April 19, 2013

Crop rotations change from year to year for a number of reasons. Economics, dealing with weed and disease pressures, the installation of drainage tile, having a place to apply manure...all are reasons that a producer might vary the number of acres devoted to any single crop enterprise in any single year. Geographic's can also have an impact on crop rotations. Large areas of southern Illinois can easily fit double crop soybeans into a rotation while that feat would be very difficult in most of northern Illinois.

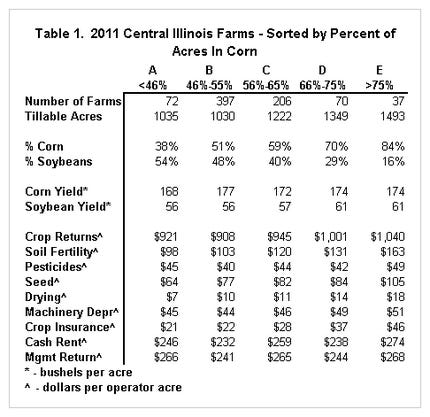

Todays' post will review some of this data and review 2011 in particular. This group of 782 farms are from better soils in central Illinois with negligible contributions from a livestock enterprise. Minimum farm size was 180 acres of row crop production.

When abundant detailed enterprise analysis information is not available there are other means to gain insight into this data. For this work, groups were established based on the percentage of land devoted to the production of corn. Those five groups are:

Group A - less than 46% corn acres

Group B - 46% to 55% corn acres

Group C - 56% to 65% corn acres

Group D - 66% to 75% corn acres

Group E - greater than 75% corn acres.

Refer to Table 1 as we review some of the characteristics of this group of farms. Group A with the least percentage of corn acres contained only 9.2% of the farms. This group is a bit more diverse in its crop enterprise mix with 8% of acres devoted to crops other than corn or soybeans. The other four groups were nearly exclusively made up of only corn and soybean enterprises. Group E contained just under 5% of the farms. Group B alone contained just over half of the farms and just over 75% of the farms were in Groups B and C.

Crop returns per acre did vary but had a mostly upward trend as the percentage of corn acres increased with a $921 per acre crop return for Group A and ranging to $1,040 for Group E. Interestingly, corn yields had no discernible trend as the percentage of corn acres increased while soybean yields appear to increase as the percentage of corn acres increased.

A review of some of the expenses show that soil fertility shows an increase in cost as the percentage of corn acres increases as does seed expense, drying expense, and crop insurance as one might expect. Machinery depreciation increased, but only slightly, and cash rent varied considerably but was the highest for Group E. In the end, management returns show a range of only $27 per acre with Group E the highest at $268 and Group A and C following closely at $266 and $265. This data represents only a single year, but management returns for 2011 provide little evidence that higher management returns are due to higher percentages of corn acres in crop rotations.

The authors would like to acknowledge that data used in this study comes from the local Farm Business Farm Management (FBFM) Associations across the State of Illinois. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,700 plus farmers and 60 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM staff provide counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact the State FBFM Office located at the University of Illinois Department of Agricultural and Consumer Economics at 217.333.5511 or visit the FBFM website at www.fbfm.org.

Like what you're reading? Subscribe to Farm Industry News Now e-newsletter to get the latest news and more straight to your inbox twice weekly.

PLUS, you might also like:

You May Also Like