Each year, the University of Nebraska-Lincoln's Department of Agricultural Economics conducts a survey of ag land industry experts for a glimpse at trends in farm land values and rental rates. Earlier this summer, UNL released the results from its 2019-20 survey, revealing that for the first time since 2014, ag land values increased on average in the past year — an increase of 3%, to a statewide average of $2,725 per acre.

Each year, panelists also are surveyed for a special feature section for the report. This year, the special feature covered historic flooding and excessive moisture over the past decade in Nebraska, and implications and rental rate adjustments for land at risk of flooding. Panelists include farm and ranch management companies, ag appraisers and ag lenders.

"2019 was an exceptional period of flooding in our state," says Jim Jansen, Nebraska Extension ag economist and an author of the survey. "In 2019, there were 344,000 acres of corn that were intended to be planted, but were prevented plant due to flooding."

From 2010 to 2019, Nebraska reported an average of 81,130 acres of prevented plant cropland. However, Jansen notes the rainfall and floods of 2015 and 2019 contributed to the highest number of prevented plant acres at 188,463 and 421,958 acres, respectively.

"If you throw out 2019 and 2015, that average drops closer to 25,000 acres, which is a small percent," Jansen says. Excluding those two years, the annual average is 25,110 acres.

According to the 2017 USDA Census of Agriculture, there are about 22 million acres of cropland in Nebraska. Those 25,000 acres account for less 1%. "Prevent plant may typically be a fairly small risk to consider in a lease, but when it does happen, you have to plan for it," Jansen says.

Panel members indicated that in 2019, 78.1% of ag land leases did not have proper provisions to account for flood damage or excessive moisture — provisions meaning elements in a written or verbal lease negotiated to account for flooding. About 15.5% of the leases partially accounted for this type of risk, while about 6.4% of the leases fully contained mitigation provisions.

Moving forward to 2020, panel members indicated 12.3% of cropland lease provisions were either added or revised to account for risk from flooding or excessive moisture. In addition, 34.9% reported a partial revision to contractual provisions.

More than half of the cropland leases didn't receive any additional or revised lease terms. "For 2020, survey responses indicated an increase over 2019 in either partially or fully addressing flooding in cropland rental arrangements," Jansen says.

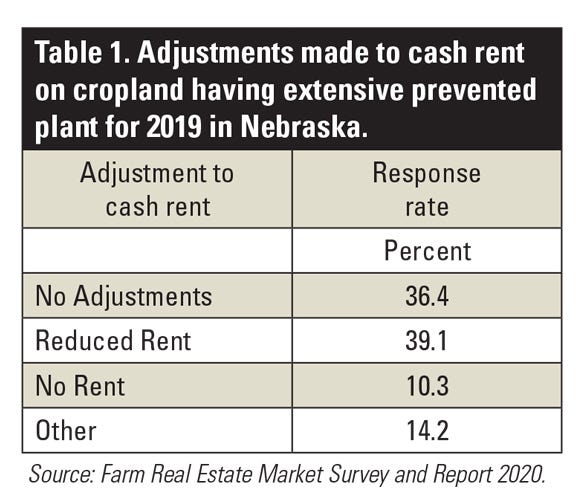

When it comes to cash rent, panel members also reported that about 36.4% of cropland leases in 2019 had no adjustment made to rental rates when extensive prevented plant occurred on the property because of flooding. About 39.1% of cropland leases had reduced rent because of excessive moisture or flooding. The remaining 24.5% of leases either did not have any rent paid or some other alternative agreement added to the lease.

"Depending on the extent of damage, the tenant may or may not be able to provide certain services remediating the issues," Jansen says. "Many landowners at a minimum each year face one major expense — it may be property tax. If a tenant receives prevent planted crop insurance indemnities, they may be willing to provide additional service in terms of cleaning up debris. Landowners may consider adjusting cash rent to a minimum amount to cover property taxes, and a portion of the rent may be offset if the tenant is willing to provide those services to remediate the property."

About the Author(s)

You May Also Like