October 5, 2018

Even though crops were ready, persistent rainfall across many areas of Iowa delayed early harvest activity this fall. Early yield reports have been strong in eastern Iowa, while early yield totals in other areas have been more variable, especially in the central, north-central and northwest crop reporting districts.

A more complete accounting of yield results will soon be reported. Despite variable growing-season conditions in Iowa, expectations were high for prospective yield totals.

Localized differences in growing-season success are likely to play a slightly larger-than-usual role in farmland sale results this fall. Early-season sales are already reflecting this uneven trend. In areas where another big crop was produced, we expect to see more strength and stability in the land market, even in the face of lower grain prices.

In areas where crop yields are disappointing, however, there appears to be a more noticeable potential for market softness. Regardless of the area, high-quality farms with the most productive soils, solid drainage, easy farm-ability and strong fertility continue to sell best.

Farmers continue to be the most prevalent group of buyers, even though nonfarming investors continue to be active buyers across Iowa.

Interest rates increasing

To better understand the land market, pay attention to key issues. First, production success or disappointment from area to area sets the mood in the countryside every year, and shows up in sale enthusiasm, or lack thereof.

Second, keep an eye on increasing interest rates, as they will continue to pressure farmland values. The Federal Reserve again raised short-term rates at its September meeting, and another 25-basis-point bump is expected before year-end. While short-term rates don’t directly impact long-term borrowing costs, short-term rates quite directly impact farm operating notes, which are coming into focus as we approach operating loan renewal season.

Third, the disruption created in the commodity markets by the enactment of global trade tariffs is real and has softened markets, particularly for soybeans, and continues to be a daily topic of discussion in the grain markets.

The emergency aid package offered through USDA is likely to help blunt the cash-on-cash impact of the disruption for 2018, but land assets are long-term assets and few buyers enter the market with a short-term perspective.

So, how global trade negotiations play out in the weeks and months ahead will continue to impact commodity prices, market confidence and, ultimately, underlying asset values, including farmland.

Reset for crop insurance

For the 2019 growing season, crop insurance price levels will be reset. In the face of lower commodity prices in 2018, there were still relatively high crop insurance price levels that were established in February 2018. If things don’t change in the grain markets, these revenue policy price levels will reset to significantly lower levels for 2019 production and will add more pressure to an already stressed market.

Lastly, don’t forget about negotiations occurring on the new farm bill. This policy is likely to impact the countryside for the next several years. Stay tuned for further analysis as new information surfaces on all these topics.

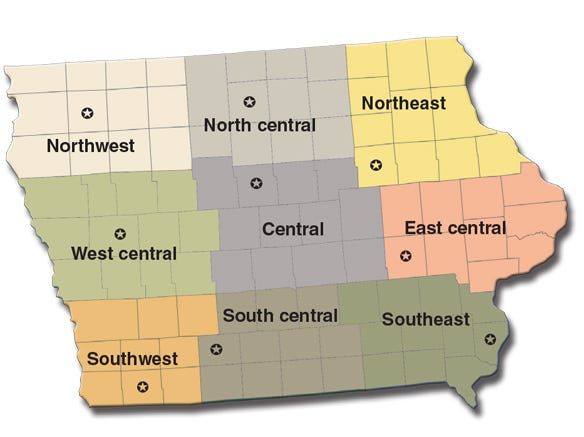

NORTHWEST

O’Brien County: West of Paullina, 127 acres recently sold at public auction for $14,300 per acre. The farm has123 tillable acres with a 94.8 CSR2 and equals $155 per CSR2 point on the tillable acres.

NORTH CENTRAL

Hancock County: Northeast of Woden, 102 acres sold at public auction for $9,400 per acre. The farm has 101 tillable acres with an 86.9 CSR2 and equals $109 per CSR2 point on the tillable acres.

NORTHEAST

Black Hawk County: East of Gilbertville, 67 acres sold for $9,000 per acre. The farm consists of 67 tillable acres with an 87.1 CSR2 and equals $103 per CSR2 point on the tillable acres.

WEST CENTRAL

Crawford County: Southeast of Denison, 38 acres sold at public auction for $5,400 per acre. The farm has 34 tillable acres with an 80.6 CSR2. The sale equals $75 per CSR2 point on the tillable acres.

CENTRAL

Hamilton County: North of Story City, 156 acres sold at public auction for $11,100 per acre. The farm has 155 tillable acres with an 85.7 CSR2, of which 7.8 acres are enrolled in CRP through 2026. Sale equals $130 per CSR2 point on the tillable acres.

EAST CENTRAL

Iowa County: North of Keswick, 200 acres sold at public auction for $5,300 per acre. The farm has 151 tillable acres with a 58.6 CSR2, while the remaining 49 acres are waterways and timber. Sale equals $120 per CSR2 point on the tillable acres.

SOUTHWEST

Page County: South of Stanton, 74 acres sold at public auction for $4,400 per acre. The farm has 72 tillable acres, with a 59.1 CSR2. The sale equals $76 per CSR2 point on the tillable acres. The farm’s buyer will receive the 2018 soybean crop.

SOUTH CENTRAL

Union County: Southeast of Creston, 129 acres sold for $4,200 per acre. This gently-to-moderately sloping farm consists of 110 tillable acres with a 61.3 CSR2. The sale equals $80 per CSR2 point of the tillable acres.

SOUTHEAST

Des Moines County: East of Mount Union, 73 acres sold at public auction for $11,000 per acre. The farm has 71 tillable acres with a 74.6 CSR2. The sale equals $152 per CSR2 point on the tillable acres.

Hertz Real Estate Services compiled this list, but not all sales were handled by Hertz. Call Hertz at 800-593-5263 or visit hertz.ag.

You May Also Like