December 12, 2019

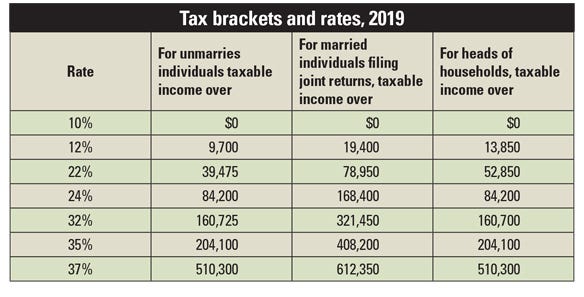

The Tax Cuts and Jobs Act was signed into law Dec. 22, 2017. Among many changes, it created new tax brackets for 2018 through 2025. It also eliminated the deduction for personal exemptions and raised the standard deduction in 2019 to $12,200 for single filers, $24,400 for married filing jointly and $18,350 for head of households. Keep in mind that most of the changes in TCJA end in 2025 and move back to pre-2018 tax law.

Section 179 expense election was one of the changes that was made permanent. In 2019, this is now $1.02 million and the phaseout starts at $2.55 million. On the Iowa returns, the maximum amount is $100,000 and the phaseout starts at $400,000. In 2020, Iowa couples with the federal amounts.

One of the other major changes in TCJA was the repeal of like-kind exchange treatment for traded personal property. Under old law, when a farmer traded machinery, the farmer depreciated the difference paid plus any remaining basis on the item traded in and no taxes were due.

Under TCJA, when a farmer trades machinery, the trade is considered a sale in the amount the dealer allowed for the trade-in, triggering ordinary taxable gain, and the farmer gets to depreciate the full purchase price of the machinery received. If farmers do not want to pay tax on the gain of the trade-in, they are forced to use Section 179 or bonus depreciation to offset the taxable gain.

Iowa did not couple with the federal change in 2018 but maintained the old like-kind exchange rules. In 2019, for Iowa returns, farmers may use the old rule for like-kind exchanges or use the new federal rule. In 2020, Iowa will couple with the federal rule.

Beware of other consequences

If farmers are forced to use Section 179 or bonus depreciation to offset gains from trading machinery, there can be other consequences. Excessive accelerated methods of depreciation reduce net Schedule F income, possibly taking it down to zero or maybe even a negative situation.

IRA and other retirement plan contributions are based on earned income (Schedule F). The deduction for self-employed health insurance is based on Schedule F net income. Contributions for self-employment tax are based on Schedule F net income. Reducing Schedule F income affects money available for retirement planning and other “above the line” deductions taken on the 1040.

Also, new in 2018 was the new “postcard” 1040 Form that also had multiple schedules attached to it. After numerous complaints, there is another new 1040 Form for 2019. This one is a combination of the old 1040 and the 1040 from 2018.

Brown is the Iowa State University Extension farm management specialist for southeast Iowa. Contact him at [email protected].

Source: ISU, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like