Government payments made up a much higher portion of farm income for the 2020 crop year, and it’s likely that won’t repeat in 2021. So, you have some important decisions to make this spring.

More than $5 billion in government payments will go out to producers who signed up for 2019 and 2020 crop year commodity programs. Federal crop insurance provided more than $113 billion in total coverage and to date has paid out over $5.8 billion indemnities for the 2020 crop year.

Ben Brown, senior research associate at the University of Missouri-Colombia, says it is important for producers to consider individual risk management goals as it relates to federal program choices. Is your goal to maximize revenue, or provide the highest level of risk protection? People often get upset if they don’t receive payments or chose a program that paid them early but failed later, he says. Avoid frustration and know your goal.

Some helpful online resources:

ARC-PLC calculator on the University of Illinois’ FarmDoc site at fd-tools.ncsa.illinois.edu

farm bill decision aid from Texas A&M at afpc.tamu.edu/tools/ farm/farmbill/2018

ARC VS. PLC

The Agriculture Risk Coverage program provides income support payments on historical base acres when actual crop revenue declines below a specified guaranteed level. The Price Loss Coverage program provides income support payments on historical base acres when the effective price for a covered commodity falls below its reference price. ARC and PLC enrollment for the 2021 crop year closes March 15.

The 2019 and 2020 crop year decisions saw producers with higher levels of crop insurance coverage more likely to choose ARC-Individual County or ARC-County. And for those seeking a simpler program, PLC remained the answer.

PLC only helps when the marketing year average (MYA) price falls below the effective reference price set by Congress, including $3.70 for corn, $8.40 for soybeans and $5.55 for wheat, with no direct connection to yield. Assistance for ARC starts when revenue drops below 86% of the historical revenue, versus 100% for PLC.

