It is hard to believe that Russia invaded Ukraine a year ago this week, sending commodity prices soaring. While the war drags on, most commodities have lost the "war" premium that pushed many to record or near record values.

The violent price swings have also exited, as the war premium has eroded from the market. The CME group corn volatility index is lower now than it was pre-war. With the volatility-to-price ratio so low, now is a suitable time for option buyers to step into the market and premium sellers to take a more cautious approach. Now might be the time for end users or producers who want to re-own sold bushels to buy calls. Producers with unsold old crops or no new crop sales on the books should consider buying puts to take advantage of the low volatility.

With so much uncertainty about the size of South American crops, China's import demands, and the upcoming U.S. production, the odds are that volatility will return to the market sooner rather than later.

Signals to watch

We argue that downside price risk is real for old and new crop corn and soybeans if we see a few unknowns fall on the bearish side. On the domestic front, we could see an excellent, timely spring planting window with improved moisture in the west. An early and fast planting pace tends to have an adverse price reaction. Export demand for old-crop soybeans could end any day as Brazil is currently pricing soybeans at an 80-cent to $1.00 discount to the United States.

The worst-case scenario would be that China cancels unshipped soybeans. With tensions between the U.S. and China growing, the risk of China canceling U.S. purchases as a punitive measure is real. Let's face it; the headline of China canceling purchases is not a surprise anymore. It is now expected to happen. It is just a matter of when.

Corn export sales and shipments have been less than stellar. Demand bulls are hopeful that China will become an aggressive buyer any day now, but if they do not show soon, USDA will have to lower exports further on the balance sheet, which will be viewed bearish to prices.

On the macro front, world traders could be disappointed that China's COVID re-opening does not go as expected. Most traders expect a post covid economic boom, as we saw in the U.S. If the boom doesn't materialize, it could negatively impact energy and grain prices. This could send crude oil below $70, which would pull most commodity classes downward as crude tends to be a canary in the coal mine for commodities.

Rally potential

Some factors could also rally the market, and the world supply of corn could be one. Looking at global domestic use less China, WASDE is showing 43Mt less. That is approx. 1.7 Bbu, with 60% (26Mt) of the cut coming from the U.S. balance sheet. This leaves 17Mt of the global use cut coming from the rest of the world.

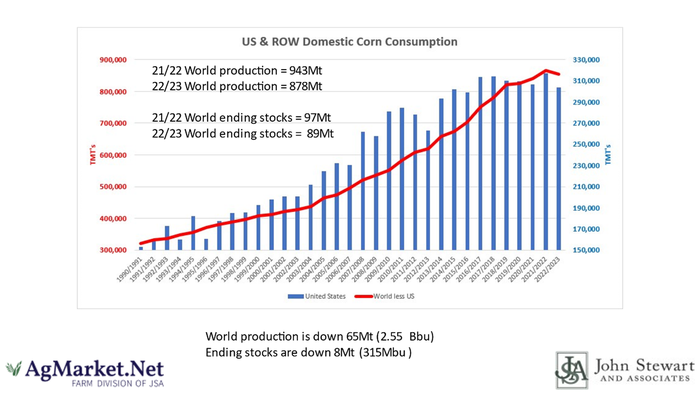

How does that compare to history? Well, it doesn't compare at all. The chart below shows the blue bars for U.S. domestic use. The red line shows the rest of the world's domestic use minus the U.S. As you can see, since 1990, the rest of the world has never seen domestic use cut Year over Year.

What all this tells us is the USDA has done some unprecedented cutting to corn demand globally to achieve the balance it has.

For comparison, look at the 89Mt ending stocks number globally less China compared to 64Mt in 12/13. However, in 12/13, when U.S. domestic use went down 15Mt vs. the previous year due to drought, the rest of the world's domestic use went up 7.5Mt!

The bottom line is that USDA has never done the global hack job on demand it has done this year in the modern ag era. The only way to somewhat measure global domestic use in the middle of the U.S. crop year is to look at the global import pace. From September through January, that pace is off roughly 4MT which is impressive but a far cry from the 17Mt needed by Aug 31.

The drought in Argentina is still taking a toll on both the corn and soybean crops, which could provide some bullish fuel to the market. Brazil has the opposite problem with too much moisture, which hinders soybean harvest and delays second-season corn planting. If the corn crop planting is delayed too much, it could push the production cycles past the rainy season, hurting its yield potential and tightening the world supply.

We encourage producers to institute risk management practices that will protect your revenue but allow them to take advantage of potential upward moves in the market.

If you have questions, please contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT.

Reach Jim at 815-665-0461, [email protected] or on Twitter: @jpmccormick3.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like