December 19, 2016

The milk market’s price recovery is underway, just not fast enough to please most milk producers. That’s the consensus of Jim Dunn, ag economist at Penn State University, and Ben Laine, senior economist at CoBank.

Despite projected supply increases, milk prices are poised for modest improvement in the years ahead. But the magnitude and speed of the recovery hinges on new export opportunities and gains in processing and production efficiency, says Laine.

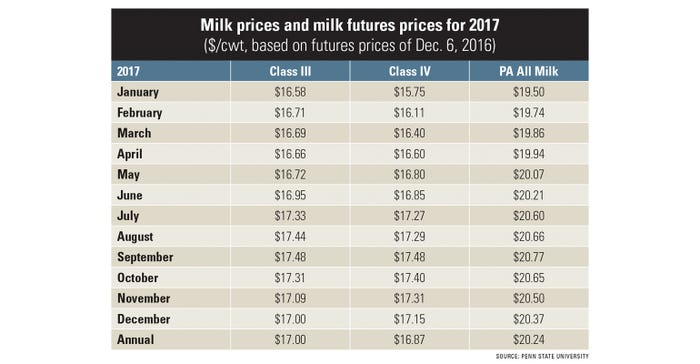

The latest dairy futures prices (see accompanying table) imply a 2017 Pennsylvania all-milk averaging $2.90 per cwt above 2016, says Dunn. Since feed prices will remain low, that will be a marked improvement in profitability over this year. Price projections are 40 to 50 cents higher than those posted for November. But they top out by early fall 2017.

Cows are still pumping out more milk in most dairy states. The increase is highest in Idaho, New York and Texas. Pennsylvania’s 2016 milk production has increased 2.2% over the 2015 level with generally fewer cow numbers.

Dunn and Laine warn that more milk production nationally will inhibit reaching higher milk prices unless exports recover. “We’re seeing dairy farm expansions,” adds Laine. “These dairies are banking on the future and on global growth.”

One immediate challenge, Laine contends, is that processing capacity hasn’t kept up with the growth in milk production. “New processing plants and plant expansions over the next couple of years will provide some relief. Meanwhile, the U.S. dairy industry must do everything it can to maintain and develop domestic demand and evolve with customers. This includes developing innovative products to adapt to changing consumer tastes.”

Cloudy export outlook

There’s cause for cautious optimism for the export outlook, asserts CoBank’s Laine, given prospects for strengthened international demand and the industry’s long track record of innovation. The industry is poised to benefit from overseas demand in Asia, Latin America and Africa driven by population growth and increased middle class consumption. But those are longer-term factors.

Nearby economic issues continue to depress dairy prices. The main ones, contends Dunn, are the strong U.S. dollar, “which has been surprisingly strong — a reflection of expected reduced regulation with the Trump administration, the Russian embargo on European Union dairy imports, and to some extent China’s economy.”

Australia, New Zealand and the EU continue to reduce milk production. China also has begun to buy again. Both are positive signs.

And both economists agree on another milk market point: The outlook for the next several years is positive, but precarious.

See Dunn’s complete analysis at December Dairy Outlook.

A synopsis of the “Future of the U.S. Dairy Industry Hinges on Exports” report is available at CoBank.com.

You May Also Like