August 8, 2019

By Jay Parsons, Daren Redfearn and Mary Drewnoski

The western Corn Belt historically has been corn and wheat cropping systems with cattle integrated on nearby grasslands. Recent agricultural production data ranked Nebraska, South Dakota, Kansas and North Dakota in the top 10 states for both corn and beef cattle production in the U.S.

In 2017, these four states had about 20% of the beef cow inventory in the U.S., with Nebraska alone having 1.9 million beef cows, according to the USDA National Agricultural Statistics Service. Forage-based livestock production is a fundamental component of these agricultural economies.

However, a large quantity of grasslands in this region were converted into annual crops during the mid-2000s. To maintain the efficiencies of beef cattle production systems, synergistic use of forage resources in a sustainable manner is essential. In addition to grasslands, this includes the complementary use of corn residue for grazing during the winter months.

In this article, we provide an economic assessment of current corn residue grazing in Nebraska, as well as some comparisons to Kansas, South Dakota and North Dakota.

Value to crop sector

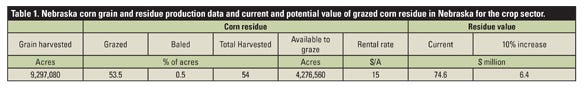

Using $15 per acre as the most commonly reported corn residue grazing rental rate for Nebraska, we estimated the current value of grazed corn residue in Nebraska at greater than $74 million (Table 1) in returns to the crop sector.

Rental rates for corn residue grazing in nearby states were much lower than in Nebraska. For comparison, regional estimates of average cash rent per acre for crop residue in 2017 averaged $7.50 per acre in Kansas. Rental rates for grazed corn residue in South Dakota and North Dakota were $12 and $5 per acre, respectively.

A survey of Nebraska farmers indicated that 40% of corn producers currently not grazing corn residue would not consider doing so regardless of potential revenue from the activity. As such, we estimated that a conservative increase in grazing utilization of 10% of the 4.3 million acres of corn residue available may add $6.4 million additional value to the bottom line of crop producers in Nebraska (Table 1).

Value to livestock enterprise

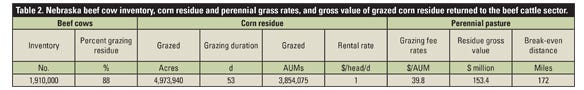

Using a corn residue stocking rate of 3 acres per animal, we estimated that 88% of Nebraska beef cows graze corn residue. This implies the current excess of corn residue available in Nebraska is largely because of a lack of cows.

Using a corn residue stocking rate of 3 acres per animal and 1.3 animal units per animal along with 53 grazing days per animal, we estimated a gross value of more than $150 million ($16.72 per animal unit month or $38.41 per head) for grazed corn residue based on grass rental rates per AUM for Nebraska livestock enterprises (Table 2).

This value would need to cover all costs for the cattle producer associated with grazing the residue, including residue rental, fence, water, transportation and any additional care expenses. We used residue rental rates on a per head per day basis full care to account for all costs associated with grazing corn residue, except transportation of the cattle to and from the residue field.

Any difference between gross value and full care rental rates (fence, water and additional care expenses) in Table 2 accrue to the cattle producer to cover transportation costs and return on investment for using a cheaper feed resource.

Under the assumption that cattle are transported in full loads of 36 head and a shipping rate of $4 per loaded mile, we calculated a maximum breakeven distance for Nebraska of 172 miles.

Potential for integration

Nebraska, South Dakota, Kansas and North Dakota have numerous crop and livestock management similarities. However, Nebraska perennial pasture rental rates are considerably higher than the other three states. This suggests a greater demand for corn residue grazing in Nebraska compared with the other states.

On a percentage basis, Nebraska grazes more than twice as many corn residue acres than South Dakota, Kansas or North Dakota. Furthermore, in comparing the breakeven distance to transport cattle to corn residue for each state, Nebraska’s is almost twofold more than for any of the other three states despite Kansas and North Dakota having a corn residue grazing rental rate half as much as Nebraska’s.

In all four states, a larger number of corn residue acres are available as a percentage of cattle operations in the east as compared to the west. This analysis shows why cattle in western Nebraska are much more likely to be transported to corn residue fields in the eastern region on a regular basis compared with the other three states.

The integration of livestock into cropping systems would be more straightforward when accomplished within a single operation. However, given the recent focus on intensive management of single enterprises and a willingness in Nebraska to transport cattle significant distances to available cropping system feed resources, it's realistic to expect much of the future integration of livestock into cropping systems to occur across multiple operations.

Parsons is a Nebraska Extension farm and ranch specialist; Redfearn is an Extension forage crop residue specialist; and Drewnoski is an Extension beef systems specialist.

Source: Cornhusker Economics, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like