Updated 1:18 p.m.

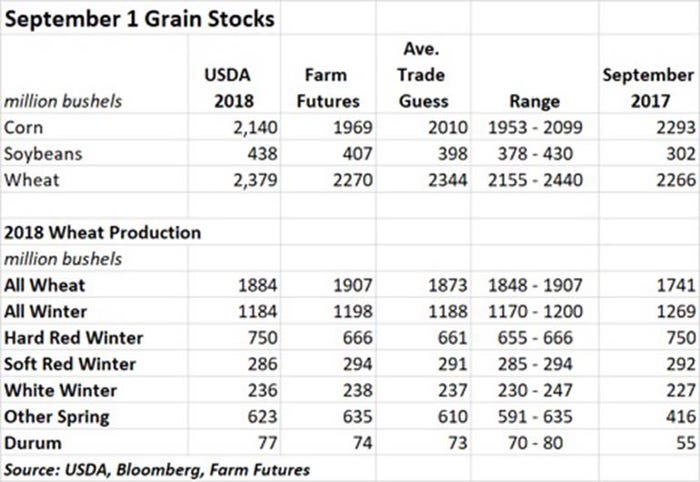

Grain futures are trading mixed this morning after bearish stocks data from USDA this morning, which reported larger than expected Sept.1 inventories of corn, soybeans and wheat.

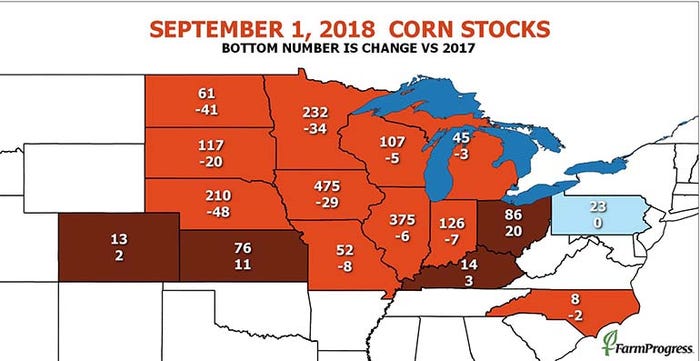

USDA put Sept. 1 corn supplies at 2.14 billion bushels, 138 million more than its last estimate of old crop carryout on Sept. 12. Today’s larger than expected total suggests feed usage during the summer was smaller than expected, helping shrink the amount walking off the farm for the 2017 crop by some 200 million bushels below USDA’s last estimate.

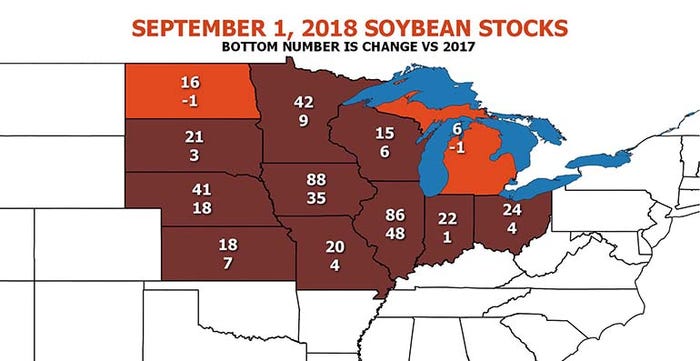

The government also raised its forecast of soybean supplies leftover at the end of the marketing year. At 438 million, Sept. 1 inventories were up 43 million from USDA’s Sept. 12 report. While part of the increase likely is due to sampling error from previous reports, the agency also said the 2017 crop was 19 million bushels larger than reported in January, raising the yield by two-tenths of a bushel per acre to 49.3 bpa nationwide. Total production was put at 4.411 billion bushels.

While corn and soybean futures remained lower after breaking to new session lows, wheat tried to reverse higher after the trade absorbed both stocks and production reports. However, an hour after the data dump those gains were also fading.

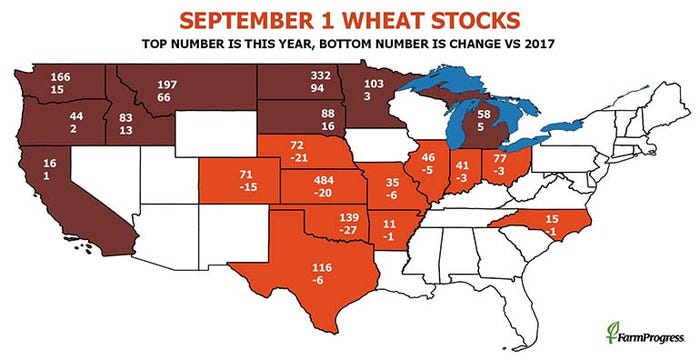

USDA raised its estimate of 2018 all-wheat production by 7 million bushels to 1.884 billion. Sept. 1 stocks of 2.379 billion bushels were more than expected and indicated summer demand was down 8% from last year, in part due to a slow start to exports during the marketing year.

While these wheat stocks numbers can be a bit murky, they also suggest wheat feed usage will be a little less than USDA forecast earlier in the month.

Given already large projected 2018 crop ending stocks for soybeans, today’s increase in old crop carryout doesn’t really change the math enough to be significant.

The increase in ending stocks is more of a concern for corn. Stocks were still down from supplies left over at the end of the 2016 marketing year, but only by 150 million bushels. This puts the onus on demand, especially in the export market unless the 2018 crop turns out smaller than expected. Harvest weather will be closed watched over the next two weeks for signs rains are causing problems, though they’re probably more of a concern for soybeans than corn.

In the short-term, December corn futures will face a test next week if today’s bearish reversal attracts follow-through selling.

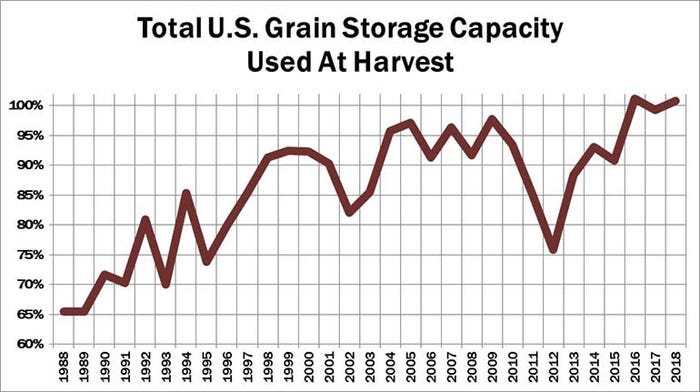

The large stocks data could make storage extremely tight unless harvest gets spread out by weather. Our updated analysis shows total fall crop production plus Sept. 1 stocks of grains exceeding projected storage capacity nationwide by 1%, a level exceeded only in 2016. Illinois, Nebraska and South Dakota could be 20% over capacity, adding to weak basis in the cash markets for corn and soybeans.

About the Author(s)

You May Also Like