Corn traders are digesting the fact the U.S. crop is now 96% planted and 86% emerged, which is very near our traditional pace. The other difficult data for the bulls to swallow is the fact weekly crop-conditions improved +3% from 65% to 68% rated "Good-to-Excellent".

As a producer I continue to worry about a weakening demand story and crop conditions that could stay mixed or slightly improved if the weather cooperates during the next few weeks. Remember, Argentina is close to halfway done harvesting a record crop and will start flooding the market with a wave of supply in the next 60-days, just about the same time Brazil will come online with a wave of surplus and about the same time the U.S. producer will be looking to move final remaining old crop bushels and start harvesting new crop supply. Also keep in mind that the Argentine government, in late-2015, eliminated the 20% tax that had been in place on corn exports.

It's just tough for me to envision any type of major demand headlines as we approach this glut of supply. That means any and all bullish tailwinds will have to come from the supply side of the equation. Unfortunately the South American crop looks incredibly strong and record in size. Yes, we can argue U.S. acres are going to be lower and the current yield forecast of 170.7 is overly optimistic, but don't forget, the USDA is already forecasting -4.0 million fewer planted corn acres here in the U.S. when compared to last year and is forecasting -4.3 million fewer harvested acres 82.4 million this year vs. 86.7 million last year.

Some in the trade believe we could shave another -500,000 to -1.5 million. Current total U.S. production is forecast at 14.065 billion bushels vs. 15.141 billion last year when the yield was 174.6. I suspect if you trim another -1.0 million acres from the harvested estimate and are eventually able to reduce the yield to 160 or lower, the game quickly becomes a lot more interesting as total U.S. production plunges below 13.0 billion bushels. I'm certainly not there as of yet, but many bulls are already trimming the -1.0 million acres from their books and have their yield penciled in sub-168. Stay tuned...

GET ALL MY DAILY GRAIN THOUGHTS HERE

Corn Planted Acres: The USDA now shows 96% of the U.S. crop as "planted". Top production states like Illinois, Iowa, Minnesota, Missouri, Nebraska, North and South Dakota are all thought to be 98% or more planted.

States Running Behind Their Traditional 5-year Average:

Colorado: 93% planted vs. the 5-year average of 96%

Indiana: 91% planted vs. the 5-year average of 96%

Kansas: 90% planted vs. the 5-year average of 96%

Michigan: 91% planted vs. the 5-year average of 94%

Ohio: 91% planted vs. the 5-year average of 96%

Pennsylvania: 82% planted vs. the 5-year average of 90%

Tennessee: 98% planted vs. the 5-year average of 99%

Wisconsin: 91% planted vs. the 5-year average of 92%

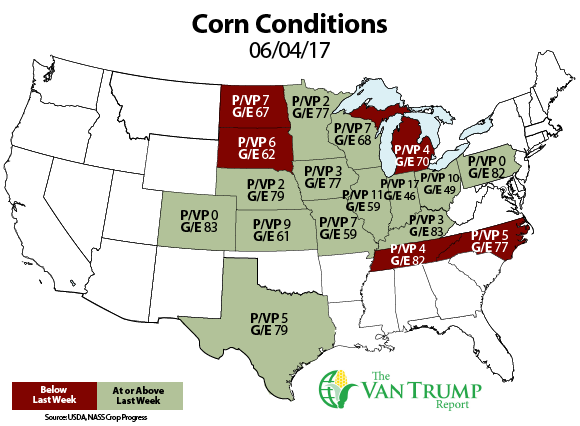

Corn Conditions: The USDA bumped conditions higher by +3% to 68% rated "Good-to-Excellent". Below are this years conditions compared to last year:

State Conditions Better Than Last Year

Pennsylvania +18% better than last year...+5% this week to 82% GD/EX

Kentucky +13% better than last year... -3% this week to 82% GD/EX

Texas +8% better than last year... +4% this week to 79% GD/EX

Iowa +7% better than last year... +4% this week to 77%GD/EX

Colorado +6% better than last year... +11 this week to 83% GD/EX

Tennessee +4% better than last year... +2% this week to 83% GD/EX

Nebraska +1% better than last year... +3% this week to 79% GD/EX

North Carolina +1% better than last year... -6% this week to 77% GD/EX

Michigan +1% better than last year... -5% this week to 70% GD/EX

Minnesota same as last year... +9% this week to 77% GD/EX

State Conditions Worse Than Last Year

Indiana -26% worse than last year... +3 this week to 46% GD/EX

North Dakota -19% worse than last year... +1% this week to 67% GD/EX

Ohio -18% worse than last year... "unchanged" at 49% GD/EX

Wisconsin -18% worse than last year... +7% this week to 68% GD/EX

Illinois -17% worse than last year +7% this week to 59% GD/EX

South Dakota -12% worse than last year... -5% this week to 62% GD/EX

Missouri -12% worse than last year... +6% this week to 59% GD/EX

Kansas -7% worse than last year... +6% this week to 61% GD/EX

About the Author(s)

You May Also Like