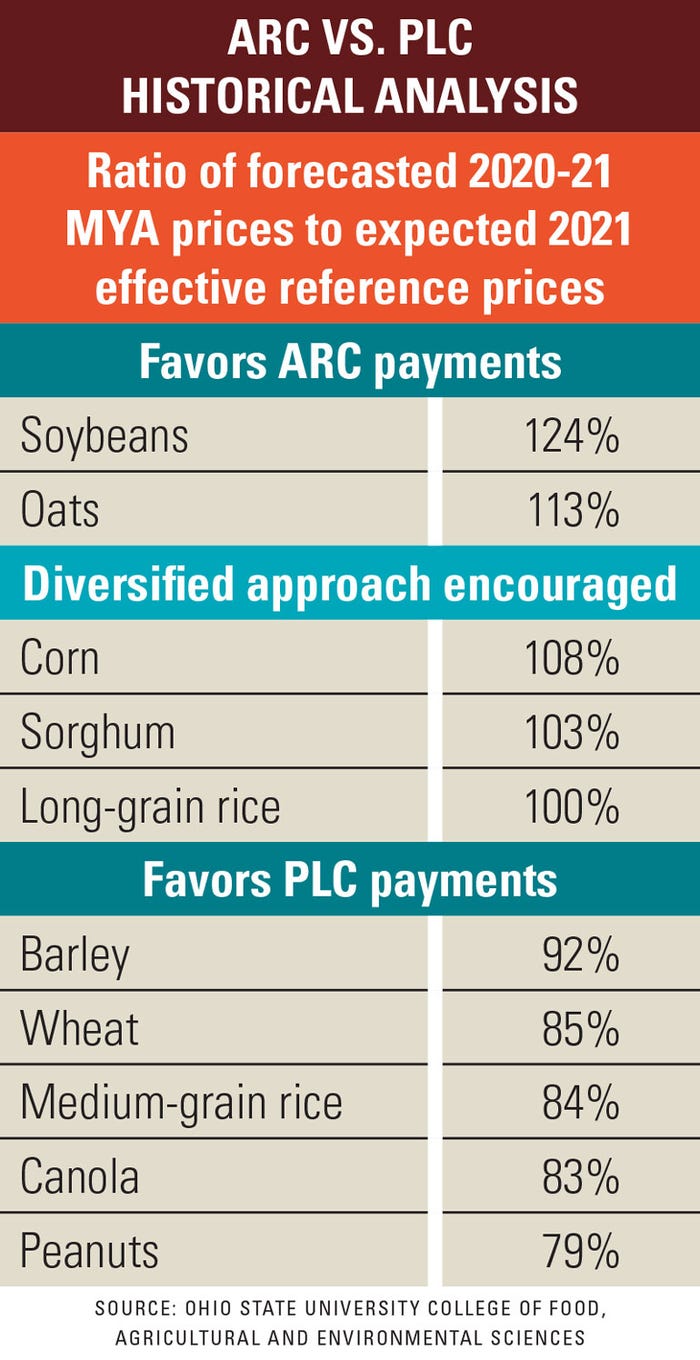

Brown says if you’re seeking payments for the 2021 crop year, wheat favors PLC, soybeans favor ARC, and corn is a toss-up. Wheat and barley have a high chance of triggering a payment and a relatively large payout. Seven commodities, including corn and sorghum, offer no signal on whether PLC will trigger payments. And four commodities including soybeans signal that ARC has a greater chance at a payment (see chart).

University of Illinois ag economist Gary Schnitkey says at this point, 2021 forecasts suggest no payment for corn, but corn MYA prices could fall below the reference price, thereby triggering payments. This indicates a likely small PLC payment at a forecasted MYA price. Soybeans are unlikely to trigger payments for PLC or ARC-CO.

“Election comes down to your operational goals,” Brown says. “If you want to manage your risk with some form of payment every year, put some farms in ARC-CO and others in PLC to diversify your portfolio.”

Brown adds that farms that went into ARC-IC in 2019 may want to amend their election; however, it may be worth it to stay with the initial election if the farm has highly variable Farm Service Agency yields, such as a river-bottom or flood-prone area that saw prevented planted acres in past years.

Crop insurance decisions

With new products on the table and updated premium rates, do your homework before deciding. Look at any potential premium rate changes, as that last 5% of coverage can quickly become expensive, says Art Barnaby, Kansas State University ag economist.

To look at the costs, take the total dollars of premium and divide it by the total dollars of coverage. Then subtract the amount of an increase from 75% to 80% and 80% to 85% coverage.

“Anytime that marginal rate gets above 50%, you have to think about whether it’s worth it,” he says. “I wouldn’t expect to think anything like that in the Corn Belt, but not all the Corn Belt is pristine, and some counties could see that.”

Back in 2012 when high prices hit guarantees, some considered dropping the Harvest Price Option to save premiums. But with the drought, corn prices hit $7.50 that year, and that price increase cut payments if producers opted out of the harvest price option.

If 2021 is a poor crop year for the Corn Belt, “prices could go even higher without HPO that could really cut into your payments. You would need bigger yield losses to get a payment,” Barnaby says.

Eco shallow loss protection

USDA’s Risk Management Agency is offering a new Enhanced Coverage Option available as an add-on to the underlying crop insurance policy for 31 spring-planted crops. ECO is purchased as an endorsement to an eligible individual insurance plan such as Revenue Protection, Revenue Protection with the Harvest Price Exclusion, or Yield Protection. ECO offers county yield coverage when purchased with YP, and county revenue coverage when purchased with RP or RP-HPE.

ECO will provide area-based coverage for a portion of the deductible of the underlying policy, similar to the Supplemental Coverage Option. ECO uses the same expected and final area yields, projected and harvest prices and payment factors as SCO. However, while SCO ends coverage at 86% of the expected crop value, ECO will cover from 86% up to the producer’s choice of 90% or 95% of expected crop value.

While ECO will give producers more options and flexibility for yield and revenue coverage, it remains to be seen what the level of participation might be as the new program is rolled out, University of Illinois economists note in an analysis of ECO.

“The benefit of ECO is that it provides additional shallow loss coverage on a portion of the deductible that tends to have more frequent losses,” says Shelby Myers, American Farm Bureau Federation economist. “Given tight farm margins, this may be an appealing option for farmers who need risk management options that provide more reassurance to credit lenders or landowners.”

About the Author(s)

You May Also Like