Corn bulls continue to point to strong demand for U.S. corn as both ethanol usage and exports remain impressive.

On Wednesday, the trade was digesting better than expected corn used for ethanol numbers, then Thursday we were digesting better than expected weekly USDA export sales data, which showed net corn sales of 1.255 MMTs, which was well above trade estimates. While many of the bears have been arguing that world corn importers are switching to South American suppliers we are seeing the highest U.S. weekly export numbers we've seen in the past couple of months.

From my perspective it looks like strong U.S. demand may continue to last for a few more weeks, at least until Argentina becomes a bit more competitive. Bottom-line, I could arguably make the case that the USDA may raise U.S. exports in one of the upcoming reports. Unfortunately they could still offset some of the additional export demand by decreasing corn used for feed and residual. Globally there's very little fresh or new headlines regarding European corn production as estimates seem to be backpedaling a bit, but still remain larger than last year.

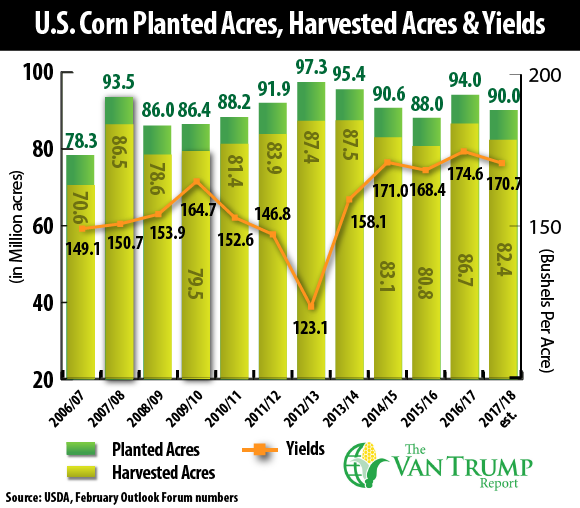

The weather in Brazil seems to be somewhat of a non-event as more wide-spread rain provides adequate coverage for second-crop corn. Looking ahead to the next few weeks, the trade is going to start more heavily debating the upcoming U.S. corn crop, where planters down south are already starting to roll. I still believe for the trade to turn more fundamentally bullish we will need to see harvested corn acres projected at sub-81 million and headline talk of a -7% to -10% reduction in the average corn yield when compared to last years record of 174.6 bushels per acre.

In other words we will need to hear talk of a sub-165 yield on six-million fewer harvested acres to shift the traditional fundamental mindset and to break out of our current trading range.

The NOAA's most recent longer-term weather outlook is providing the bulls with a bit more hope as it shows an increased region of above-normal temps. I continue to see this market as range-bound and eventually wanting to test $3.50 on the lower end before transitioning into a full U.S. weather market.

About the Author(s)

You May Also Like