April 23, 2020

The COVID-19 pandemic collapsed portions of the U.S. economy this spring and impacted both crop and livestock markets via demand uncertainty, thus lowering prices. And the dispute between Saudi Arabia and Russia sent crude oil prices to their lowest levels in more than 20 years, resulting in negative profit margins for ethanol plants that slowed or shuttered nearly 50% of the nation’s production.

Since mid-January, July corn and soybean futures prices declined by roughly 18% and 16%, respectively. It is now estimated that the decline in ethanol to blend for transportation fuel has decreased corn demand by 375 million bushels for the 2019 crop.

Livestock feed demand is expected to be a record 5.675 billion bushels for corn and remains large for soybeans at 2.125 billion bushels for the current marketing year. For the 2019 crop, the national average farm cash prices for corn declined to $3.60 per bushel and soybeans to $8.65 per bushel in USDA’s April World Agricultural Supply and Demand Estimates report.

On April 13, the University of Missouri Food and Agriculture Policy Research Institute report released adjustments to its 2020 farm income outlook. According to the report, the impact of COVID-19 on the U.S. economy will depend on the length and intensity of the pandemic. It forecasts a 5% to 10% reduction in crop cash prices for the 2020-21 marketing year and an 8% to 12% reduction in livestock sector cash prices.

Darkest before the light

Most Iowa farmers are resilient in their approach to managing uncertainty, production and crop prices. The likelihood of larger 2020 planted row crop acres and thus lower cash prices were already anticipated. That’s because 15.9 million U.S. corn and soybean acres were prevented planting in 2019 and will be returning to production.

The good news is row crop farmers still have time and several price risk management tools in place for these potential lower cash prices. Here are five factors farmers should consider in dealing with crop price risk management in 2020:

1. Planted acreage. In its Prospective Plantings Report for 2020, USDA estimates U.S. farmers will plant 97 million acres of corn and 83.5 million acres of soybeans. Iowa farmers will plant an estimated 14.1 million acres of corn and 9.3 million acres of soybeans. While the USDA Final Planted Acreage Report will not be released until June 30, indications are it will be difficult for Iowa or U.S. farmers to reach that much corn planted acreage. Some of these corn acres could be shifted to soybeans, or perhaps have prevented planting claims.

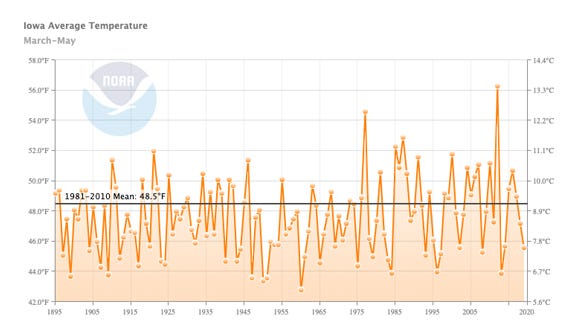

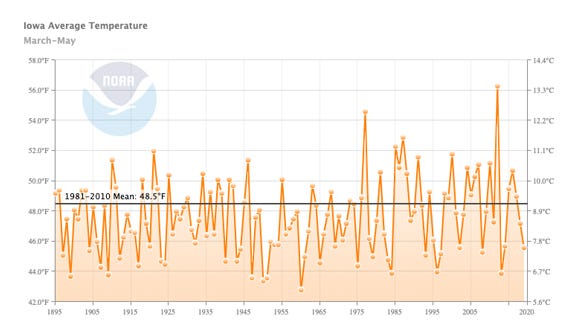

2. Impact of weather. The only year in recent history that Iowa has planted more than 14 million acres of corn was the 14.3 million acres planted in 2012. That year was the warmest March through May temperatures ever logged in records going back to 1895.

WARM SPRING: Iowa in 2012 had the warmest spring on record. It resulted in a large number of corn acres planted in the U.S. and in Iowa that year.

While most crop production estimates will use the 30-year trend yields, including those released by USDA on May 12, the growing season and impact of weather especially during pollination will have a large impact on the actual production of corn and soybeans.

3. Crop insurance. Most all Iowa corn and soybean planted acres are covered by Revenue Protection crop insurance. This coverage guarantees revenue, and uses the spring crop insurance prices of $3.88 per bushel for corn and $9.17 per bushel for soybeans. If harvest prices in October are below these spring prices, then a decline in your final yield below your actual production history could trigger an indemnity payment.

Using the prevented planting provision of crop insurance is still a potential for those insured acres that are too wet for planting in a timely manner. Farmers should work with their crop insurance agent well in advance of abandoning acres to prevented planting.

4. Price Loss Coverage payment. Most farmers have already elected and enrolled their corn base acres in the Price Loss Coverage program for both 2019 and 2020. The decline in national cash corn prices below the $3.70 per bushel effective reference prices will likely trigger PLC payments that could be made in October of both 2020 and 2021. Most farmers likely elected and enrolled their soybean base acres in the Average Revenue Coverage program. Those ARC-County payments are not assured without the likelihood of low county yields.

5. Crop marketing. Expect corn and soybean futures price volatility to continue. Identify now reasonable timelines, as well as futures and cash price objectives, as a part of your old- and new-crop marketing plans. Discipline will be critical to make necessary sales, and written plans are recommended. Price uncertainty will be driven by the status of the coronavirus pandemic globally, the continuation of low crude oil futures prices, weather during the growing season and the potential for China to make large purchases of ag products to fulfill its Phase 1 trade agreement.

Use the Iowa Commodity Challenge information for guidance in making your marketing decisions. It is on the ISU AgDecision Maker web page and includes editable old and new crop marketing plan templates at tinyurl.com/iacrops.

USDA’s coronavirus relief program

Secretary of Agriculture Sonny Perdue announced $19 billion in aid for farmers and ranchers hit hard by the COVID-19 national emergency. The remaining $3 billion will be used by USDA to buy produce, dairy and protein products for food banks and other nonprofits to be distributed to people in need.

The first $16 billion of the program is dedicated to direct payments to farmers and ranchers who face losses due to the pandemic. USDA economists looked at commodity losses between mid-January to mid-April to determine funds to be allocated.

Farmers and ranchers may apply for assistance regardless of their operation size or market outlet if they have suffered eligible losses. The $9.5 billion from the CARES Act can be used with less restriction than the Commodity Credit Corporation funds that have more stringent requirements. For updates on the programs, visit COVID-19 Federal Rural Resource Guide and Coronavirus and USDA Service Centers.

Johnson is an ISU Extension farm management specialist. Contact [email protected].

Read more about:

Covid 19About the Author(s)

You May Also Like