Soybean traders continue to propose questions about potential "trade wars". Even though there has been no formal announcement, there's many in the market who believe China is clearly pushing more buying interest towards Brazil.

There also seems to be more concern surrounding NAFTA, as President Trump starts to take a harder stance on Nicaraguan immigrants pouring into the U.S. across the Mexican border. Essentially the President has said he will pull out of NAFTA if Mexico isn't willing to better police their border and stop allowing drug dealers and criminals from Central America to freely cross into U.S. territories.

Bulls continue to point towards South American supplies being down close to -15 MMTs compared to last years crop. I continue to believe the production hiccup in Argentina ultimately puts more pressure on the U.S. to produce a good crop.

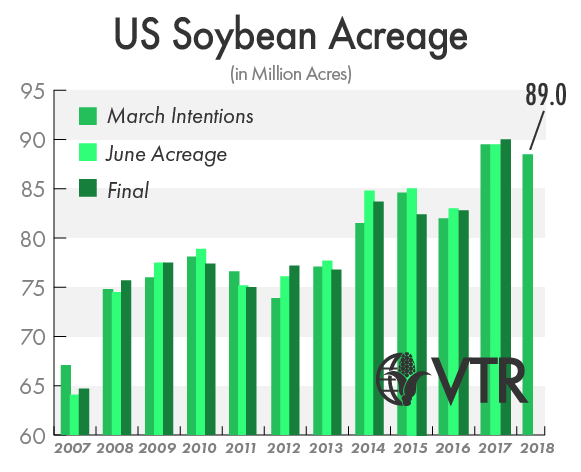

In other words, the average U.S. yield needs stay north of 50 bushels per acre or the trade is going to start getting a bit more nervous, especially if U.S. planted acres stay sub-90 million.

Monthly NOPA data released yesterday showed processors crushed 165 million bushels, about what the trade was expecting. If there was any surprise, it was probably the massively large soybean oil stocks number.

GET ALL MY DAILY MARKET NEWS HERE

About the Author(s)

You May Also Like