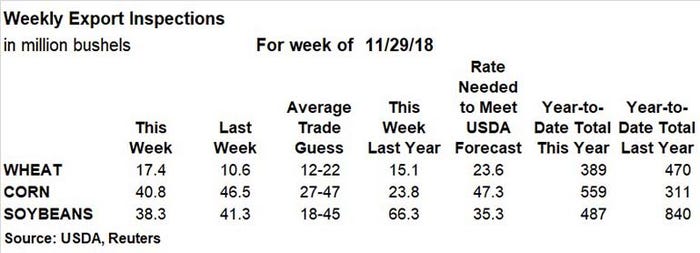

For the week ending Nov. 29, weekly grain export inspections landed as expected, with wheat coming in moderately ahead of the prior week, while corn and soybeans came in slightly below last week’s tally.

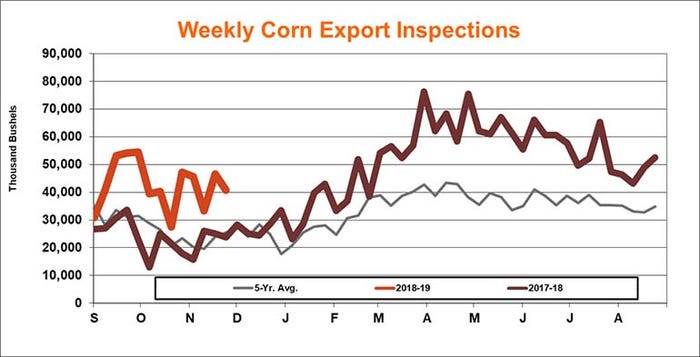

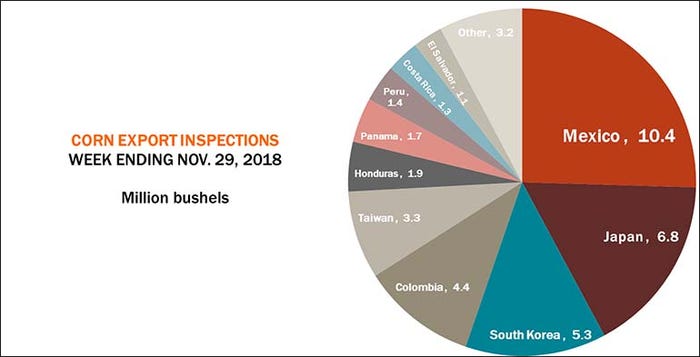

Corn export inspections last week reached 40.8 million bushels, falling below the prior week’s total of 46.5 million bushels but in the middle of trade estimates that ranged between 27 million and 47 million bushels. The weekly rate needed to match USDA forecasts moved higher, to 47.3 million bushels, although cumulative marketing year-to-date totals of 559 million bushels are still nearly 80% higher than the pace from 2017/18.

“The corn numbers were decent and would be headliners most years,” says Farm Futures senior grain market analyst Bryce Knorr. “But corn has filled some of the shipping capacity normally reserved for soybeans due to China’s tariffs.”

Last week, Mexico was the No. 1 destination for U.S. corn export inspections, with 10.4 million bushels. Other top destinations included Japan (6.8 million bushels), South Korea (5.4 million), Colombia (4.4 million) and Taiwan (3.3 million).

Soybean export inspections last week reached 38.3 million bushels, easing from the prior week’s tally of 41.3 million bushels but on the high end of trade estimates, which ranged between 18 million and 45 million bushels. The weekly rate needed to keep pace with USDA forecasts eased to 35.3 million bushels. Meantime, 2018/19 marketing year-to-date totals of 487 million bushels remain 42% lower year-over-year.

