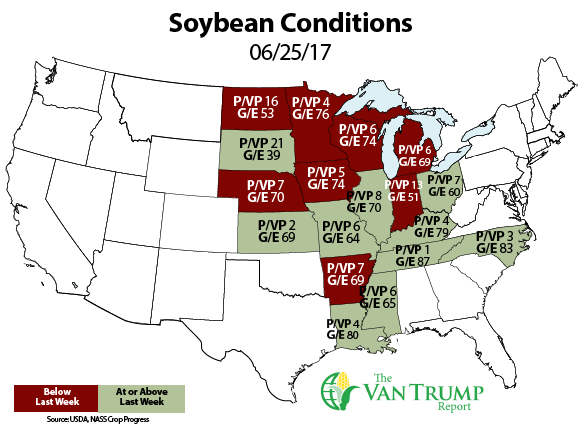

Soybean bulls are happy to see the USDA lower crop-conditions from 67% to 66% rated "Good-to-Excellent". Conditions in South Dakota fell last week by -9%, Louisiana by -7%, North Dakota and Wisconsin by -4%, Arkansas and Nebraska by -2%, Indiana and Minnesota by -1%. Conditions improved +3% in Illinois and North Carolina, +2% in Ohio, Kansas and Mississippi, and +1% in Kentucky and Tennessee.

The bears continue to believe the USDA, on Friday, will show a record number of U.S. acres getting even larger. I'm not thinking it will be by much, but I do suspect to see U.S. planted soybean acres higher than U.S. planted corn acres. Looking further out on the horizon, government policy shifts pertaining to biodiesel is extremely important in forecasting overall demand, but we still don't know if and when we will hear more specifics.

Like most, I'm hoping sooner rather than later, as I suspect it could help stop some of the recent bleeding. As both a producer and a spec, I'm starting to wonder if there is much meat left on the bone for the bears, at least in the next 30 to 45 days. The longer-term weather forecasts are somewhat unreliable out into the "pod filling stage" and there is still a ton of outstanding U.S. risk remaining in the field. I also feel like there's some weather concerns for spring crops in Canada, canola in Australia, oilseed in India and rapeseed in Ukraine.

I'm hoping the trade has already digested a big portion of the massive crop recently harvested in South America and record acres planted here in the U.S. I believe a bearish report on Friday might be an opportunity to lift some hedges or dip a toe in the water for a short-term bullish bet. Historically, I don't feel like my batting average for picking bottoms would get me in the hall of fame, so I'm only looking to take an extremely small bite. As a producer I'm looking to lift a portion of my hedges on the next downstroke.

GET ALL MY DAILY COMMENTS HERE...

State Conditions "Better Than" Last Year

· North Carolina +16% better than last year... +3% this week at 83% GD/EX

· Tennessee +15% better than last year... +1% this week at 87% GD/EX

· Arkansas +13% better than last year... -2% this week at 69% GD/EX

· Kansas +10% better than last year... +2% this week at 69% GD/EX

· Missouri +7% better than last year... +1% this week at 64% GD/EX

· Michigan +6% better than last year... -2% this week at 69% GD/EX

· Kentucky +1% better than last year... +1% this week at 79% GD/EX

· Minnesota +1% better than last year... -1% this week at 76% GD/EX

· Mississippi +1% better than last year... +2% this week at 65% GD/EX

State Conditions "Worse Than" Last Year

· South Dakota -36% worse than last year... -9% this week at 39% GD/EX

· North Dakota -24% worse than last year... -5% this week at 53% GD/EX

· Indiana -23% worse than last year... -1% this week at 51% GD/EX

· Wisconsin -10% worse than last year... -4% this week at 74% GD/EX

· Nebraska -8% worse than last year... -2% this week at 70% GD/EX

· Ohio -7% worse than last year... +2% this week at 60% GD/EX

· Iowa -3% worse than last year... +0% this week at 74% GD/EX

· Louisiana -3% worse than last year... -7% this week at 73% GD/EX

· Illinois -1% worse than last year... +3% this week at 70% GD/EX

About the Author(s)

You May Also Like