If the September WASDE report from USDA saw surprisingly little adjustment of U.S. cotton numbers, the October report saw even less. With traders and analysts expecting a downshift in U.S. production, the average U.S. all-cotton yield was reduced only one pound per acre, translating to a minor 10,000 bale cut in 2020 production. There were no changes to U.S. domestic milling or exports. So, with the “unaccounted” fudge factor absorbing the minor change in production, the result of no change in the 7.2 million bales of forecasted ending stocks. The resulting stocks-to-use ratio thus remains above the burdensome 40% threshold level.

The foreign and world cotton balance sheets were tightened up with less production and higher consumption, trimming world ending stocks by 2.7 million bales. While this monthly adjustment is a positive thing, the resulting level of 101 million bales of ending stocks is not fundamentally price supportive.

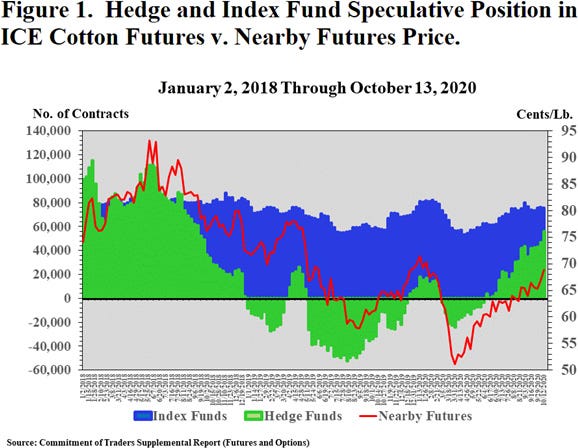

How has the market responded to all this? The nearby ICE Dec’20 futures contract broke through its long term 66-something cent resistance, apparently on the strength of expanded hedge fund buying (see Figure 1). As of this writing, Dec’20 futures are trading just over 70 cents.

While the passive, buy-and-hold index funds have gradually expanded their net long position, the trend-following hedge funds have more dramatically expanded their long position recently. As Figure 1 shows, hedge fund speculation is historically variable, expanding and contracting their long position, and even swinging net short when they perceive the situation as bearish.

The hedge funds are currently in a bullish mindset. I assume this mostly reflects their expectation that the cumulative effect of multiple tropical events, rainy harvest weather, and cooler temperatures have perhaps significantly reduced the size of the U.S. cotton crop.

Are they right? Time will tell. USDA will begin to supplement their remaining objective yield survey data with more ginnings data. As we move into November, we should have a clearer picture of the size of the U.S. crop.

A selling opportunity

The questions I have include:

Even with (hypothetically) a million fewer bales of U.S. production, will hedge funds maintain their net long position if U.S. ending stocks still exceed six million?

What if we simply wind up with a very large supply of lower quality bales?

If they are right, how soon might hedge funds simply take profits on their bullish bets?

What happens to futures if hedge funds get spooked by some “black swan” development related to the election, the pandemic, or China?

What if the surging cotton prices in China indicate an emerging recovery/expansion of demand?

I don’t know if any of those things are going to happen, but I have observed that hedge fund buying can be fickle, transitory, and unpredictable. So, unless the current rally in ICE cotton is based on some unfolding improvement in demand, I suggest growers view it as a selling opportunity.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://cottonmarketing.tamu.edu.

About the Author(s)

You May Also Like