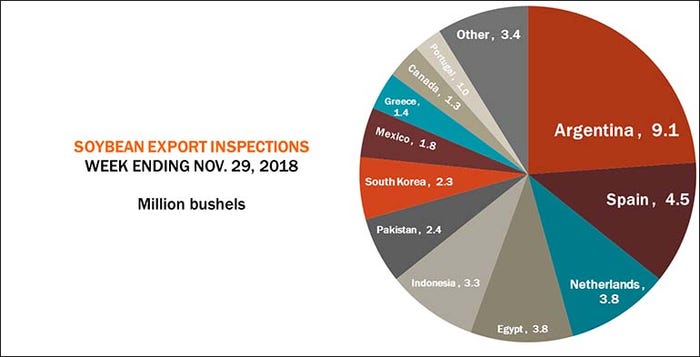

“Today’s inspections reported included four shipments of soybeans in containers from Kansas sent to China totaling 68,400 bushels, but nothing of volume as usual,” Knorr says.“Argentina was the leading destination in a bit of ‘selling sand to the Arabs’ sort of trade. That is, Argentina had a bad crop this year and can’t get any supplies out of Brazil until its neighbor’s new crop hits the pipeline, so it needs U.S. soybeans to keep its processing industry running.”

Argentina accounted for 9.1 million bushels of U.S. soybean export inspections last week. Other top destinations included Spain (4.5 million), the Netherlands (3.8 million), Egypt (3.8 million) and Indonesia (3.3 million).

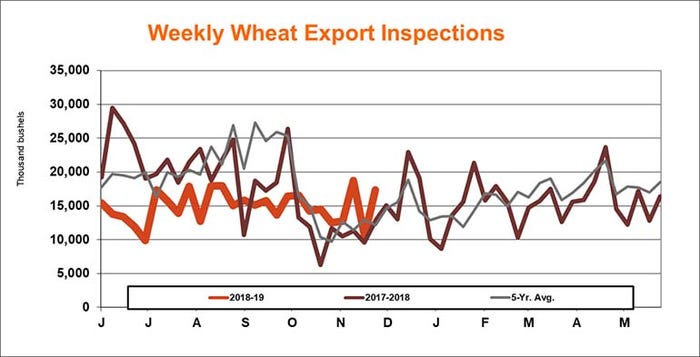

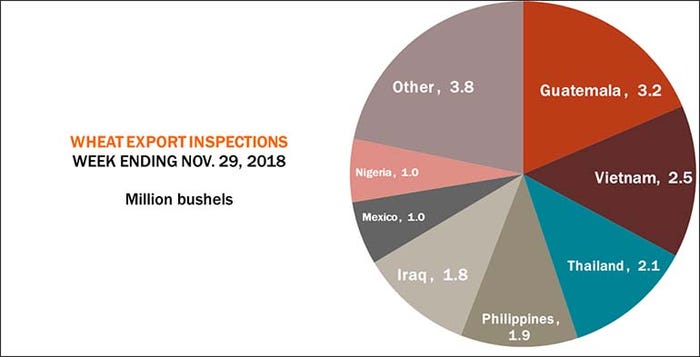

Wheat export inspections last week were for 17.4 million bushels, moving moderately ahead of the prior week’s total of 10.6 million and in the middle of average trade estimates that ranged between 12 million and 22 million bushels. The rate needed to match USDA forecasts continues to move higher, however, to 23.6 million bushels. Marketing year-to-date totals of 389 million bushels remains moderately behind 2017/18’s pace of 470 million bushels.

“Wheat showed some improvement, but the total remained below the rate needed weekly over the next six months to reach USDA’s forecast for the 2018 crop,” Knorr says. “The government assumes business will pick up in the second half of the marketing year, but increased supplies out of Russia may limit potential except for the classes in shorter supply due to droughts in Australia and northern Europe.”

Guatemala was the No. 1 destination for U.S. wheat export inspections last week, with 3.2 million bushels. Other top destinations included Vietnam (2.5 million), Thailand (2.1 million), the Philippines (1.9 million) and Iraq (1.8 million).

