August 4, 2020

This year is shaping up to be one of the most interesting tax years in a long time. Between USDA assistance — such as the Commodity Food Assistance Program, or CFAP payments — Paycheck Protection Program loans and everything in-between, it’s critical to stay up-to-date on projected year-end numbers to avoid an unpleasant tax surprise.

Here’s an example to illustrate the importance of situational awareness:

Married dairy farmers John and Jane received $100,000 in PPP funds in 2020. They spent the money in accordance with the program and had the full loan amount forgiven in 2020. In their case, it was spent entirely on qualifying payroll expenses.

John and Jane also took advantage of an opportunity to acquire a milk base for $75,000 from a neighboring farmer who was retiring. As many cooperatives have enacted some type of base excess program in light of COVID-19, some farmers have acquired other neighboring milk bases, seeing this as an economic opportunity.

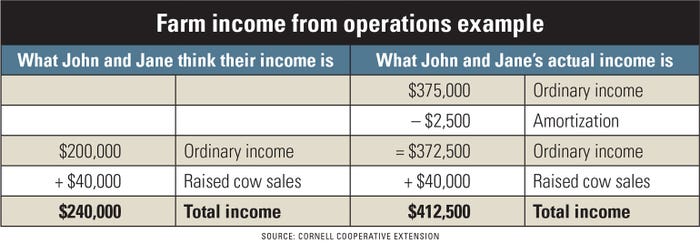

The farm had $200,000 of profit from ordinary farm operations. They also have $40,000 from raised cow sales.

When thinking about their tax situation for 2020, John and Jane forgot the expenses paid with PPP funds are not deductible if the loan is forgiven (unless Congress changes the rules). In other words, their $200,000 farm profit is really $300,000 because the $100,000 of payroll expenses they used PPP funds for does not count as an allowable expense. They also erroneously included the milk base as an expense in their records as they were unaware that they can’t expense the purchase of the milk base. Rather, they must amortize it over a 15-year period, which gives them a $2,500 deduction for the current year.

As a result, John and Jane will owe tax on $412,500 of total income ($372,500 from ordinary operations and $40,000 from raised cow sales).

The difference in the table above shows a disconnect of $172,500 in taxable income between what John and Jane think they will owe taxes on and their actual income. They will want to discuss this when they sit down with their tax adviser.

To manage their tax liability, they can choose to either prepay expenses or make some capital expenditures. One of the mistakes that is often made, though, is trying to manage taxable income down to zero to minimize tax liability. In other words, John and Jane may end up spending an additional $412,500 in qualified expenses — and unnecessarily burn through liquidity before the end of 2020 — in order to pay zero federal tax.

In 2020, married couples can have up to $80,000 in taxable income and be in the zero capital gains bracket. Basically, there is no reason for John and Jane to spend more than $372,500. (If they are concerned about Social Security earnings, then they may want to prepay even less in order to report self-employment income.) That would leave only $40,000 of raised cow sales, which would have zero federal tax.

If they reside in New York, they will likely have some tax credits to offset any state tax with the $40,000 raised cow income. But, even if they didn’t live in New York, they would likely be in the 5.25% tax bracket.

They would end up owing just under $1,000 of tax to New York. Paying $1,000 of total tax on $40,000 of raised cow sales probably makes sense for John and Jane, as they can hold off on prepaying an additional $40,000 and use those funds in 2021 to offset ordinary farm income (that is also subject to self-employment taxes).

The moral of the story is that 2020 is shaping up to be a year where tax planning will be more critical than ever. Failure to plan could leave many farmers with an unexpected tax liability.

Arezzo is a senior tax consultant for Farm Credit East.

You May Also Like