February 24, 2017

Net incomes for Illinois grain farms are projected lower for 2017 than for 2016. If these projections hold, weakening of financial position will continue in 2017. Trend yields and commodity prices of $3.80 per bushel for corn and $9.90 per bushel for soybeans are used in 2017 projections.

Deviations in yields or prices from these assumptions will change 2017 incomes. Net incomes on grain farms likely will remain at low levels as long as corn prices remain below $4 per bushel.

Watch: Working capital erosion

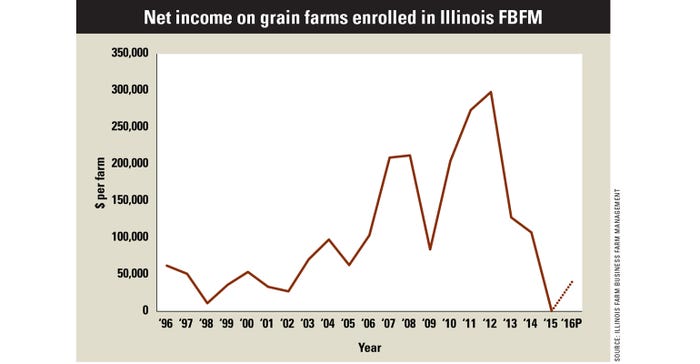

The chart below shows a history of average net incomes on grain farms enrolled in Illinois Farm Business Farm Management. Over time, average farm size has increased. In 2015, the average size of farms summarized was about 1,500 acres, with some being smaller, and some being considerably larger.

After being at higher levels from 2010 to 2012, net incomes decreased each year from 2012 to 2015. In 2015, net incomes averaged $500 per farm, the lowest level of any year between 1995 and 2015, and well below an income level needed to result in stable financial positions on grain farms. From income, farmers must provide for debt repayments, expansion and family living. Most farms did not cover these requirements in 2015, resulting in reductions in working capital.

FBFM has not summarized 2016 net incomes yet. As a result, 2016 income still is only a projection, but is projected to be higher than in 2015 — perhaps averaging in the $40,000-to-$50,000 range. Several factors contributed to the income increases:

• Decreases in costs and cash rents. Costs decreased in 2016, primarily because of lower fertilizer prices. Also, cash rents decreased slightly.

• Above-average yields. Illinois yields were exceptional in 2016. USDA reports an average Illinois corn yield of 197 bushels per acre in 2016, 22 bushels higher than the 175-bushel yield in 2015. The 2016 yield is 3 bushels below Illinois' all-time-high yield of 200 bushels per acre, set in 2014. USDA reports a 2016 Illinois soybean yield of 59 bushels per acre, a record-high besting the previous record of 56 bushels per acre, set in 2014 and 2015.

• Relatively high ARC-CO payments. Many farmers received sizable payments in the fall of 2016 related the 2015 crop. Agriculture Risk Coverage at the county level likely will make payments on the 2016 crop, which will be received in 2017. These 2016 ARC-CO payments likely will be about half the amount of the 2015 ARC-CO payments, with some farms not receiving any payments.

As usual, farm incomes will range considerably. Farms that had average yields or below will face considerably lower incomes, as appears to be the case in southern Illinois. Farms with exceptional yields will have higher incomes.

While higher than 2015 incomes, projected 2016 incomes will not result in the building of financial reserves on most Illinois farms. Most farms will continue to see erosion of working capital, potentially leading to the need to refinance outstanding operating loan balances.

Net income in 2017?

Based on projections and expected commodity prices, 2017 incomes will be lower than 2016. Net incomes for 2017 are projected using trendline yields and commodity prices of $3.80 per bushel for corn and $9.90 per bushel for soybeans. These prices are near fall delivery bids for 2017.

Trend yields and current expectations on commodity prices result in a 2017 income projection that is lower than the average 2016 income, roughly halfway between 2015 and 2016 incomes. The 2017 income projection is lower because:

• Yields are projected at trend levels. Much of the reason for higher 2016 incomes were above-average yields across much of Illinois.

• ARC-CO payments are projected to be lower for the 2016 crops, which will be received in 2017. Moreover, ARC-CO payments likely will again decline for the 2017 crop, resulting in even lower payments for ARC-CO in 2018.

As revenue has declined, costs have been reduced. However, revenue continues to be projected lower each year since 2012. In 2017, lower ARC-CO payments contribute to lower projected revenues.

While projected low, a potential for higher incomes could come if corn prices increase. The $9.90 soybean price used in income projections results in profitable soybean production, while the $3.80 corn price results in, at best, breakeven levels for corn production. Having corn prices above $4 per bushel, which is not that far away from current levels, would lead to improved net incomes on grain farms.

Schnitkey is a University of Illinois agricultural economist. The full text of this article can be found on the U of I farmdoc website.

About the Author(s)

You May Also Like