In Iowa and across the Corn Belt, a late cover crop planting date last fall and cold weather this spring has left farmers with reservations about terminating their cover crop now, when it’s so small — especially if weed control is a primary goal. However, to comply with standard crop insurance rules, farmers would have to go ahead and terminate anyway.

Sarah Carlson, cover crop specialist with Practical Farmers of Iowa, explains how farmers can delay cover crop termination and still fully insure their soybean crop this year. Iowa Natural Resources Conservation Service has created a process for asking for special treatment.

“Luckily, we’ve already done the research to show that in this case, farmers and insurance providers can have their cake and eat it, too,” Carlson says. She says PFI member Tim Sieren, farming near Keota in southeast Iowa, evaluated soybean yields on his farm when rye was killed May 5, 2017, either 11 days after planting soybeans or two days before soybean planting, in this trial. Soybeans yielded the same across all treatments at 66 bushels per acre and 67 bushels per acre, respectively.

NRCS has special process

This evidence plus the statewide lag in cover crop growth prompted USDA’s NRCS to create a process to allow farmers to delay terminating cover crops and still fully insure their cash crops. This process is called a “deviation” from the USDA Risk Management Agency’s Cover Crop Termination Guidelines.

If you want the option to leave your cover crops in the field longer this year, Carlson says you should follow these three steps to secure your deviation today.

1. Check your RMA termination deadline.

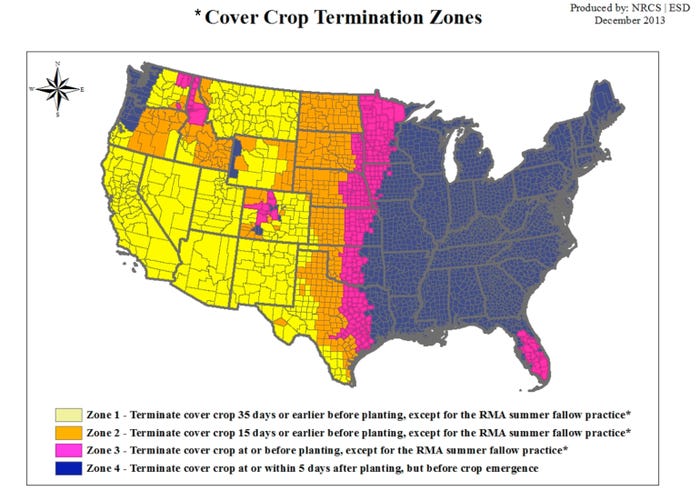

Iowa falls into termination zones 3 and 4. For the western half of the state (the pink region), farmers must terminate an overwintering cover crop at or before planting, and have seven extra days to terminate if this is no-till. For the central and eastern half of the state (the blue region), farmers must terminate an over-wintering cover crop at or within five days after planting a cash crop, and have seven extra days to terminate if no-till.

As long as the cover crop has been terminated within these guidelines and it was terminated before crop emergence, a farmer can fully insure the corn or soybean crop.

Now that you know what the rule is for your area, does it fit with your management goals on the cover crop? If it doesn’t and you want to request an extension, follow the guidelines explained in Step 2.

2. Let your crop insurance agent know you’ll be requesting a deviation. Within the RMA guidelines, it states: “Insurance shall attach to a crop following a cover crop when the cover crop meets the definition provided in the Basic Provisions, was planted within the last 12 months, and is managed and terminated, according to NRCS guidelines. If growing conditions warrant a deviation from the guidelines, producers should contact either Extension or the local NRCS for management guidance. For information on cover crop management and termination guidelines, refer to Cover Crop Termination Guidelines at nrcs.usda.gov.”

3. Request a termination deviation from your county NRCS office. The county office will work with the state NRCS office to provide a letter stating that cover crops can be terminated outside of the current guidelines but prior to reaching 24 inches in height if followed by a soybean cash crop, allowing flexibility to use cover crops for weed control and providing continued soil health benefits.

Preemergence herbicide effects and label compliance also need to be considered when delaying termination. For more information on how to agronomically manage cover crops to avoid a negative effect on corn or soybean yield, call Carlson at PFI at 515-232-5661.

About the Author(s)

You May Also Like