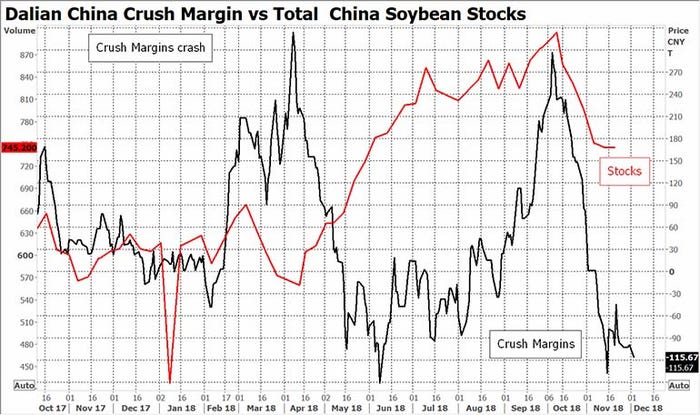

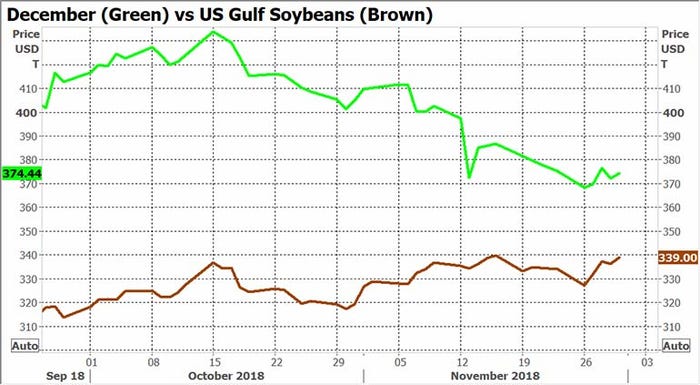

In the short-term, Chinese processors may be in no hurry to buy. They built up large inventories and their crush margins are terrible.

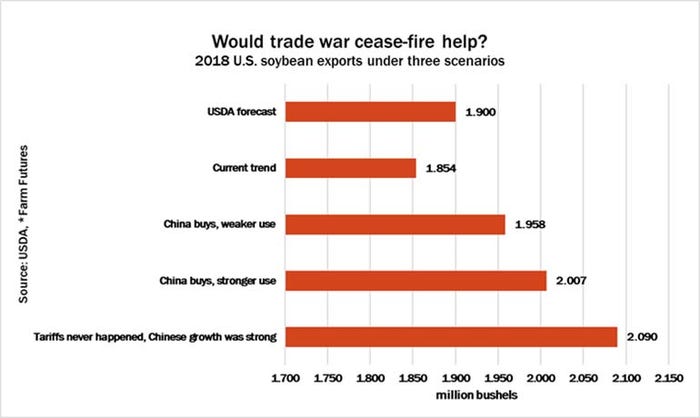

Without any sales to China, it looks like USDA may be too high on its forecast for 1.9 billion bushels of U.S. exports as it is. I’ve put together several scenarios, depending on whether sales resume in earnest that depend on total Chinese imports.

The U.S. has plenty of soybeans to send to China, but they will be more expensive than Brazilian originations unless the 25% tariff is removed as a good will gesture.

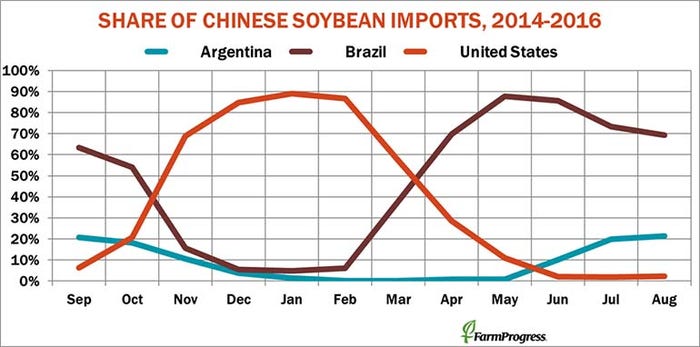

In past years the U.S. has dominated Chinese imports from December through February as our new crop supplies are shipped out quickly before the South American harvest hits the export pipeline.

About the Author(s)

You May Also Like