February 5, 2018

The prices that feedlot managers are bidding for feeder cattle suggest they are “betting on the come” in the fed cattle market.

“Betting on the come” is derived from a gambling expression. It means you don’t have what you want or need at the moment, but you are betting, and hoping, you will get what you want and need when the time comes.

Current feeder cattle prices imply feedlot breakevens at $121 per cwt and up. Summer live cattle futures fall short of that mark. Lighter-weight feeders also have feedlot breakevens that cannot be covered against fall 2018 live cattle futures.

After holding between $123 and $131 for February and April 2018 contracts, $116 and $121 for June, and $113 and $118 for August and October, respectively, back in November, futures dropped more than $7 per cwt on average by mid-January.

In the last four months of USDA Cattle on Feed data, U.S. feedlots with 1,000-plus head, placed 8.44 million head of cattle on feed, about 186,750 head more than the same four-month period a year prior.

In November, Iowa feedlots at 1,000-plus-head capacity placed 20,000 head more than the previous year, and the less than 1,000-head-capacity Iowa feedlots placed 33,000 head more. Ample corn supply, relatively favorable feed prices and cyclically larger feeder cattle numbers likely contributed to higher placements.

Strong feeder cattle price continues

While the strength in feeder prices cannot be fully explained or justified, at least relative to live cattle futures, this does not necessarily mean the strength will not continue. A strong positive basis exists between Iowa auction feeder cattle prices and feeder cattle futures prices.

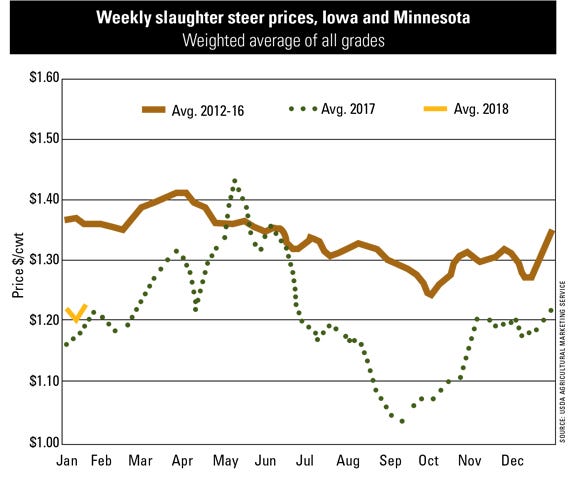

Cattle prices spiked in March, May and June as retailers promoted beef aggressively. Timely marketing of fed cattle strongly supported the cattle market in first-half 2017.

Over the last two months, basis for 700- to 899-pound steers has averaged $7 per cwt. This is $2 per cwt higher than last year. A tighter-than-expected supply of traditional yearling steers, along with solid demand for feeders that will likely finish before the ever-so-elusive June live cattle futures contract matures, have contributed to the recent strength.

Basis has been running about $9 per cwt higher than a year ago for feeder cattle weighing less than 700 pounds. Over the last eight weeks, basis for 500- to 599-pound steers averaged $32 per cwt, compared to $22 per cwt last year.

For 600- to 699-pound steers, basis has averaged $20 per cwt compared to $12 per cwt one year ago. Basis for lightweight feeders is determined, in part, by feedlot cost of gain. With a relatively low and stable cost of gain, basis for calves is strong and will likely remain so for some time to come.

Looking back at last year

The wide basis continues to point to a discrepancy between what futures traders believe cattle prices are going to do and what cattle feeders think prices will do in the coming months. Cattle prices spiked in March, May and June as retailers promoted beef very aggressively (see chart).

The fed cattle market was strongly supported by timely marketing of cattle, too. From the start of 2017 to their peak, the April and June live cattle futures contracts each gained roughly $25 per cwt. Basis also strengthened, which was good for hedgers and those holding a cash market position.

Feedlot closeout values reached some of the highest levels in the last 15 years. March through June yearling-to-finish returns were estimated at $344 per head on a cash market basis, assuming no hedging or forward pricing. These values were higher than suggested by futures market forecasts months earlier.

It could be that feedlots expect something to adjust to bring husky closeouts again this year. Such expectations could be encouraging them to bet on the come on feeder cattle prices now.

Market needs strong beef demand

Demand remains critical for beef and for the cattle market in 2018. Recent aggressive placements of cattle on feed should provide enough beef to support upcoming retail promotions with no issues.

In general, increasing supplies result in lower prices. But how much lower, if at all, is the key. If beef demand continues strong, retail price pressure may be rather modest, with less negative impact on wholesale beef and cattle markets. A large enough increase in demand could offset greater supplies and maintain or increase prices. A strong export market will be necessary to support prices.

Feedlots need to remain current in their marketings. Will aggressively marketing these cattle ensure that feedlot margins turn black? The answer is that aggressive marketing is not guaranteed to fix margins, but it seems increasingly clear that failing to do it will ensure that margins remain “in the red” for the remainder of the year.

Live cattle futures for 2018 contracts have rallied roughly $5 per cwt since mid-January. What no one knows is exactly how much more the market may rally. It is easy to conservatively state that prices will trade at, or below, current levels.

But as last year demonstrated, more upside potential can exist than is generally expected. Prepare now to seize windows of opportunity that may open up in the days, weeks and months ahead.

As cattle make their way through the system the next few months, packers will need to stay covered to support their forward sales. If cattle are green enough, indicative of a current market, cattle feeders at times could hold considerable leverage. Thus, there could be some price support moving into the spring and summer. Being in position could result in positive returns.

Schulz is the Iowa State University Extension livestock economist.

About the Author(s)

You May Also Like