Worries about war, tight supplies and high fertilizer prices provide plenty to ponder when figuring corn and soybean marketing plans this spring. But even more grist for the grain market rumor mill emerged this month.

Though the news was forced off the front pages by world events, government forecasters predicted La Niña cooling of the equatorial Pacific will last into the northern hemisphere summer, one of the first indications the growing season could generate fireworks over weather concerns.

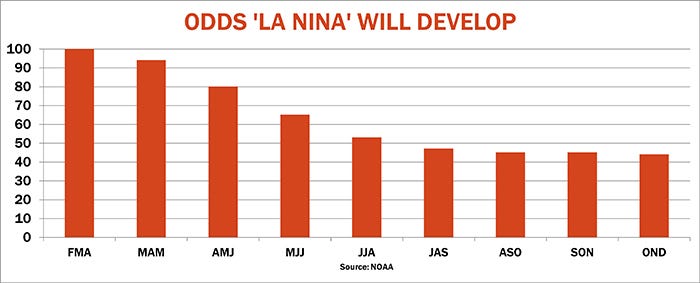

While La Niña is associated with some of the big-time droughts in the U.S., there are no signs of that kind of disaster -- yet. Indeed, the official National Weather Service analysis only put La Niña odds at 53% for June through August.

But that was up from barely 20% as recently as December, a sign the current La Niña, which started in July-September 2020, isn’t ready to roll over.

Warmer and drier

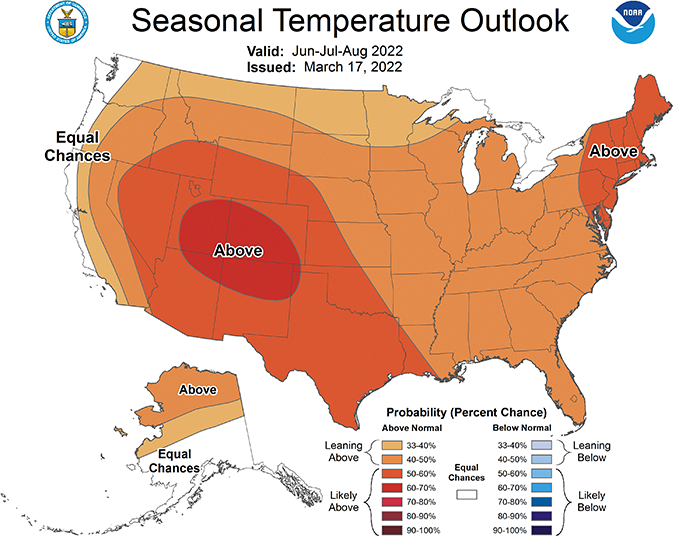

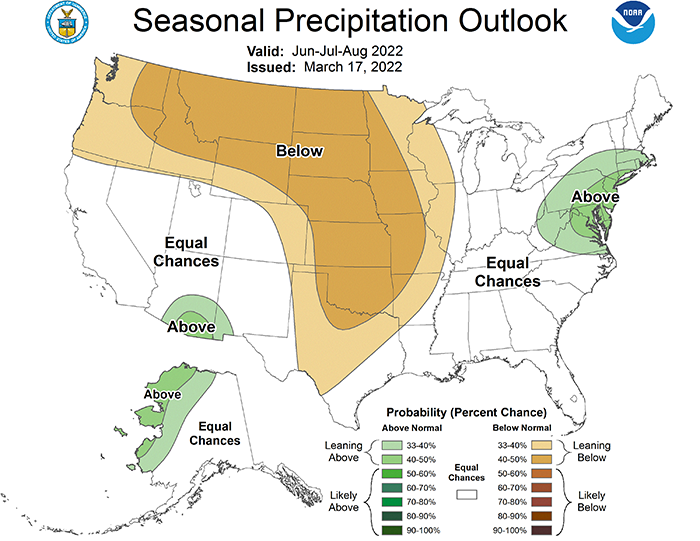

The El Niño/La Niña cycle features prominently in updated summer weather outlooks released last week that called for above normal temperatures over nearly the entire U.S., with below normal precipitation from central Illinois westward.

