July 19, 2023

By Kenny Burdine, University of Kentucky

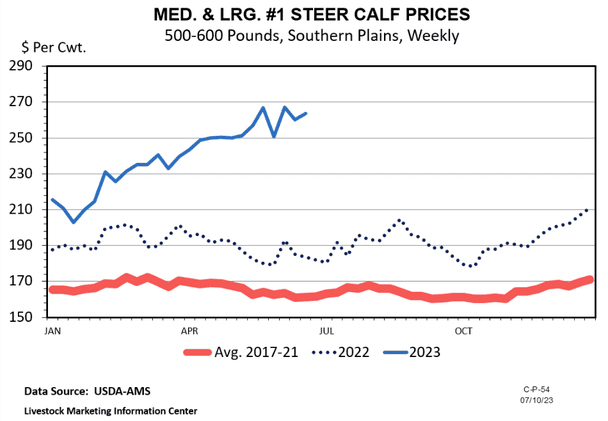

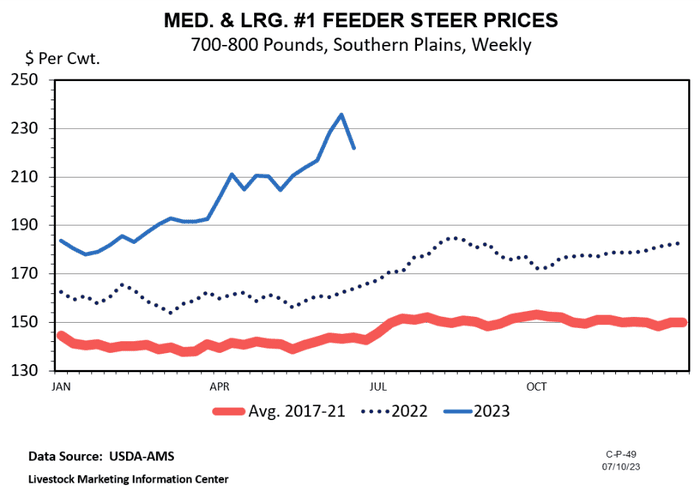

As we sit midway through July, it’s hard not to reflect a bit on the strength of this feeder cattle market. In many ways, it seems like it took us forever to get here. In truth, we are seeing feeder cattle prices at levels that have not been seen since the summer of 2015. Eight years is quite a while, but the last eight years have seemed to be especially long given all the headwinds the cattle sector has faced.

Drought conditions in significant cattle production regions during 2011-2013 extended the contraction phase of the previous cattle cycle and resulted in January 2014 being the inventory low of the last cattle cycle. And the herd only increased moderately in size that year. Calf prices actually set new records in the spring of 2015 and held pretty strong through summer, before dropping sharply in the fall. Prices rallied to relatively strong levels in the spring of 2016, but once again dropped sharply by fall, and it was clear that the historic run was over.

Despite the fact that calf prices had dropped considerably, US beef cow numbers continued to increase for several years. Much of this occurred in the Southern Plains as those producers were still rebuilding from the 2011-2013 drought. At the national level, beef cow numbers didn’t actually peak until 2019. That meant that on-feed inventory and beef production were likely to peak in 2020, which was heavily impacted by the pandemic. And as the industry recovered from COVID impacts and worked through backlogs in the second half of 2020 and early 2021, it also had to absorb sharply higher feed prices. Then, 2022 brought another widespread drought that impacted most all cattle producing regions and led to sizeable increase in female slaughter and another increase in beef production.

This series of events set us up for what we have seen thus far in 2023. Weather remains a challenge in some regions, there is a lot of uncertainty about the likely size of the 2023 corn crop, and there are legitimate demand questions that can be asked. But the cowherd is roughly 9% smaller than it was in 2019 and has not been this small since 1962. Supply fundamentals appear to be in the driver’s seat and feeder cattle and calves are hot commodities.

It’s hard not to compare the current market to what we saw in 2014 and 2015. As impressive as prices were then, it really felt as though that market turned south quickly as the size of the cowherd grew. While there is no way to know how long this run of strong prices will last, there are several reasons why I expect producers to have a longer period of high prices this time. First, I don’t think a sufficient number of females are available to start expansion in 2023, even if weather cooperates. Second, production costs are a lot higher this time, which is going to limit interest in expansion to some extent. And third, profitability of other species is a lot lower now than in 2014 / 2015.

This last factor is one that I think gets forgotten when one remembers the time period following the 2014 / 2015 price run. Profitability was strong across all livestock species, so all species were in expansion mode. But each species differs in how quickly it can expand production. For example, pork production increased by more than 7% in 2015. By the time beef production increased in 2016, values were already being impacted by increased competition from the pork sector. Given current feed prices and other costs, I don’t think the interest in expansion across other species will be as strong. If calf prices remain strong and weather allows, I have no doubt that this cow herd will get bigger in the coming years. But I also think it will be a much slower expansion that what we saw during the last cycle.

Drought conditions in significant cattle production regions during 2011-2013 extended the contraction phase of the previous cattle cycle and resulted in January 2014 being the inventory low of the last cattle cycle. And the herd only increased moderately in size that year. Calf prices actually set new records in the spring of 2015 and held pretty strong through summer, before dropping sharply in the fall. Prices rallied to relatively strong levels in the spring of 2016, but once again dropped sharply by fall, and it was clear that the historic run was over.

Despite the fact that calf prices had dropped considerably, US beef cow numbers continued to increase for several years. Much of this occurred in the Southern Plains as those producers were still rebuilding from the 2011-2013 drought. At the national level, beef cow numbers didn’t actually peak until 2019. That meant that on-feed inventory and beef production were likely to peak in 2020, which was heavily impacted by the pandemic. And as the industry recovered from COVID impacts and worked through backlogs in the second half of 2020 and early 2021, it also had to absorb sharply higher feed prices. Then, 2022 brought another widespread drought that impacted most all cattle producing regions and led to sizeable increase in female slaughter and another increase in beef production.

This series of events set us up for what we have seen thus far in 2023. Weather remains a challenge in some regions, there is a lot of uncertainty about the likely size of the 2023 corn crop, and there are legitimate demand questions that can be asked. But the cowherd is roughly 9% smaller than it was in 2019 and has not been this small since 1962. Supply fundamentals appear to be in the driver’s seat and feeder cattle and calves are hot commodities.

It’s hard not to compare the current market to what we saw in 2014 and 2015. As impressive as prices were then, it really felt as though that market turned south quickly as the size of the cowherd grew. While there is no way to know how long this run of strong prices will last, there are several reasons why I expect producers to have a longer period of high prices this time. First, I don’t think a sufficient number of females are available to start expansion in 2023, even if weather cooperates. Second, production costs are a lot higher this time, which is going to limit interest in expansion to some extent. And third, profitability of other species is a lot lower now than in 2014 / 2015.

This last factor is one that I think gets forgotten when one remembers the time period following the 2014 / 2015 price run. Profitability was strong across all livestock species, so all species were in expansion mode. But each species differs in how quickly it can expand production. For example, pork production increased by more than 7% in 2015. By the time beef production increased in 2016, values were already being impacted by increased competition from the pork sector. Given current feed prices and other costs, I don’t think the interest in expansion across other species will be as strong. If calf prices remain strong and weather allows, I have no doubt that this cow herd will get bigger in the coming years. But I also think it will be a much slower expansion that what we saw during the last cycle.

You May Also Like