April 4, 2023

Farmer sentiment weakened again in March as the Ag Economy Barometer fell 8 points to a reading of 117. Weaker prices for key commodities including wheat, corn, and soybeans from mid-February through mid-March were a key factor behind this month’s weaker sentiment reading.

Interest rates concern farmers

Although the Farm Financial Performance Index was unchanged from February, farmers continue to express more concern about rising interest rates. In fact, 25% of respondents choose interest rates as one of their top concerns for the upcoming year. That number has been increasing steadily since last summer when just 14% of respondents identified interest rates as a top concern.

Higher input costs remain the number one concern, chosen by 34% of producers this month, but concern about input costs has been falling since last summer’s peak when it was chosen by 53% of producers.

Farm investments

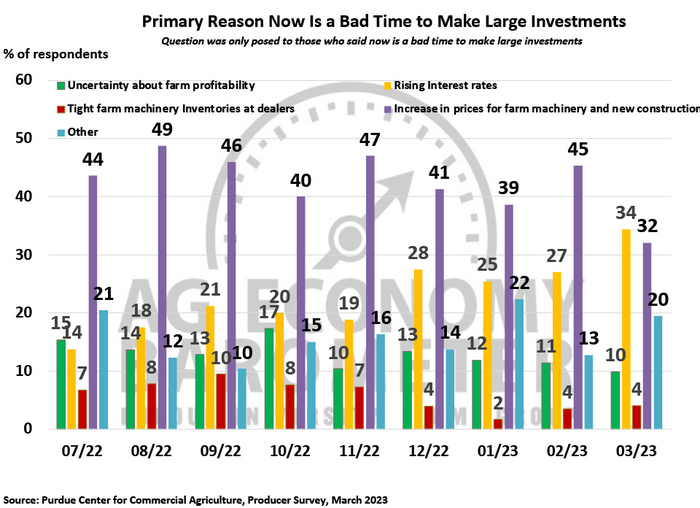

For the third month in a row, there was little change in the Farm Capital Investment Index which came in at 42 in March. However, among respondents who said it was a bad time for large investments, there was a change in perspective.

In previous surveys going back to last July, the increase in prices for farm machinery and new construction was the top choice among respondents as the key reason now is a bad time to make such investments. That changed this month with the increase in prices eclipsed by rising interest rates as the primary reason.

High prices for machinery and new construction was chosen by 32% of respondents this month, down from 45% last month, while rising interest rates was chosen by 34% of those who think now is a bad time for investments, up from 27% in February. Rising interest rates was chosen by only 14% of the respondents last summer.

Land value outlook mixed

The Short and Long-Term Farmland Value Indices moved in opposite directions in March. The short-term index, which asks respondents about their farmland value expectations in the upcoming 12 months, fell 6 points to a reading of 113. On the other hand, the long-term index, which asks respondents about their farmland outlook for the upcoming 5 years, rose 5 points to 142.

This month’s short-term index was the weakest reading since September. One out of five producers said they expect farmland values to weaken in the next 12 months. Although the long-term index continues to provide a more optimistic view of future farmland values than the short-term index, the percentage of producers who think values could weaken in the next five years has been rising. This month 17% of respondents said they expect weaker values in the next 5 years, up from 13% a year ago and 7% two years ago.

Renewable diesel

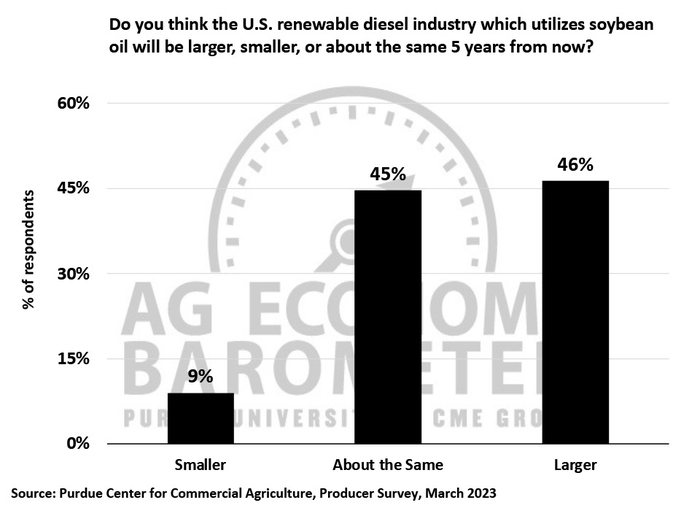

This month’s survey included several renewable energy questions focused on the ethanol and renewable diesel sectors. When asked to look ahead 5 years, nearly half (46%) of respondents said they expected the renewable diesel industry to be larger than it is today. This compares to just 25% of respondents who expect the ethanol industry to grow in size over the next 5 years.

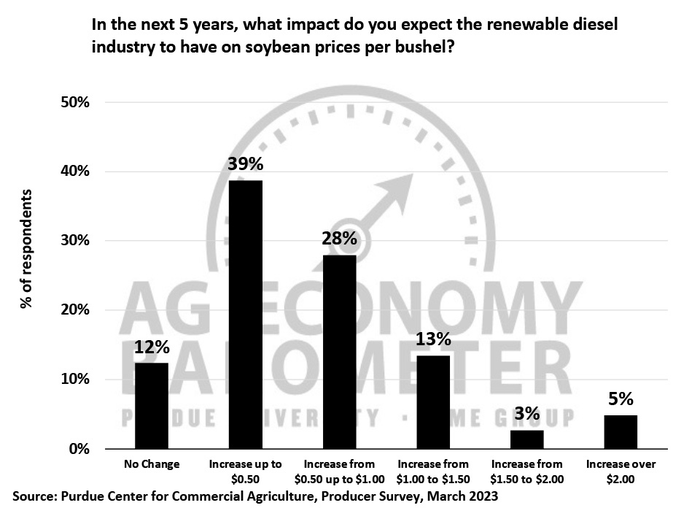

In a follow-up question, respondents were asked what impact they expect the renewable diesel industry to have on soybean prices over the upcoming 5 years. The most common response chosen by 39% of respondents was a price increase of up to $0.50 per bushel.

Bank closures

This month’s survey was conducted from March 13-17, 2023 which coincided with the demise of Silicon Valley Bank and Signature Bank. Although the March survey did not include any questions directly related to the bank closures, it did reveal that rising interest rates have become a bigger concern among farmers.

Additionally, when responding to the open-ended comment question posed at the end of each survey, multiple respondents voiced concerns about the banking sector’s problems and its potential to hurt the economy which likely also weighed on producer sentiment.

The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey.

Source: Purdue University-CME Group

About the Author(s)

You May Also Like