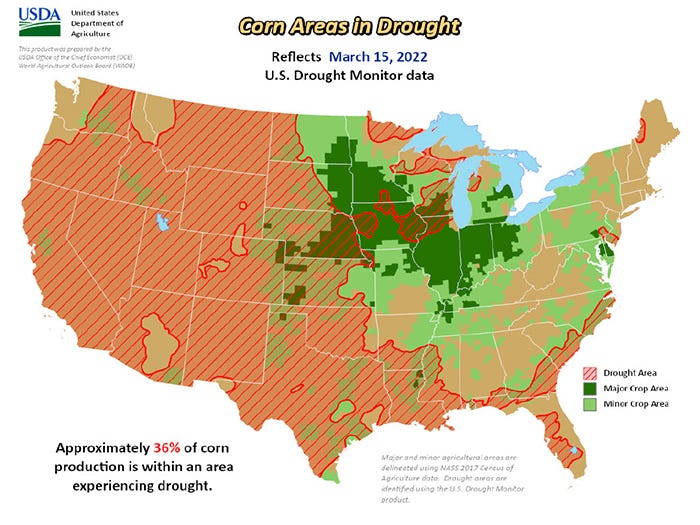

To be sure, the fine print says both forecasts are only “leaning” in this direction. But the western half of the country is already in drought, including 36% of corn acres. Once underway these trends tend to keep going as warm, dry soils reinforce chances for drought to spread.

More granular, unofficial forecasts suggest drying conditions could be offset by more normal July temperatures in the eastern Corn Belt. And any attempt to translate the data into specific yield and rally forecasts includes plenty of room for error: La Niña explains less than half the variance seen over the past five decades.

Yields could fall

Still, plugging potential yield cuts to price forecasting models suggest levels futures could target if markets heat up this summer.

A summer La Niña could cut average nationwide corn yields four to five bushels per acre from the 20-year or “normal” yield of 178.1 bpa. A yield of, say, 173.5 bpa would cut production by 650 million bushels from the 15.24 billion forecast by USDA at its February outlook conference, though that assumes farmers don’t increase acreage from the 92 million guess used by the government.

Rally targets from this analysis range from $6.56 to $7.59, based on prior years. Plugging the lost bushels into my supply and demand model puts the targeted selling range at $6.54 to $7.36 for December corn futures. For reference, the high close so far is $6.5175.

The connection between soybean yields and summer La Niña episodes is actually more compelling than corn statistically. But the impact isn’t as great, perhaps because late summer conditions can make or break yields.

Some November soybean futures targets based on previous La Niña rallies have already been met – the current high close is $14.9525 with an intraday high of $15.55. But others point to surges all the way to $17.60 or better – close to the old crop nearby futures high from February. My models suggest La Niña could cut soybean yields by 2 bpa, knocking 125 million bushels off USDA’s production estimate. And when those numbers are plugged into the forecast, the selling target range moves to $15.19 to $16.38.

La Niña could also affect other growing regions. As in the U.S., it’s associated with lower feed grain yields in the Former Soviet Union. And next year’s Argentine corn and soybeans could again be threatened if the phenomenon lasts into fall.

The projections are intriguing, but remember, these are based on very preliminary long-term weather forecasts that may nor may not prove out. Prices are at profitable levels and warning signs are already showing up on charts for wheat, gold, and crude oil bull markets.

And, fertilizer costs show no sign of easing for growers still needing to book nutrients. Ammonia traded above $1,600 at some dealers last week, with urea solidly over $1,000, DAP topping $1,100 and $900 potash common on the retail market.

That’s yet another reminder that more remains unknown than known about how an already tumultuous year will play out.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like