Commentary

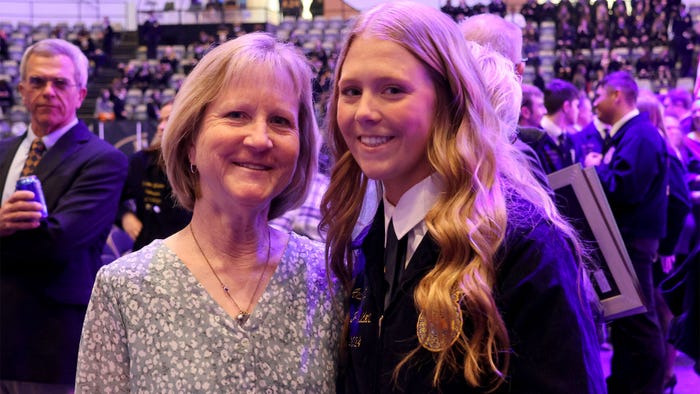

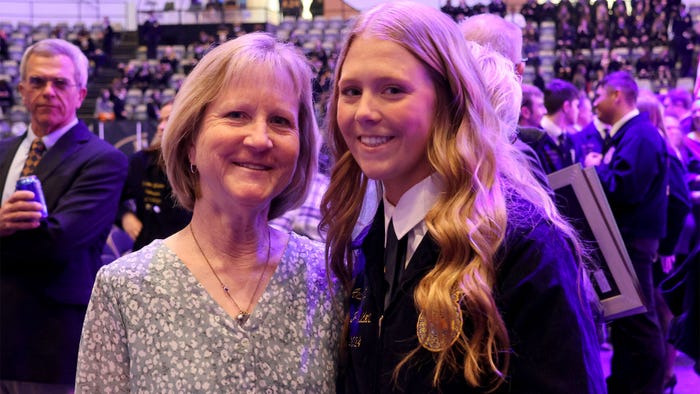

Missouri State FFA president Andi Belt and her grandmother Mari Eckler

Commentary

Moms, grandmas matter for FFA membersMoms, grandmas matter for FFA members

Show-Me Life: Scenes from the Missouri State FFA Convention show dads and grandpas are no slackers either in the lives of rural youth.

Subscribe to receive top agriculture news

Be informed daily with these free e-newsletters