January 18, 2023

Jacqueline Holland and Ben Potter are on assignment at the Farm Futures Business Summit. In the meantime, enjoy the guest commentary from the risk management team at Advance Trading Inc.

Corn

March corn futures are higher this morning after a strong day yesterday. Funds were buyers of many commodities yesterday. Corn prices have rallied 30 cents since the January crop report. March corn is at its highest point since early November. These are selling opportunities for those that have corn in storage, whether in the elevator or in the bin. Basis is still very strong. There is not any futures carry in the market to warrant holding on to a lot of corn going forward. The March/July corn spread has inverted by 14 cents, which means March corn is 14 cents higher than July corn futures. This continues to show you that the market wants corn now.

December corn is also at its highest point since the first trading day of 2023. The January crop report showed us that winter wheat acres are up almost 4 million acres from 2022. That is a big number, and that may signal some concern for corn acres going into spring. This is likely why we have seen the jump in December 2023 futures. Use rallies to get floors in place, and sales made.

Soybeans

Beans were also higher yesterday, after being lower in the overnight session. This morning, March beans are higher, but they are off the highs. Weather forecasts continue to show improved rains for Argentina, but many private estimates have Argentina’s bean crop in the 35-39mmt area. The USDA is at 47.5mmt. There will still be an overall big crop of beans coming on here soon, and that is a concern. The bullish factor is that some of those beans in Paraguay and Brazil may get imported into Argentina for them to crush. Like corn, there isn’t any board carry, and cash beans should be sold. The March/July bean spread was a 10 cent carry back on 12/31/22, but today it is a 9-cent inverse. This is a swing of 19 cents in favor of selling any beans you have left from the 2022 crop. You can buy back with call options to stay in the market.

November beans have struggled since the January crop report last week. The additional 4 million acres of wheat likely means we have more double crop bean acres next year, which can pressure new crop bean values. We also have that big South American crop coming on to compete with us as well.

Wheat

Wheat was stronger yesterday and it is higher again this morning. Wheat is the weakest of these 3 commodities in my opinion, but it is showing great resolve this week. The bullish factor for wheat, in my opinion, is that wheat is getting into feed rations. This might be where we see more demand. Our exports haven’t been that great and the world has wheat.

Outside markets

Crude oil is up $1.50/barrel today and is at a 2-month high. Crude oil has rallied $9/barrel since January 4th. China is going into their Lunar New Year this weekend and the idea is that they will be more active during this holiday, and after, and they will need more energy. It will also be tough to handle inflationary pressures once their economy opens back up. This may be a reason for the influx of investor money in commodities this week.

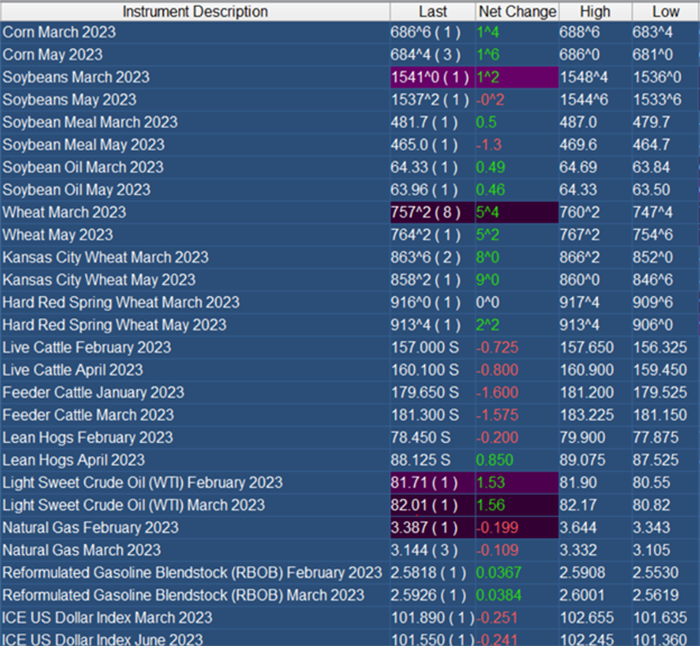

CBOT Prices as of 6:45 a.m. CST

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc.

Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like