I, and others, have recently been describing the cotton market outlook as a tug of war between the big crop/excess production viewpoint and the good/improving demand viewpoint.

While there is still time for some adjustments to U.S. production, I think it is more of a sure bet that we will have a large crop and ample supply, albeit with mixed quality supplies. The outcome for U.S. export demand is more variable since it is under the influence of U.S. supplies, foreign competition, and other indirect things like currency markets, trade relations, and general economic conditions.

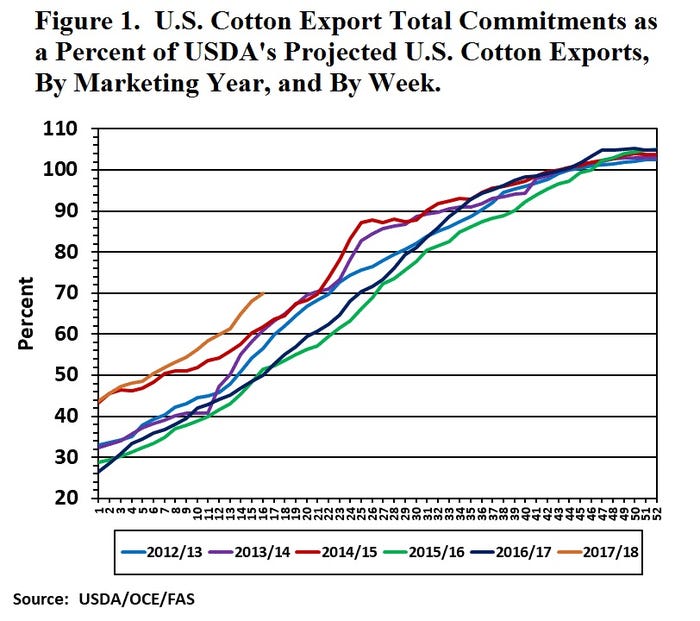

The bullish demand argument deserves more scrutiny. The notable aspect of recent U.S. cotton exports is evident in Figure 1. As of November, the USDA forecast was for a total 14.5 million bales of U.S. all cotton exports (i.e., upland and pima) for the 2017/18 marketing year.

As of late November, the U.S. had already sold 70 percent of the total forecasted, including 2.2 million bales of U.S. upland cotton that has been sold and shipped, and another 7.5 million bales that has been sold, but not yet shipped. Together, these two amounts add up to what USDA calls “Total Commitments” of U.S. upland cotton.

HISTORICALLY HIGH

Total commitments representing 70 percent of forecasted exports is historically high for this early in the season. During the previous five years, this ranged between 50 percent and 60 percent (Figure 1) for the same time period. Much of the new crop cotton that is now making up these exportable supplies was bought under good cash basis terms for growers.

So, what does this relatively fast pace of exports imply? One interpretation is that the USDA forecast of 14.5 million bales of total exports is too low, and will be adjusted substantially higher. If that were to happen, it would whittle away at forecasted ending stocks, and the fundamental outlook for U.S. cotton would be more bullish. It would, for example, justify a continuation of futures prices in the low to mid-70s. Supporting this viewpoint is that the good cash basis terms reflect the overall strong demand for cotton.

There is another interpretation that is not as price-supportive. For months, USDA’s balance sheet for cotton has implied that the 2017/18 marketing year will result in a substantial increase in ending stocks, year-over-year. Such an outcome would ordinarily be price-weakening, and I would associate it with ICE cotton futures eventually declining towards 60 cents.

Figure 1 U.S. Cotton Export

MAY CALM DOWN

What if this possibility led merchants and mills to front-load U.S. export sales in what will eventually turn out to be the 14.5M bales of U.S. exports that USDA has been forecasting all along?

The mills may have been willing to contract a lot on-call, since that just fixes the basis now, and leaves the price level to be fixed at some future, presumably lower, level. And what if the strong basis offerings from merchants to growers are simply rationing available quality cotton?

If this alternative explanation is correct, then the U.S. cotton export business may calm down, weekly export sales might get smaller, and we might go into a holding pattern. This was the more typical pattern not too many years ago, when U.S. cotton would sit in the CCC loan program all spring while merchants bought and shipped cotton from other countries.

These alternatives remain to be seen, but growers should consider the downside price risk.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/

About the Author(s)

You May Also Like