For live cattle, the last high of significance prior to the current decline was August 10.

The oscillator rose above the zero line at that time and moved $9.70 from the contract low.

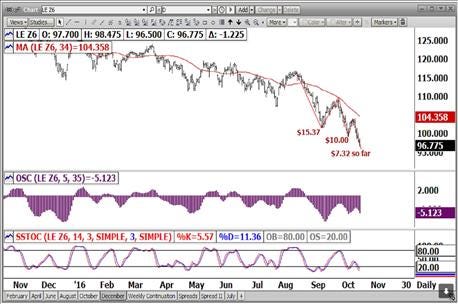

From that $116.65 high, December fell initially to $101.27 before correcting. That was a $15.37 move.

The correction took December back to $108.90 before resuming the downtrend to the next contract low of $98.90 for a $10.00 move. December rallied briefly to $103.82 before resuming the downtrend again to where we are this morning.

So far, this move has been approximately $6.50.

If December falls below $93.82, it will suggest we should anticipate further downside movement.

At this time, the second move down was 65% of the first. The current move down of $6.50 is 65% of the second move. I understand this does not mean a great deal at this time, but it is the only clues we have available with support-price levels eroding and seemingly conflicting supply/demand data.

I continue to perceive risk of loss to be as elevated as it has ever been in the cattle, regardless of position.

In the feeder cattle, the May $120.00 call is trading under $4.00 this morning. That is $14.00 to break even as I write this.

The contract high for May is $135.50. On the weekly continuation chart, $150.00 is the last high of significance before breaking lower. Due to the current down move perceived a fifth wave, and all of the sideways to downward slant trading this year a wave four, it leads me to anticipate a rally of significance when the market turns.

At this time, the fifth wave has a contracting pattern unfolding, like the fats. I fully understand the reluctance to want to buy anything cattle related. However, that is exactly what I perceive you should do. I recommend buying the May $120.00 call at $4.00 or better. (This is a sales solicitation.)

An investment in futures contracts is speculative, involves a high degree of risk and is suitable only for persons who can assume the risk of loss in excess of their margin deposits. You should carefully consider whether futures trading is appropriate for you in light of your investment experience, trading objectives, financial resources and other relevant circumstances. Past performance is not necessarily indicative of future results.

About the Author(s)

You May Also Like