.

With the weather issues that have plagued most growers in some way, many argue that we can not produce trend line yields under these conditions. In fact I received an e-mail yesterday released by a group whose model now shows a forecasted national U.S. yield of 154.7 bushels. In other words a whopping -15 bushels behind the current USDA forecast. I have no idea if this group will ultimately be right on target or proven insanely wrong. From everything I've learned through the years, it's just way too early to make big bold bets about the crop. The margin of error can be extremely large in forecasts made prior to early or mid-July. The trade is definitely keeping a close eye on the weather forecasts and conditions in the north and eastern portions of the belt.

Most concerns continue to come from the Dakota's as well as portions of Illinois, Indiana and Ohio. As I mentioned in my morning report, I could see any bearish knee-jerk reaction to the USDA report being a buying opportunity for the weather bulls. As a producer, I continue to remain patient. I am keeping a close eye on the DEC18 contract, thinking a sale north of $4.20 might be worth considering longer-term. I also believe there's now a chance that new-crop DEC17 corn could technically try to challenge resistance up in the $4.20 to $4.30 area, probably where I make my next small sale. Keeping a very close eye on the market, specifically the USDA today and the forecast for next week.

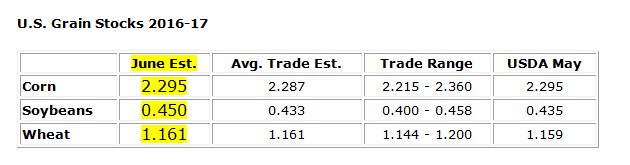

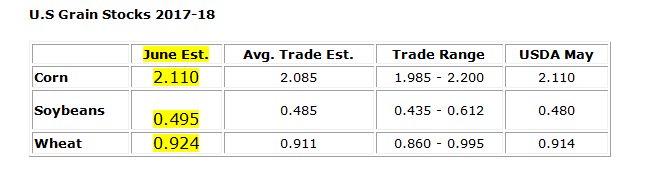

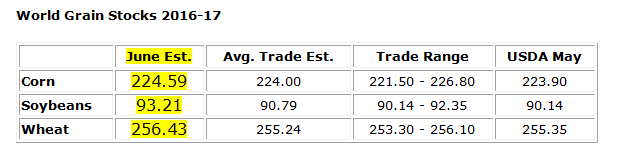

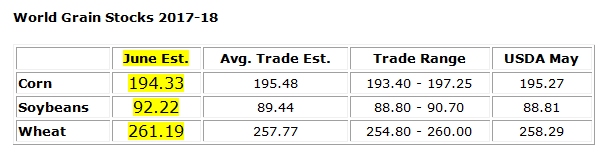

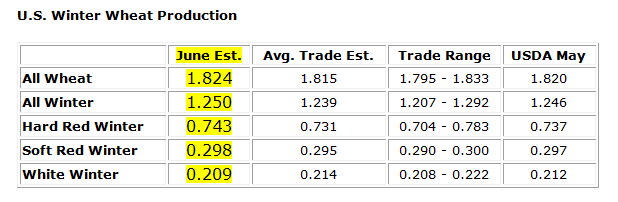

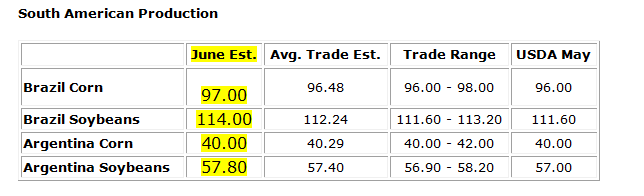

Soybean prices are steady this morning, but have made a nice bounce higher the past few days In fact as a producer, the NOV18 contract hit our cash sales target of $9.50 yesterday and we sold our first small portion (5%) of our estimated 2018 production. Weather here in the U.S. obviously remains a longer-term "wild card" and could easily throw the market a major curve ball in the weeks ahead so we are paying close attention. Despite all-time record large planted acres, any widespread weather hiccup that brings about talk of a national yield falling to sub-45 bushels per acre, then the bulls have a story. I personally think we are still a ways away from that being the case, but weather is certainly offering up some possibilities. As a producer I will be looking to reduce a bit more longer-term risk if we can catch another leg higher. Staying engaged! See the latest USDA numbers below. GET ALL MY DAILY AG THOUGHTS HERE

About the Author(s)

You May Also Like